ESG Investing Course

Table of contents

Introduction

What is a ESG investing?

The Benefits

incorporate ESG investing in portfolio

Strengths and Weaknesses

Risk

How to invest in ESG securities?

Critical considerations

How to invest in ESGs?

Conclusion

Introduction

Today, it’s common for large companies to invest in startups that support their growth. In addition, institutional investors like family offices (hedge funds) and mutual funds are becoming more focused on ESG issues as a part of their investment strategy. These entities are looking beyond just the financials and asking questions such as “Are these investments aligned with our long-term strategy?” or “What is the company doing to reduce its environmental impacts?’ You must understand what ESG investing is so you can make well-informed decisions when it comes to your portfolio. To build a strong foundation in sustainable investing, professionals can explore the best finance and investment courses Singapore has to offer and enhance their decision-making frameworks.

What is ESG investing?

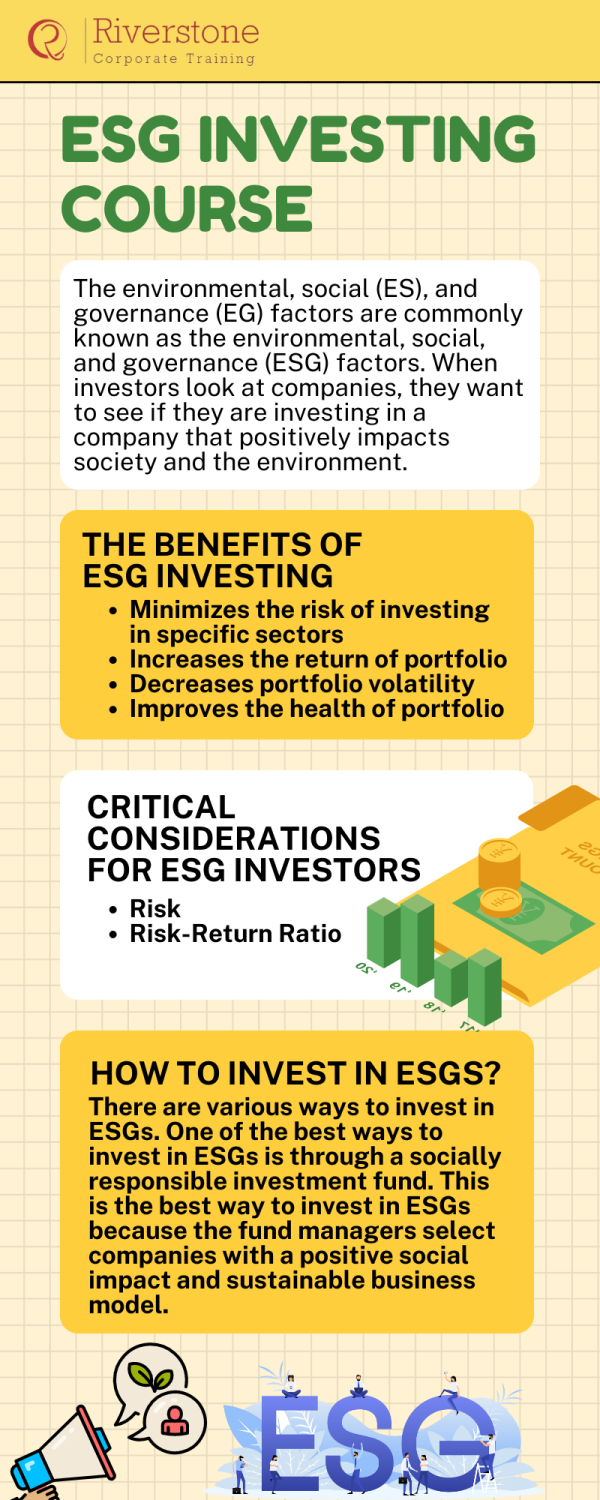

The environmental, social (ES), and governance (EG) factors are commonly known as the environmental, social, and governance (ESG) factors. When investors look at companies, they want to see if they are investing in a company that positively impacts society and the environment. As a result, ESG integration in investment decision making has become an essential strategy for aligning financial returns with ethical and sustainable business practices.

