Why Learn Financial Modeling Course

Table of contents

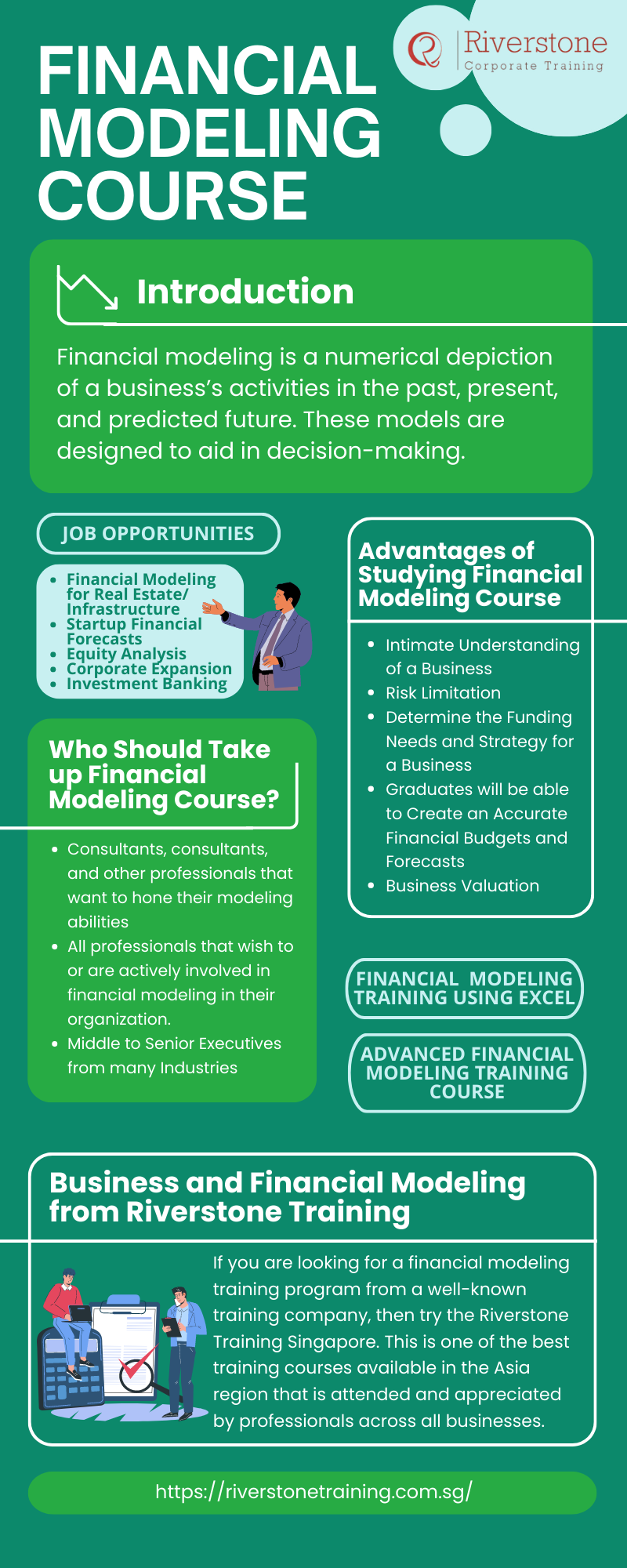

Introduction

Overview

Advantages

Financial Modeling Training

Why should take this course?

What you will learn?

Job Opportunities

Worth taking this course?

Advanced Financial Modeling Training Course

Financial Modeling Training Singapore

Financial Modeling Training Using Excel

The Best Financial Modeling Course

Business and Financial Modeling from Riverstone Training

Introduction to Financial Modeling Course

The Best Financial Modeling Course in Singapore is a numerical depiction of a business’s activities in the past, present, and predicted future. These models are designed to aid in decision-making. Company leaders might use them to estimate the expenses and profitability of a proposed new project.One essential component taught in the course is the importance of profitability index in financial modeling, which helps assess the viability of investments and project returns. Financial analysts use them to explain or predict the influence of events on a company’s stock, ranging from internal elements such as a change in plan or biz strategy to external factors such as changes in economic policy or legislation. The course also includes practical financial statement analysis training in Singapore, equipping learners to interpret complex reports with confidence. For business leaders, a financial model is quite helpful. Financial analysts examine and forecast how future events or executive choices will affect a company’s stock performance.

Best Financial Modeling Course Overview

The Singapore financial modeling course is highly valued in the world of finance. Financial modeling combines accounting, finance, and business indicators in Excel to generate an anticipated abstract picture of a corporation. This financial modeling for beginners and “dummies” tutorial will teach you everything a beginner needs to know!

