Startup Valuation course

Table of contents

Introduction

A startup is a fast-changing business with a short time to prove its value. Venture capital investors have less patience for slow growth and uncertainty within a company than with more giant, more stable corporations. As such, valuation expectations are much higher in early-stage startups than in established businesses. To navigate this demanding environment, professionals can benefit from a venture capital training course for professionals and a comprehensive company valuation course for startup businesses, which equip them with the tools to make informed investment and valuation decisions.

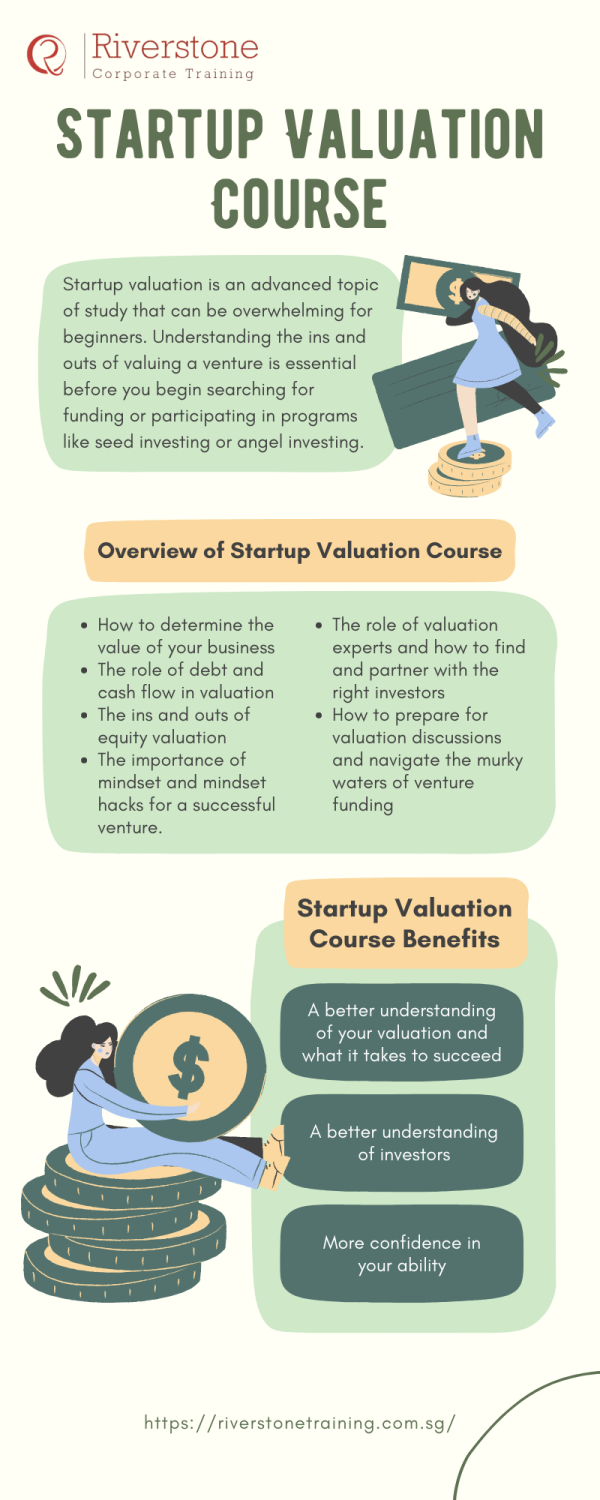

Startup valuation Course is an advanced topic of study that can be overwhelming for beginners. Understanding the ins and outs of valuing a venture is essential before you begin searching for funding or participating in programs like seed investing or angel investing. We will discuss everything related to the process and expectations of startup valuation before you get started.

Overview of Startup Valuation course

The key to successful venture valuation is understanding the ins and outs of the process. Luckily, you can learn and use this in your day-to-day application. Riverstone Training has curated a comprehensive course, Startup Valuation and Advanced Fund Raising Course, that covers the ins and outs of startup valuation, including:

How to determine the value of your business

From market fit to growth potential and beyond.

The ins and outs of equity valuation

From equity types to valuation methods.

The role of debt and cash flow in valuation

From debt to cash flow types.

The role of valuation experts and how to find and partner with the right investors.

How to prepare for valuation discussions and navigate the murky waters of venture funding.

The importance of mindset and mindset hacks for a successful venture.

Why Study Startup Valuation Course

There are a lot of myths and misunderstandings surrounding the process of valuing a startup valuation course. Understanding the basics of this process can help you avoid some of the most common mistakes startups make when valuing their companies. Understanding the primary function of startup valuation will also help you in your entrepreneurial journey. Imagine, for example, that you have an idea for a popular business. You’d like to get funding to make it a reality. You may want to start your company if you have an idea for a startup that solves a real-world problem. Now imagine that you don’t know if your business idea is good or if it has any market demand. Will you be able to raise funding for your new venture? What if you’re wrong?

