What is Company Valuation Course

Introduction

A company valuation course can be an excellent way to learn how to value a company. It can also be utilized as a tool to enhance your investment portfolio. The course will teach you the different methods used to value a company and how to select the suitable method for each situation. There are various ways to value a company.

The most common methods are:

- The discounted cash flow method.

- The earnings power value method.

- The asset-based valuation method.

Each method has perks and drawbacks, which should be utilized in different situations. The discounted cash flow method is commonly used in valuation. Investors often utilize it to value companies they seek to invest in. However, managers can also utilize it to help them value their companies. As the earnings power value method is a more conventional approach to valuation. Managers commonly use it to value their own companies because it does not require as many assumptions as the discounted cash flow method. The asset-based valuation method is the least known method of valuation. Managers usually use it to value their own companies because it accurately represents the company’s true worth. For professionals looking to specialise in this niche area of finance, understanding asset-based valuation is a crucial step in learning how to build a successful career in company valuation.

What is a Company Valuation course?

A company valuation is a process of assessing the worth of a company. This can be done for various reasons, such as when a company is looking to sell itself or when investors consider putting money into the company. The valuation process takes into account various, including the company’s financial history, its assets, and the industry it op in which. Enrolling in a certified corporate valuation training course can equip professionals with the necessary tools and frameworks to perform accurate and insightful company valuations for strategic decision-making.

Why is Company Valuation Training Important?

Company valuation is essential because it lets businesses know their worth. This information can help make decisions like selling the company or taking on new investors. Valuations can also be considered for tax purposes, as they can help determine the value of assets for estate planning or other tax purposes.

How to Calculate Company Valuation in our course?

Are you looking to understand how company valuation works? This blog post will explain the basics of how to calculate company valuation.

What is Company Valuation?

Company valuation is the process of assessing the worth of a company. This can be done for various reasons, such as when considering investing in a company or when planning for a company’s financial future. Several method scan be used to value a company, and the most appropriate method will depend on the specific situation. Enrolling in the best company valuation training course can help professionals understand these valuation methods in depth and apply them effectively in real-world scenarios.

How to Calculate Company Valuation?

