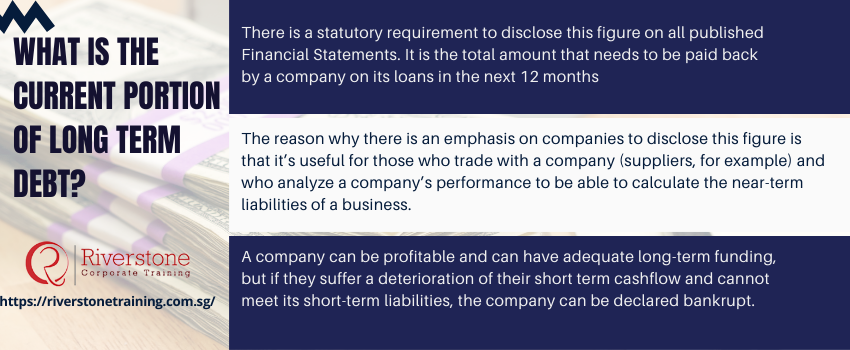

What is the Current Portion of Long Term Debt?

- There is a statutory requirement to disclose this figure on all published Financial Statements. as it forms part of what financial information is required for Singapore companies. It is the total amount that needs to be paid back by a company on its loans in the next 12 months

- The reason why there is an emphasis on companies to disclose this figure is that it’s useful for those who trade with a company (suppliers, for example) and who analyze a company’s performance to be able to calculate the near-term liabilities of a business.

- A company can be profitable and can have adequate long-term funding, but if they suffer a deterioration of their short term cashflow and cannot meet its short-term liabilities, the company can be declared bankrupt. In such a situation many creditors of the company end up not getting paid. A situation creditors would wish to avoid before it takes place and investors may not want to invest in a company whose near-term liabilities are escalating.

How Long Term Debt figure calculated?

It’s a simple figure to calculate.

Most loans will have a repayment schedule agreed with their lender. The payments that the company is required to make in the 12 months after the company’s Financial Statements calculated as the ‘current portion of long term debt

Such payments contractually required under the loan agreement and the total figure disclosed on the face of the company Balance Sheet, are essential components when learning how to read a balance sheet for Singapore businesses accurately and interpret financial obligations effectively.

Why is the figure important to disclose?

Revealing the amount to be repaid over the next 12 months gives readers of the accounts a clearer picture of the short-term indebtedness of the company. The figure can be added to the company’s overdraft and even Directors Loans, if they are immediately repayable, to get a realistic picture of how much the company might have to repay in the short term.

Suppliers and other credit providers can perform specific calculations to see how affordable a company’s long term debt profile is. One of the most popular measures of debt affordability is the company’s ‘interest cover.’ Companies with interest cover of 1 or less are considered risky by lenders or creditors.

Similarly, if the business is approaching a ratio of 1 between its Current Assets and Current Liabilities (the current portion of long term debt included in current liabilities) it’s considered risky too. This is usually a sign that the business is struggling to meet its short-term obligations, , which highlights the importance of understanding what is a financial statement in Singapore accounting to assess such liquidity risks effectively.

Navigating the Current Portion of Long-Term Debt Under Singapore Financial Reporting Standards (SFRS(I) 1-1):

Generate an article that will describe in details how the Singapore companies subclassify and present current portion of long-term debt as per SFRS(I) 1-1. This material ought to clarify the amendments of this standard especially w.r.t. liabilities having associated covenants, which are tested at a time between 12 months, and their outcomes on classification. Introduce concrete examples (maybe, using illustrative excerpts of the financial statements of a fictitious company in Singapore) so that the accounting entries and disclosures needed can be clearly explained. This would be exceptionally useful to accountants, finance specialists and students who are conversant with accounting system in Singapore.

For deeper understanding, professionals can benefit from practical finance workshops for Singapore companies and enroll in an advanced financial modeling training course to accurately apply these standards in dynamic business settings. Those looking for structured learning may consider the best financial modeling course Singapore for working professionals, especially through the best in-house training provider for finance teams Singapore.

Conclusion:

It’s by no means the only way to consider a company’s short term financial position, but the current portion of long term debt is part of such calculations.

Its primary significance to both the reader and the preparer of accounts is that the figure accurately calculated and revealed in the published financial statements.