Startup Valuation Course Benefits

A better understanding of your valuation

You will learn more about your business and what makes it valuable. This will help you better understand your own business and the strengths and weaknesses of your company.

A better understanding of what it takes to succeed

You will learn more about the discipline and hard work needed to succeed in the business world. This will help you better understand the road ahead in starting a business.

A better understanding of investors

You will learn more about investors’ expectations and how to calculate the startup company valuation to make investors notice. This will help you better understand your expectations and the expectations of your investors.

More confidence in your ability

You will be more confident in your ability to succeed in the startup valuation or assist the company in the fundraising process

What to Expect in Riverstone Training Startup Valuation Course?

Riverstone is a significant provider of training solutions for both individuals and corporations.

Riverstone Training has several resources that can help you get started. Taking a startup valuation course will take the first step in the right direction. Riverstone course will help you understand the basics of startup valuation and provide you with valuable insights into the world of startup investing.

Once you have completed the Startup course, you will be ready to start valuing the startup, managing your investee companies or funds, investing in the startup at the correct valuation, etc. Startup valuation is different from the traditional valuation. However, before you do, you should take some time to consider your goals and objectives. You will also learn how to clearly plan what you want to achieve with your startup fundraising process.

Regarding startup fundraising, If you are unsure about what you want to achieve with your startup companies or portfolio, it is best to start small and build up your company over time. This way, you can ensure that your startup is successful before committing too much money or time to it.

The bottom line

Best Startup valuation Course in Singapore is a complicated process that relies on a lot of assumptions. It’s important to remember that the valuation of your company is just an estimate. It’s improbable that investors will be willing to purchase your company for the exact amount you’ve calculated. Startup valuation is a challenging process requiring much research and validation.

It’s important to remember that valuation is just an estimate of your company’s worth. It’s improbable that investors will be willing to purchase your company for the amount you’ve calculated. Startup valuation is an advanced topic of study that can be overwhelming for beginners. Understanding the ins and outs of valuing a venture is crucial before you begin searching for funding or participating in programs like seed investing or angel investing. That’s why engaging a certified company valuation services provider in Singapore can offer professional insights and ensure your valuation approach aligns with industry standards.

Startups Valuation and Fund raising FAQ

What is the valuation in fund raising?

Valuation in fund raising sets the startup’s worth. Courses teach founders how to value a startup.

How does startup funding and valuation work?

Startup funding relies on valuation. Investors assess potential returns based on the startup’s value.

How do you evaluate funding for a startup?

Evaluate startup funding needs, considering costs and growth plans. Seek funding courses for guidance.

What is reasonable valuation for startup?

Reasonable startup valuation balances potential with risk. Courses help founders calculate it.

What is a startup funding valuation?

Startup funding valuation determines equity offered to investors in exchange for capital.

What does raising funds for startups mean?

Raising funds for startups means securing capital from investors or sources to fuel growth.

What is raising and valuation?

Fundraising and valuation go hand-in-hand. Proper valuation attracts investors.

How does fundraising and valuation work?

Fundraising involves securing capital, while valuation determines the startup’s worth.

What is the purpose of raising funds?

Raising funds serves to finance growth, product development, and operational needs.

How do we do fund raising?

Fund raising involves pitching to investors, networking, and showcasing a compelling business plan.

Upcoming Trainings

Corporate Valuation: Techniques & Applications

The certified business valuation training course in Singapore cover various methodologies used for business valuation, the process of valuation exercise and its importance and implications on

22 Apr 2024

Attend

Finance for Non Finance

Bangkok

Finance For Non-Finance Managers

Finance for non-finance managers course is for participants who do not have any finance background or knowledge. This course will

05 Jun 2024

Attend

Finance for Non Finance

Jakarta

Finance For Non-Finance Managers

JFinance for non-finance managers course is for participants who do not have any finance background or knowledge. This course will

03 Jun 2024

Attend

Excel

Jakarta

Advanced Excel for Professional

Microsoft Excel is an excellent business tool because it has numerous functions and formulas to store, evaluate, and modify data

17 Apr 2024

Attend

Excel

Singapore

Advanced Excel for Professional

Microsoft Excel is an excellent business tool because it has numerous functions and formulas to store, evaluate, and modify data

08 May 2024

Attend

Excel

Ho Chi Minh

Advanced Excel for Professional

Microsoft Excel is an excellent business tool because it has numerous functions and formulas to store, evaluate, and modify data

11 Jun 2024

Attend

LET’S TALK

Speak with expert.

Email:

info@riverstonetraining.com.sg

Phone:

(+65)9730-4250

Address:

Level 20, Tower 2, One Raffles Place, Singapore 048616