LET'S TALK

Speak with expert.

Email:

info@riverstonetraining.com.sg

Phone:

(+65)9730-4250

Address:

Level 20, Tower 2, One Raffles Place, Singapore 048616

Due-diligence training is necessary for businesses operating in risky sectors or industries. This helps the company to understand the risks associated with using there and mitigate them. It also allows management to check if the business has identified any potential risk factors and prepared mitigation plans in case they emerge. Due-diligence training is vital when starting a new business, expanding into new markets, or partnering with another company. It can help uncover risks that might not have been apparent before and prevent future problems from arising through due diligence on another company’s practices. Therefore, if you plan to expand your operations, partner with other companies, or sell services to a specific industry, you should know what due diligence entails and how it can help protect your company from potential negative consequences. This article will cover all the essential information you need to know about conducting a due-diligence training program.

Due diligence is researching and analyzing a company or a project before entering into a formal agreement. It refers to a method of assessing the financial health and legal and operational structure of the people or entities you’re considering doing business with. Due diligence is intended to eliminate risky relationships. For example, a car dealer wants to buy a used car from a private seller. The car dealer thoroughly searches the vehicle and checks the car’s history. When the car does not account for any significant collision, the car dealer may feel confident buying the vehicle. This is one of the examples of a due diligence procedure necessary for all stages of business growth. A business regulator will expect all types of businesses to conduct due diligence training when they wish to expand their operations or enter new markets.

Due-diligence training programs can be divided into two categories based on the length of the program.

Conducted by third-party consultants or auditors. This training program is best suited for companies that conduct business across different industries or are involved in risky sectors. - Conducted by third-party consultants or auditors. This training program best suits companies that conduct business across various industries or are engaged in challenging sectors.

Conducted by an in-house business team for their staff. The purpose of this training program is to educate employees about the importance of conducting due diligence and understanding the potential risks in their areas of operations.

Due diligence is a vital part of investing in any company or asset. It helps you understand the company’s financial health and assess the potential risks associated with the operation of the business. In this way, mitigate risks and minimize the chances of future problems arising. The primary reason for conducting due diligence training is to understand your business’s risks and identify potential areas for risk mitigation. This helps you know your business’s risk profile and develop plans for mitigating risks if and when they emerge.

The primary objective of conducting a due-diligence training program is to create awareness among employees about the reason and process for conducting due diligence when entering into business relationships or partnering with other companies.

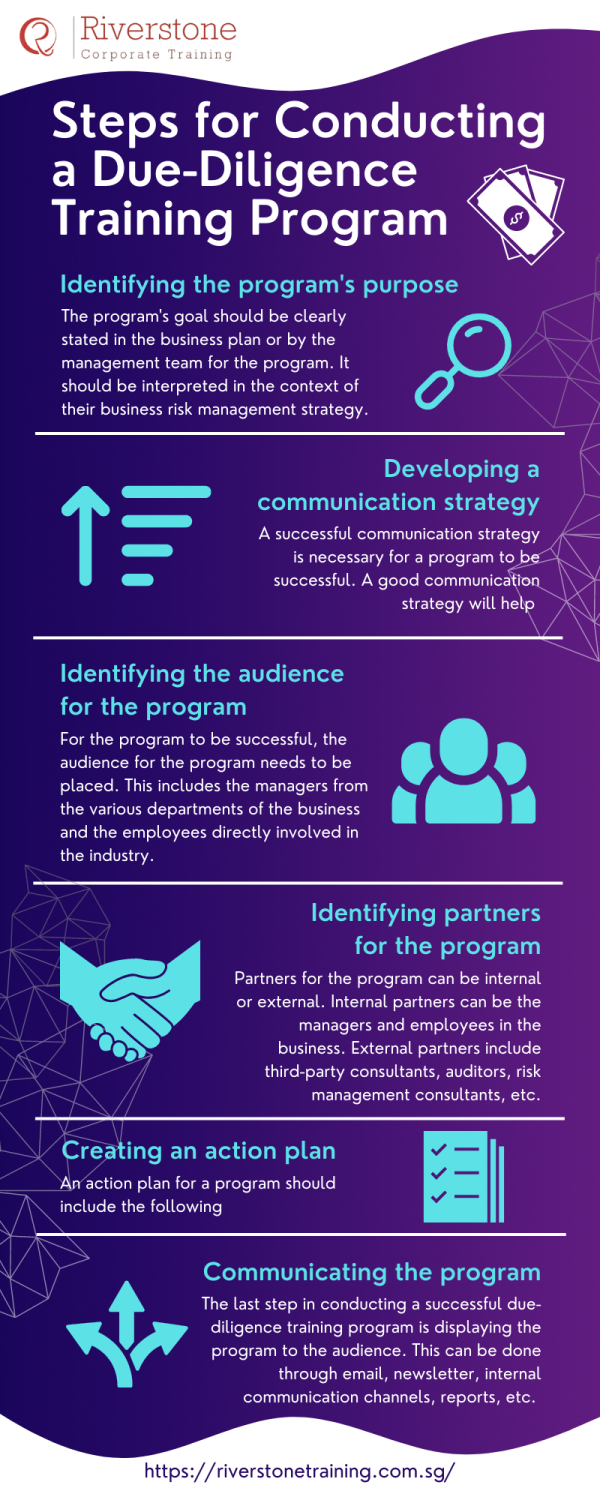

There are specific steps required to conduct a successful due-diligence training program. These include identifying the purpose of the program, identifying the audience and the program’s content, developing a communication strategy, identifying partners for the program, creating an action plan, and communicating the program to the audience.

The program's goal should be clearly stated in the business plan or by the management team for the program. It should be interpreted in the context of their business risk management strategy.

A successful communication strategy is necessary for a program to be successful. A good communication strategy will help with the following:

For the program to be successful, the audience for the program needs to be placed. This includes the managers from the various departments of the business and the employees directly involved in the industry.

Partners for the program can be internal or external. Internal partners can be the managers and employees in the business. External partners include third-party consultants, auditors, risk management consultants, etc.

An action plan for a program should include the following

The last step in conducting a successful due-diligence training program is displaying the program to the audience. This can be done through email, newsletter, internal communication channels, reports, etc. When developing your program, it is essential to consider the audience, the program's purpose, and the risks that need to be highlighted. You should also consider if the program will be conducted by an internal team or a third-party consultant.

Due diligence is a vital process in any acquisition or investment activity. It’s crucial to ensure that your team knows all the risks and opportunities associated with any investment they are considering. This includes understanding the risks associated with investments in stocks, bonds, and other types. Due-diligence training programs help teams identify and address these risks and opportunities. These programs typically include a series of meetings, presentations, and exercises that focus on identifying potential risks and opportunities associated with investments.

However, if you are looking for the Best Due-diligence course in Singapore, visit Riverstone University.

The Course will provide participants with a structured process and methodology to analyze and understand financial information and improve their

The Excel introductory training course is a complete beginner’s course that includes all the basic concepts in Microsoft Excel. It

The course equips you with a comprehension on the various innovation strategies for your business model, which will enhance you

The course equips you with a comprehension on the various innovation strategies for your business model, which will enhance you

The Course will provide participants with a structured process and methodology to analyze and understand cash and working capital information

In these uncertain times, constructing dynamic cash flows is important to go ahead of the invariable forecasting protocol. The course

info@riverstonetraining.com.sg

(+65)9730-4250

Level 20, Tower 2, One Raffles Place, Singapore 048616

Important Links

2025 © Riverstone Training