To improve investment practices’ environmental, social, and governance factors, major financial institutions like Blackrock, a member of the world’s largest investment management companies, have incorporated ESG factors into the investment decision-making process. The goal is to align investments with the long-term interests of investors. Understanding how strategic behavior affects such decisions can be further enhanced through a Game theory decision making course, which equips professionals with tools to navigate competitive dynamics and optimize outcomes in complex financial environments.

The Benefits of ESG investing

Minimizes the risk of investing in specific sectors

Increases the return of your portfolio

As it is one of the sought-after skills in finance, studying financial modeling course comes with several advantages. Students who can complete this program stand to gain the following benefits: enhanced analytical thinking, practical Excel skills, and the ability to build investment-ready models. These capabilities are especially valued by employers, making a real‑world financial modeling certification Singapore an excellent asset for advancing your finance career.

Decreases your portfolio volatility

Improves the health of your portfolio

By choosing to invest in companies that support a more sustainable future, you increase the return in your portfolio. With ESG investing, you may also generate more significant long-term capital gains.

Investments that support a more sustainable future can help investors avoid volatility in their portfolios by reducing the risk of specific sectors or companies in the market.

Risk-averse investors may avoid certain sectors, like fossil fuel companies, due to the high chance that the company may negatively affect the environment. Environmental investments could also reduce the risk of acquiring certain companies if they have a poor record of ESG performance.

Investments that support a more sustainable future can help you beat the trend by providing a buffer against potential market declines.

How to incorporate ESG investing in your portfolio

You can incorporate ESG factors into your investment strategy in several ways. The most common way is to have a portion of your portfolio dedicated to low-carbon, green, or socially responsible companies. You can also look for investments that support and promote sustainable industries like renewable energy, food, or transportation. Another option is to have a portion of your investment portfolio focused on a specific sector or companies that show good ESG performance. One of the simple strategy is investing in a particular industry, like clean technology companies, or by investing in a specific company that demonstrates how it meets environmental, social, and governance factors. Another way is by investing in an exchange-traded fund (ETF) or a traditional mutual fund.

The strengths and weaknesses of ESG investing

Investing in companies that focus on the environment or social factors has many benefits but can also be a source of risk. Because these factors are what investors are looking for when choosing their investments, it means less room for profit. If done correctly, investing in ESG-friendly companies can help reduce risk in your portfolio and increase your overall return. While these factors can positively impact your portfolio, you also need to be prepared that certain investments could fail due to poor ESG performance. With the right strategy, you can maximize the benefits of ESG investing while minimizing its potential pitfalls.

Risks of ESG Investing

Whether a company’s sustainability report is complete and accurate or not, it will impact the return on investment (ROI) of an ESG-focused portfolio. After all, the key to investing is to find great buys and judge them by their ROI. But what happens when you invest in a company that doesn’t have a sustainability report? Or a company that’s not doing an excellent job in it?

Investing in sustainable and ethical companies is essential because it should be done to impact the environment and society positively.After all, it is not always possible for companies to report their efforts to ensure social and environmental impact.

How to invest in ESG securities

The first step to to invest in ESG securities is to understand what they are and how they differ from conventional stocks. Next, you must research a company’s ESG factors and examine if they align with your investment goals. Lastly, it would help if you found a broker that allows you to invest in ESG securities. Once you’ve taken these steps, you are on your way to investing in ESG securities. However, this is only the first step.

Critical considerations for ESG investors

Risk

Risk is nothing but a probability that the outcome of an action will result in loss. In the context of fund investing, it means the possibility of losing money from an investment.

Return – It is the amount of profit or gain that is earned from an investment.

Risk-Return Ratio

This describes the relationship between the expected return and the level of risk for a given investment.

How to invest in ESGs?

