What is Auditor Opinion?

An auditor’s opinion is a document that accompanies a client’s essential financial statements. It delivers an opinion as to whether material misstatements exist in the financial statements. The audit report starts with an introduction section that outlines the responsibility of management and the audit firm.

The features of Auditor Opinion

To fully understand how these opinions are formed and their implications, professionals can benefit from an independent financial audit training course, which provides practical insights into audit standards and reporting practices. An auditor’s opinion includes four different types of auditor’s opinion that are listed below:

Unqualified Opinion

An unqualified opinion is also referred to as a favorable opinion. The auditor gives an unqualified opinion report if the financial are presumed to be free from materials’ misstatements. Also, unqualified opinions are given based on the internal controls of an entity. If management has claimed responsibility for its creation and maintenance, the auditor must perform fieldwork to test its effectiveness.

Qualified Opinions

Generally, a qualified opinion is given when a company’s financial records have not followed GAAP in all business transactions. Although the wordings of qualified opinions are similar to unqualified opinions, the auditor provides an additional paragraph that includes deviation from GAAP in the financial statements and points out why the auditor report is not unqualified.

Adverse Opinion

The most unfavorable opinion a company can receive from an auditor is an adverse opinion. An adverse opinion includes financial records not prepared as per GAAP and grossly misstated. The adverse opinion may be an indicator of fraud, and the company may be forced to re-audit its financial statements. Lenders, investors, and other financial institutions do not accept financial statements with adverse opinions.

Disclaimer Opinion

If, in any event, the auditor is unable to complete the auditor’s report due to the absence of financial records or insufficient cooperation from the management, the auditor issues a disclaimer opinion. This is a sign that no view over the financial statements was able to be determined.

Why is it important?

An auditor’s opinion is used to determine the business’s financial records. The type of auditor’s opinion a company receives will impact the reliability of investors. This means that companies should always strive to get a reasonable opinion. A qualified opinion is the second-best option, and disclaimer and adverse opinions have a negative impact on the businesses.

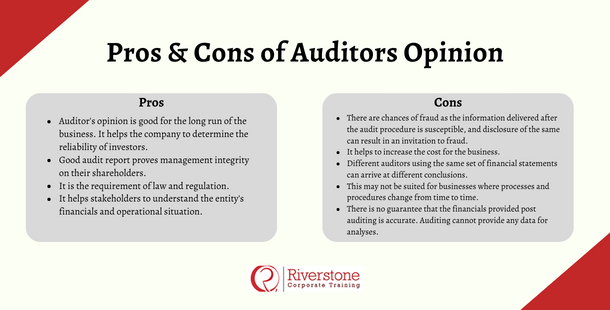

Pros & Cons of Auditors Opinion

Pros & Cons of Auditors Opinion

Pros of Auditors Opinion

- Auditor’s opinion is good for the long run of the business. It helps the company to determine the reliability of investors.

- Good audit report proves management integrity on their shareholders and highlights the importance of financial statements in business Singapore for maintaining transparency and trust.

- It is the requirement of law and regulation.

- It helps stakeholders to understand the entity’s financials and operational situation.

Cons of Auditors Opinion

- There are chances of fraud as the information delivered after the audit procedure is susceptible, and disclosure of the same can result in an invitation to fraud.

- It helps to increase the cost for the business.

- Different auditors using the same set of financial statements can arrive at different conclusions.

- This may not be suited for businesses where processes and procedures change from time to time.

- There is no guarantee that the financials provided post auditing is accurate. Auditing cannot provide any data for analyses.

Beyond the Unqualified: Deciphering Modified Audit Opinions in Singapore

Although audited opinions of unqualified (clean) opinion is the benchmark of a business in Singapore, it is vital to appreciate that the modified opinion is important in enhancing financial transparency. In this contents, a distinction will clearly be made between qualified opinion, which identifies certain isolated points of concern and the adverse opinion which is even more disastrous as it states that there are misstatements that are pervasive and the financial statements are rendered unreliable. We will also describe a disclaimer of opinion, when the auditor just was not able to accumulate enough evidence. The understanding of these differences is important to the investors and creditors as well as other stake holders to make accurate estimates about financial strength of a company in Singapore.

The Auditor’s Judgement: How Professional Due Diligence Shapes the Audit Opinion in Singapore

Have you ever asked how an independent auditor comes up with his/her critical opinion to the financial statements of a company? It is a painstaking task advancing under importance of Singapore Standards on Auditing (SSAs). This paper will unlock the process: the arduous risk examination and the assessment of the internal controls, compilation of adequate, reasonable audit evidence and the use of mature and experienced professional judgment. By understanding the M&A due diligence process, one can realize the great burden imposed on auditors to protect the integrity of financial affairs. It highlights why their unbiased view counts so much in instilling trust and confidence in Singapore corporate environment.

Implications of a Modified Audit Opinion for Your Business’s Future in Singapore

The consequences of obtaining anything other than an unqualified audit opinion may have critical implications to businesses that are situated in Singapore. This material will go into the practical effects of a qualified, adverse, or disclaimer of opinion. Find out how these results on the audit may hurt the reputation of your company, its chances of getting essential financing, attract new investors, and even cause close attention by authorities such as ACRA. We will also give an idea about what should be done to correct the issues that are identified working on the requirements of being financially sound and building the trust back on stakeholders to have a healthier business in its future in Singapore. For those looking to strengthen their understanding of audit implications and financial best practices, enrolling in a Beginner to advanced finance course Singapore can offer valuable insights and practical tools.

Conclusion

Auditor’s opinion is a valuable tool to engender confidence in a business. However, a company needs to meet all the GAAP guidelines if they want to avoid a poor auditor’s opinion, which could negatively impact business. One effective way to ensure your team understands and complies with these standards is by leveraging interactive online training content Singapore providers offer, helping employees stay updated and audit-ready.

Pros & Cons of Auditors Opinion

Pros & Cons of Auditors Opinion