Definition of Operating Margins

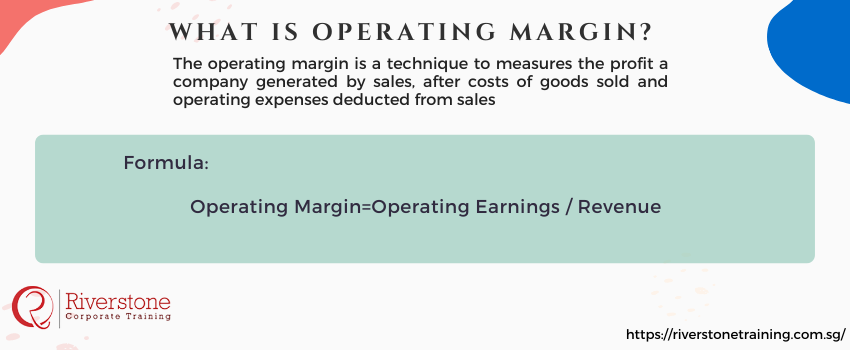

The operating margin is a technique to measures the profit a company generated by sales, after costs of goods sold and operating expenses deducted from sales

The formula of operating margin

The operating margin calculated by dividing an organizational operating profit by its total sales. The Formula of Operating Margin is:

Operating Margin=Operating Earnings/Revenue

When an organization is calculating EBITDA margin which is Earning before interest and taxes, the earning is the same as the operating earnings. Operating earnings is revenue subtracted cost of sold goods and the consistent general selling and administrative costs of ongoing the business activity, excluding interest and taxes.

Calculation of Operating Margin:

Operating margin of a company calculated by dividing its operating income by its total net sales revenue:

Operating Profit Margin=Operating Income/Total Revenues

Operating income called before interest and tax earnings (EBIT) or Earning Before Interest, Depreciation and tax earnings (EBITDA).

EBIT or Operating income is the income that is gone out on the income report; after operating costs and overhead, like selling prices, the cost of goods sold and administration expenses are subtracted.

EBIT=Total Income − Operating expenses – Depreciation and amortization

EBITDA = Total Income − Operating expenses

Importance of Operating margin:

An operating margin of an organization is also known as return on sales, and it is a good indicator of how well a business managed and how risk factors are the organization having. It represents the proportion rate of revenues that are accessible to cover non-operating prices, like paying interest. That is why lenders and investors pay keen attention to the operating margins. Operating margins are highly variable and a significant indicator of risks in a business. The operating margin represents the past workings and achievements of the company and is an excellent way to measure whether a considerable improvement in earnings is likely to last.

Limitations of Operating Margin:

Following are some of the Operating margin limitations:

- Operating margin only used to associate businesses that operate in the same industry and, preferably, have the same annual sales and business models.

- It makes it easy to compare the profitability ratio between industries and companies, and many analysts use a profitability ratio, which excludes the effects of financing, accounting, and tax policies.

- EBITDA used as operating cash flow because it excludes non-cash expenses, such as depreciation.

Conclusion:

An excellent operating margin is compulsory for a company that enables the company to pay for its fixed costs, like interest on the debt. A higher operating margins indicates that the company has less financial risk. Operating margins can be considered as total revenue from production sales all costs lessees before the adjustment of taxes, shareholders dividends, and interest on the debt.