A Hacks For Petty Cash Accounting.

A Hacks For Petty Cash Accounting.

Petty cash is the small amount of money reserved on hand to repay for minor expenses, like reimbursements or office supplies. A petty cash fund will undertake periodic settlements, with transactions documented in the financial statements.

A petty cash fund can be a box with a minor amount in each section for larger organizations.

Petty cash transactions deliver convenience for small transactions for which issuing a check is unacceptable or irrational. The small amount of cash that a company deliberates petty cash will vary, with many companies keeping between a minimum of $100 to $10,000.

Examples of works that a petty cash fund used for are:

- Cards for clients

- Office provisions

- Paying for lunch for employees

- Repaying an employee for travel or meeting expenses

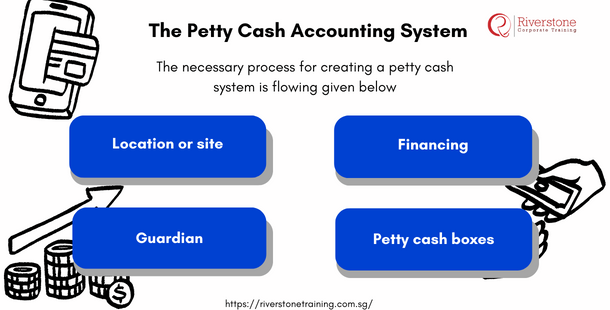

The Petty Cash Accounting System

A petty cash system is a system of procedures, controls, rules, and events that a company uses to distribute cash for various miscellaneous requirements, such as office provisions and facilities. The necessary process for creating a petty cash system is flowing given below:

- Location or site:

companies where petty cash funds are made decided upon the need and urgency. It will depend on organization policy; there may be a single organization or one per every department separately.

- Guardian:

These are generally administrative staff, who are working on Adhoc issues of the company regarding manage most of the day and have enough clerical skills to continue the essential record-keeping with a higher level of accuracy.

- Financing:

Financing will depend upon the size of the department as well as the petty cash funds. There is a high risk of theft of petty cash, so it is better not to create a sizeable petty cash fund. Smaller, little money is valuable and refilled more frequently.

- Petty cash boxes:

Company set up safe petty cash boxes with a supply of petty cash vouchers.

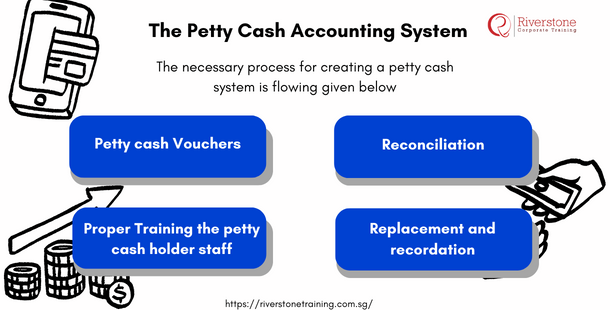

- Petty cash Vouchers:

Staff can purchase petty cash vouchers from the office supply store according to department needs.

- Proper Training the petty cash holder staff:

petty cash guardians should be adequately trained, estimate requirements for releasing petty cash, how to fill out vouchers correctly in exchange for cash payments, and when to appeal additional money when cash in hand is low.

- Reconciliation:

The accountant periodically inspects the cash in hand and creates receipts in each petty cash box to examine if the total amount matches the original amount of funds customary for the table and reconcile any modifications.

- Replacement and recordation:

Endorse is when the cashier refills the amount of cash in the petty cash box, as demanded by the petty cash guardians. That involves summarizing and recording all expenses in the general ledger.

Example of Petty Cash Accounting:

Company ‘XYZ’ formed a petty cash fund of $1000 on Jan 1, 2021. The journal entry will be:

| Petty Cash | 1000 | |

| Cash at Bank | 1000 |

In January 2021, the following payments made from the petty cash box:

| Office general Supplies | $400 |

| Highway toll tax | 40 |

| Postage fee | 40 |

| Freight-In | $250 |

The entries to record the about expenditures from petty cash is on the journal are:

| Office general Supplies | 400 | |

| Highway Toll tax | 40 | |

| Postage fee | 40 | |

| Freight-In | 250 | |

| Petty Cash | 730 |

The company refilled the fund $730. The journal entry will be:

| Petty Cash | 730 | |

| Cash at Bank | 730 |

Conclusion:

Petty cash is one of the essential needs of a company to perform a day-to-day activity. An organization must integrate satisfactory control to lessen the risks of stolen petty cash or improper reimbursement.

A Hacks For Petty Cash Accounting.

A Hacks For Petty Cash Accounting.