Understanding of Equity Accounts?

What are Equity Accounts?

- These represent to readers of financial statements the structure of the Equity funding in a business.

- The business, on inception, will have shares, and shareholders will be asked to pay an amount for those shares. This is often a nominal sum, $1 to $10 per share.

- Over time, mainly if the business is thriving in raising new Equity funds, the company will issue further Equity Capital. It’s unlikely that this new capital raised on the same valuation as previous funding. To the extent that the new price for shares is higher than the original price, this is known as Share Premium.

- It’s also likely that as a business grows, it will have additional classes of shares. These too can be considered ‘Equity Accounts.’

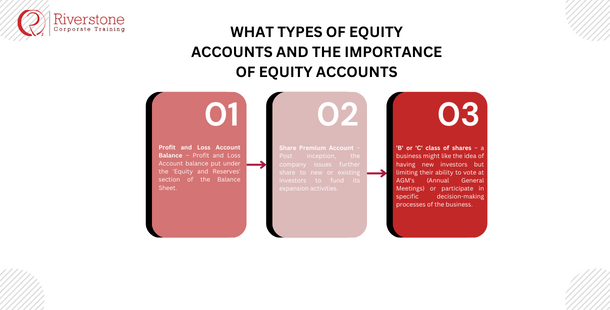

What types of Equity Accounts and the Importance of Equity Accounts

What types of Equity Accounts and the Importance of Equity Accounts

Profit and Loss Account Balance

Profit and Loss Account balance put under the ‘Equity and Reserves’ section of the Balance Sheet. This figure will represent the accumulated business profit or losses since a company’s inception.

It’s important to note that a business should not pay a dividend under many country’s legislation unless there is a sufficient positive balance in the Profit and Loss Account to do so.

Share Premium Account

Post inception, the company issues further share to new or existing investors to fund its expansion activities. These shares will most likely be given at a higher value than their nominal value, and this excess included in the Share Premium Account

‘B’ or ‘C’ class of shares

A business might like the idea of having new investors but limiting their ability to vote at AGM’s (Annual General Meetings) or participate in specific decision-making processes of the business.

Different classes of shares can be issued, offering subscribers of such shares additional voting and participation rights. These categories often stay in place even when the business is significantly larger. If you look at the financial pages of a newspaper, the Financial Times, for example, you will find different prices quoted for companies who have ‘A’ and ‘B’ shares

Application of Equity Accounts

The Equity Accounts collectively represent the Equity of a company. A company with a solid Equity base is often seen as a mature and financially reliable company.

What types of Equity Accounts and the Importance of Equity Accounts

What types of Equity Accounts and the Importance of Equity Accounts