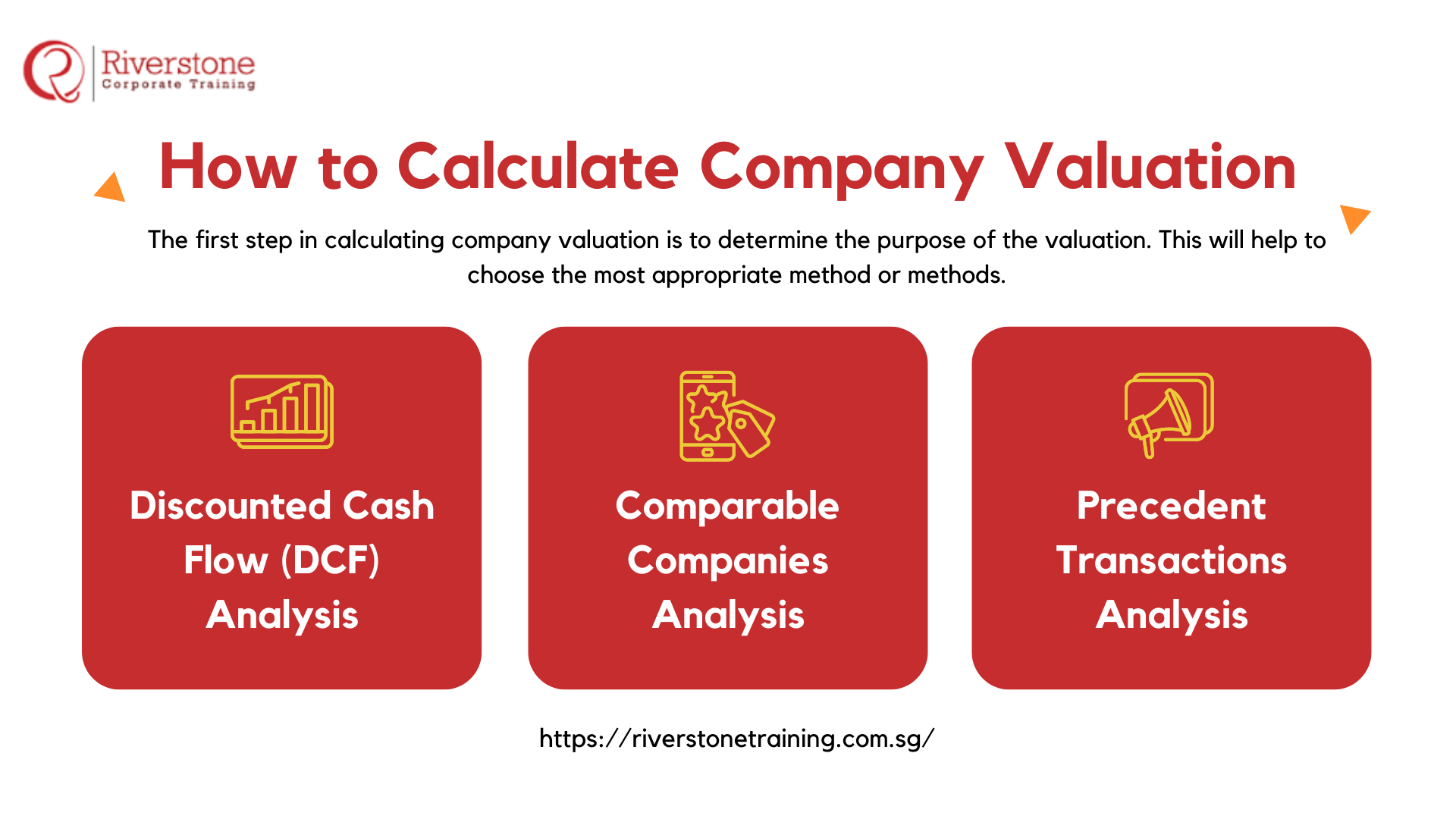

The first step in calculating company valuation is to determine the purpose of the valuation. This will help to choose the most appropriate method or methods.

The most common methods are:

- Discounted Cash Flow (DCF) Analysis: This method estimates the future cash flow that a company will generate and discounts it back to its present value. The discount rate used should reflect the riskiness of the cash flows.

- Comparable Companies Analysis: This approach compares companies that have been publicly traded and use their market value to estimate the value of the subject company.

- Precedent Transactions Analysis: This approach looks at past transactions involving companies in similar

Different types of Company Valuations method taught in our course

Many types of company valuation courses are available, each with advantages and disadvantages.

Here are a number of the most popular types of company valuation courses:

- Discounted Cash Flow (DCF) Analysis: This type of analysis is typically used to value companies that are expected to generate positive cash flows in the future. The advantage of using DCF analysis is that it allows you to directly incorporate a company’s expected future cash flows into the valuation. The disadvantage of DCF analysis is that it can be challenging to accurately estimate a company’s future cash flows.

- Comparable Company Analysis: This type of analysis is typically used to value companies that are not expected to generate positive cash flows in the future (such as distressed companies).The advantage of using comparable company analysis is that it does not require you to estimate a company’s future cash flows. The disadvantage of comparable company analysis is that finding accurate, comparable companies can be challenging.

- Precedent Transaction Analysis: This analysis is typically used to value companies involved in recent transactions (such as mergers & acquisitions). The advantage of using precedent transaction analysis is that it can provide you with direct evidence of how similar

Why is Company Valuation Training Important?

In today’s business world, company valuation is more critical than ever. There are many reasons why this is the case, but perhaps the most important reason is that it can help you decide whether to invest in a company. If you’re considering investing in a company, you need to know how much that company is worth. That’s where company valuation comes in.

Company valuation can be used to determine the value of a company for many different purposes, such as:

- Setting a price for selling the company

- Determining the value of shares for employees and shareholders

- Assessing the riskiness of investing in the company

- Negotiating loans and other financial agreements

As you can see, company valuation is an essential tool for anyone involved in the business. If you’re thinking about investing in a business, make sure you understand how company valuation works.

Conclusion

In conclusion, a company valuation course is essential for any business owner or manager. By understanding the principles of valuation, you can make more informed decisions about your company’s future. Whether you’re looking to buy or sell a business, raise capital, or want to understand your company’s worth, a company valuation course can give you the insights you need. For organizations seeking to deliver this learning in a scalable and engaging way, partnering with a custom e-learning content development company in Singapore can ensure the training is tailored, interactive, and effective.