Financial models can be used for various purposes, including making business choices at a firm, investing in a private or public company, pricing securities, or conducting a corporate transaction such as a merger, acquisition, divestment, or capital raising. This financial modeling primer is intended to teach you the fundamentals.

Advantages of Studying Financial Modeling Course

As it is one of the sought-after skills in finance, studying a professional financial modeling training course Singapore comes with several advantages. Students who complete this program stand to gain the following benefits:

Intimate Understanding of a Business

After a thorough understanding of the business, a financial model is created. Analysts understand how a firm runs and the various aspects that may influence it. Businesses must also understand what changes are likely to occur in a scenario when there are changes in the organization’s internal and external environments.

Risk Limitation

Because a financial model aids in investment analysis and risk mapping by predicting the economic impact of a given business, it assists firms in avoiding total risk.

Determine the Funding Needs and Strategy for a Business

Financial models forecast predicted cash inflows and outflows. A company can learn about the net cash flows needed to organize to run its operations. The next stage is to choose between loan and equity finance. The financial models assist in understanding the cash flow situation after meeting the interest expenditure and loan payback.

Graduates Will Be Able to Create an Accurate Financial Budgets and Forecasts

Financial models provide realistic financial budgets and predictions based on corporate data. Businesses can utilize these budgets and projections to keep their business activities organized and inside the set framework.

Business Valuation

Financial models may help companies determine their valuation. A financial model helps business to prepare the projections for 3-5 years and also establishing the free cash flows which is very useful for DCF methods of business valuation. This is useful for firms when restructuring, such as selling a stake to third parties and investors. For professionals seeking to master these techniques, enrolling in the best business valuation course in Singapore can provide essential skills and practical insights into accurate and reliable valuation methodologies.

Financial Modeling Training

Financial modeling training in Singapore may be obtained in various methods, including through a bank or financial institution’s training program, an online course at a university, or on-the-job experience. For financial analyst occupations and positions in finance, any form of training might be beneficial.

An excellent financial modeling course is perfect for staying ahead of the competition and in the future, whether you work in investment banking or wish to establish a small business. A financial modeling course will teach you strategies that can help you advance in your career by leveraging financial analysis tools for financial modeling and offering practical financial modeling and valuation training in Singapore.

Who Should Take up Financial Modeling Course?

Consultants, consultants, and other professionals that want to hone their modeling abilities

All professionals that wish to or are actively involved in financial modeling in their organization.

Middle to senior executives from many industries

What You Will Learn During the Financial Modeling Course

A financial modeling course online will teach you how to develop spreadsheet models, modeling approaches, and popular applications. The organization will usually award you a certificate when you complete a course. You may create a new skill set that will aid you in your work or your own small business by taking a class.

Financial Modeling Job Opportunities

Those with financial modeling skills are highly coveted in the financial sector of any country.

Here is the list of career opportunities:

Financial modeling for real estate/infrastructure

As a real estate or infrastructure developer, it will be your responsibility to construct precise financial models that indicate how profitable the real estate project you wish to invest in is. The most crucial thing to grasp is that you will need to study real estate statement models as a junior and senior real estate developer.

Startup financial forecasts

It makes no difference whether you work in finance or not for this one. Every entrepreneur who runs a startup must make predictions about how their firm will perform in the future.

In this instance, cash flow valuation will be the responsibility of the CFO, the company’s founder, or the person in control of the financial staff.

Equity analysis

Equity researchers must produce studies that advise their clients on whether or not to invest. Financial models are frequently included in these reports.

Corporate expansion

Corporate development organizations are the corporate equivalents of well-known investment bankers. They must collaborate on transactions.

Investment Banking

This is the first career in which spreadsheet models were employed. When it comes to mergers & acquisitions or capital raising, investment bankers have traditionally used financial models generated in Excel to assess any specific firm.

Are Financial Modeling Courses Worth Taking?

Financial Modeling Course abilities are in high demand. According to the US Bureau of Labor Statistics, the job forecast for financial analysts is predicted to expand by 5% by 2029, which is faster than the overall job outlook. Furthermore, the typical salary for financial analysts is $83,660, which is much higher than the national average.

Advanced Financial Modeling Training Course

The financial modeling course will show you how to create a complete financial model for a firm using current model templates, normalized historical financials, audit checks, scenario analysis, cash flow sweeps, and various best practices.

There are numerous significant strategies used by world-class financial analysts in advanced financial modeling (AFM). We will enumerate some of the finest and most sophisticated methodologies that financial modelers should think about adopting to provide industry-leading financial analysis.

Scenarios are used by advanced financial modelers to make a model more dynamic and to cover a wide variety of possibilities. These scenarios are created in Excel, and they may be built using a variety of formulae and functions.

The following are the most typical assumptions for which scenarios in a financial model are built:

Volume and output (units, customers, services, etc.)