There are various ways to invest in ESGs. One of the best ways to invest in ESGs is through a socially responsible investment fund. This is the best way to invest in ESGs because the fund managers select companies with a positive social impact and sustainable business model. When investing in a fund that focuses on ESGs, you also invest in a fund manager and his research team. That is why investing in a socially responsible investment fund with a high research rating is essential. Moreover, you need to invest in a socially responsible investment fund that is regulated and compliant. To further enhance your ESG investment strategy, consider enrolling in an investment portfolio audit course Singapore to learn how to assess the financial integrity, governance practices, and sustainability disclosures of the funds you’re investing in.

Navigating ESG Investment Strategies: From Screening to Impact Investing in the Singapore Context

By no means, it should be considered that ESG investing is a one-solution strategy, as it represents a range of strategies with different objectives. It would go into the different types of approach that investors in Singapore can use: negative screening (excluding bad industries), positive screening (picking the best-in-class firms) to thematic investing (investing in green industries). We shall also learn about the subtlety of impact investing that aims at attaining quantifiable social and environmental value as well as financial gains out of it. Learning about the available alternative strategies, one of the most significant parts of our ESG Investing Course, will allow you to match your investments to your views and your financial needs in the modern context of sustainable finance in Singapore. Professionals seeking deeper insights can explore our ESG risk management course Singapore to build resilient, values-driven portfolios. Organizations delivering sustainable training at scale may also benefit from e‑learning content creation and design Singapore to develop engaging ESG modules.

Conclusion

In this digital era where information is at our fingertips, investors are looking for new ways to diversify their portfolios and hedge investment risks. Investing in ESG strategies promises better long-term returns with reduced volatility.

If you are looking to study ESG investing and don’t know where to start, look no further than Riverstone Training; Riverstone training provides top-notch and easy-to-learn training programs on an extensive variety of business courses, ESG investing course included. Be sure to check out Riverstone Training

ESG Masterclass FAQ

How do I become an ESG expert?

Expertise in ESG through online masterclasses. Seek free or structured ESG training for in-depth knowledge.

How do I start learning ESG?

Begin ESG learning online. Explore free and structured ESG training courses.

What is ESG in training?

ESG training imparts sustainability understanding. Covers environmental, social, governance aspects.

Who should attend ESG training?

ESG training suits professionals, investors, analysts aiming for responsible practices.

Who gives ESG certification?

ESG certification offered by institutions. Look for recognized ESG certification providers.

What is the best practice for ESG?

Best ESG practice involves integrating sustainability into business strategy and operations.

What is best in class ESG performance?

Top ESG performance aligns with high sustainability standards, setting benchmarks.

How do I get ESG certified?

Get ESG certified via recognized programs. Online courses offer ESG certification.

How much does ESG certificate cost?

ESG certificate cost varies by program. Research options for affordability.

What is the best ESG qualifications?

Top ESG qualifications include certified ESG professional or diploma courses. Online options available.

Upcoming Trainings

Corporate Valuation: Techniques & Applications

The course covers various methodologies used for business valuation, the process of valuation exercise and its importance and implications on

22 Apr 2024

Attend

Finance for Non Finance

Bangkok

Finance For Non-Finance Managers

Finance for non-finance managers course is for participants who do not have any finance background or knowledge. This course will

05 Jun 2024

Attend

Finance for Non Finance

Jakarta

Finance For Non-Finance Managers

JFinance for non-finance managers course is for participants who do not have any finance background or knowledge. This course will

03 Jun 2024

Attend

Excel

Jakarta

Advanced Excel for Professional

Microsoft Excel is an excellent business tool because it has numerous functions and formulas to store, evaluate, and modify data

17 Apr 2024

Attend

Excel

Singapore

Advanced Excel for Professional

Microsoft Excel is an excellent business tool because it has numerous functions and formulas to store, evaluate, and modify data

08 May 2024

Attend

Excel

Ho Chi Minh

Advanced Excel for Professional

Microsoft Excel is an excellent business tool because it has numerous functions and formulas to store, evaluate, and modify data

11 Jun 2024

Attend

LET’S TALK

Speak with expert.

Email:

info@riverstonetraining.com.sg

Phone:

(+65)9730-4250

Address:

Level 20, Tower 2, One Raffles Place, Singapore 048616