Fixed expenses (rent, overhead, administration)

Prices on the market (goods, services)

Other sector-specific metrics

Costs that change (consumables, labor rates, components of COGS, marketing, etc.

Exchange rates (for businesses operating in multiple currencies)

Rate of discount (cost of equity, cost of debt, WACC)

Capital expenses (sustaining CAPEX, growth CAPEX, cost overruns, project delays)

Assumptions about macroeconomics (GDP growth, interest rates, inflation, etc.)

The macros function in Excel is the most often used tool for creating various scenarios and sensitivities. This method allows you to quickly switch between Scenarios A, B, C, and so on in a model.

Financial Modeling Training Singapore

If you’re searching for a financial modeling training school in Singapore, an online training platform may be the most convenient option to learn how to create a model from the ground up. Several platforms offer a variety of Excel modeling, valuation, strategy, and other corporate finance courses, which are available round the clock to analysts worldwide. You will get two years of access to all training materials and resources if you register online.

Financial modeling and implementation managers, finance managers, and tax managers are the top three in-demand finance and accounting occupations in Singapore in 2018, with a median annual income of over $100,000.

Financial Modeling Training Using Excel

Financial Modeling Training Using Excel refers to creating anticipated financial statements that estimate the company’s financial success in a future period based on assumptions and past performance data. DCF valuations, mergers, acquisitions, private equity, project finance, and other areas use such financial models.

Let’s look at how to create a financial model in Excel. The modular method entails making fundamental statements such as income statements, balance sheets, and cash flows utilizing several modules/sheets. The primary goal is to construct each statement step by step and, once completed, tie all supporting programs to the core assertions.

The steps below to create a basic financial model in excel.

Step 1: Make the Worksheet for Historical Financial Statements.

Step 6: Generate Amortization Schedule

Step 2: Analyze ratios

Step 7: compute the final net intangibles

Step 3: Generate income statement projection

Step 4: create a working capital schedule

Step 5: Create a depreciation schedule

Step 8: Complete the income statement projection

Step 9: Create a shareholder’s equity and debt schedule

Step 10: Complete the Balancesheet and Cashflows statement

Individuals who want to improve their financial modeling and Excel abilities can take the Financial Modeling and Forecasting course. Excel training will cover everything from fundamental to advanced tools and functions. The income statement, statement of financial position, and cash flow estimates will all be covered in the financial modeling module. The training will take a hands-on approach, with real-life examples to construct models and teach concepts. It is an excellent choice for advancing your career and improving your overall financial modeling and forecasting efficiency. Skilled financial modelers are in great demand and well-compensated due to the industry’s lack of competition. As a result, enrolling in this Financial Modeling and Forecasting course provides you with the possibility to boost your earning potential.

The Best Financial Modeling Course

The Best Financial Modeling Course is a skill-set that is in high demand. Whether you want to change jobs, get a promotion, or start your firm, financial modeling may help you anticipate future business performance and assess how different factors will affect your income.

So, what is the best financial modeling course?

The best training program in financial modeling is the Business and Financial Modeling from Riverstone Training.

Business and Financial Modeling from Riverstone Training

If you are looking for a financial modeling training program from a well-known training companu, then try the Riverstone Training Singapore. This is one of the best training courses available in the Asia region that is attended and appreciated by professionals across all businesses.

Upcoming Trainings

Finance for Non Finance

Bangkok

Finance For Non-Finance Managers

Finance for non-finance managers course is for participants who do not have any finance background or knowledge. This course will

05 Jun 2024

Attend

Finance for Non Finance

Jakarta

Finance For Non-Finance Managers

JFinance for non-finance managers course is for participants who do not have any finance background or knowledge. This course will

03 Jun 2024

Attend

Excel

Kuala Lumpur

Advanced Excel for Professional

Microsoft Excel is an excellent business tool because it has numerous functions and formulas to store, evaluate, and modify data

03 Apr 2024

Expired!

Excel

Jakarta

Advanced Excel for Professional

Microsoft Excel is an excellent business tool because it has numerous functions and formulas to store, evaluate, and modify data

17 Apr 2024

Attend

Excel

Singapore

Advanced Excel for Professional

Microsoft Excel is an excellent business tool because it has numerous functions and formulas to store, evaluate, and modify data

08 May 2024

Attend

Excel

Ho Chi Minh

Advanced Excel for Professional

Microsoft Excel is an excellent business tool because it has numerous functions and formulas to store, evaluate, and modify data

11 Jun 2024

Attend

LET’S TALK

Speak with expert.

Email:

info@riverstonetraining.com.sg

Phone:

(+65)9730-4250

Address:

Level 20, Tower 2, One Raffles Place, Singapore 048616