What is financial statement – Income statement, balance sheet, and cash flows

A financial statement is a formal record of all financial activities of a company or an organization. To have a clear understanding of a financial statement, it is important to define the following terms.

- The income statement is a financial report that shows the financial performance of a company on how money spent on expenses and money earned over a specific period of accounting. It helps in providing a summary of the profit or loss that a company incurred during a given period, commonly referred to as accounting period.

The income statement has two categories: operating and non-operating. Operating sector shows income information on expenses and revenues that are as a result of normal business activities. For example, a company dealing with the production of automotive will incur expenses at the production stage and make revenue by selling the vehicles. On the other hand, non-operating sector shows indirect expenses and revenues. For example, if the same automotive company sells investment securities or invests in real estates, the revenue falls under the non-operating part. - The balance sheet is a financial document that keeps the company’s record of shareholder’s equity, assets, and liabilities within a specific accounting period. A balance sheet has two main parts: assets and liabilities plus the shareholder’s equity on another side. These two must have a balance for a business to function well. The importance of this record is to give the investors an overview of what is owned by a company or an organization and the amount of shareholders investment.

- Cash Flow: just like the name suggests, it a financial statement that records the amount of money flowing into and out of business. When a company has a positive cash flow, it means that it can settle debts since the return money is good. Negative cash flow means that the money is not being received for the payable items. The importance of cash flow financial statement is to assess the liquidity of a company’s income and to determine whether the business will remain solvent or not.

Having understood the meaning of financial statements, the following are the benefits of having a financial statement in business.

- It helps to determine the potential of a business whether it can generate cash, highlight sources of cash and how to use it to improve the business.

- To know if an organization is an able to repay debts.

- To keep records on the financial trends and know opportunities that will profit the company.

- It helps in investigating specific business transactions.

- It provides potential investors with relevant information, especially the shareholder’s equity information.

Income Statement or Profit and Loss statement Financial Statement

The income statement and profit and loss statement (P&L) terms are used interchangeably in accounting. The profit and loss statement (P&L) provides a summary of costs, expenses, and revenues that a business incurs during a specified accounting period. The P&L statement is also referred to as the statement of operations, income statement, income and expense statement, statement of financial results

Just like the cash flow and balance sheet statements, the P&L statement is quarterly and annually released by any public company. This statement shows the financial changes experienced by a company over a specific period; either quarterly or annually. To achieve accuracy in accounting, the income statement is compared with the cash flow statement.

The following terms will give a clear understanding of the income statement.

Revenues/Income

In simple language, income is the revenue earned by business out of selling products and services or the money that an individual gets as a way of compensating labor efforts or investments. Income comes also be defined as the money business, or an individual receives after providing a service or goods or returns received after investing capital as a shareholder. Another definition of income is net income. The net income is the cash that remains after all expenses have been deducted after selling goods or services.

A salary and bonuses are revenues of an employee while social security, pension, and investments are main retiree sources of revenue. On the contrary, the main source of income for a business is from selling products and services, or external investments such real estate.

Cost /Expenses

Cost and expenses are different though some people in business may use them interchangeably. For example, cost can be specific such as what is the cost of a house or car? In most cases, cost is considered as a one-time project, especially when purchasing something. In business, cost is mainly associated with pricing and marketing strategies. On the contrary, the expense is more formal and is related to taxes and balance sheet. An expense is a regular payment for something that helps in running the business. The main difference between cost and expense is that an expense is regular while cost is one time.

In accounting, the cost is associated with product prices to the seller or producer while expenses are documented in the P&L statement. Expense is a regular payment such as rent, utilities, marketing strategies and payroll. A cost is a one-time purchase of buying a business phone.

Depreciation- types of depreciation

Depreciation is the method of placing the cost of a business asset (a tangible asset) over the useful life of the asset. Business assets depreciate over time and are important to take such records through auditing for accounting and tax purposes. Depreciation records are important because it helps in reducing the cost of the tangible assets and reduce the tax according to the revenue regulations within a specific country. It also helps a business to write-off the value of assets over a specific accounting period.

Note that depreciation expense is a non-cash transaction.

An example of depreciation:

As earlier noted, depreciation is a non-cash transaction, but it indicates the value of an asset over a specific time. For instance, if a business purchases an asset worth $50,000, it can decide to write off the entire cost within the first year, or write off the value over a lifetime of the equipment which is ten years. Most of the business owners love depreciation because it virtually increases the net income. Consequently, the asset can be discarded for $10,000, meaning it qualifies a rescue value of $10,000. Using this data, it is possible to calculate the depreciation expense which is the difference between the cost of the equipment and the rescue value and divide it by the useful life. This calculation will be ($50,000 – $10,000)/ 10 = $4,000. This means the business will not write off the entire asset ($50,000) in one year, but it will become $4,000 expense for every year until the asset is written off after 10 years.

The loss of market value is also referred to as depreciation. Good examples of assets that lose market value with time are real estate and currency. For example, in 1998, Russian ruble lost its value by 25%. In 2008, there was a house crisis in the US and homeowners in places like Las Vegas were affected because the value of the houses depreciated by 50%.

Types of Depreciation

There are three types of depreciation in accounting:

- Straight line depreciation.

- Unit of production depreciation.

- Accelerated depreciation.

Straight Line Depreciation

This is simplest and commonly depreciation method used in accounting. In this type, depreciation is calculated by taking the buying price of equipment or asset and subtracting the rescue value, commonly known salvage value and divide it by the productive years. The productive year is an estimate of the number of years the asset is expected to benefit a business (the useful life of the asset). Calculating the depreciation value helps the company know the selling value in the case that it does not need the asset.

Depreciation expense = total buying cost- salvage value / useful life

Straight line depreciation assumes a constant value depreciation of an asset over the useful life which is accounted for in the balance sheet.

Unit of Production Depreciation

Just as the name suggests, the depreciation is calculated per unit of production which is a fixed rate. Therefore, the company needs to know the cost per unit of production and multiply it by the number of units to be produced within a specific accounting period to know the depreciation expense of that asset.

Depreciation expense = total buying cost – salvage value/ estimated total number of units

Estimated total units = the number of units a machine can generate over its lifetime

Depreciation expense = depreciation per unit * number of units generated within the accounting period.

Accelerated Depreciation

This type of depreciation allows a business to write off equipment during their early years, faster than the straight-line depreciation. It uses a shorter number of years as compared to the straight-line depreciation. This depreciation method is common to assets that can be easily replaced before the useful life is over. A good example of such assets is computers.

Accelerated depreciation method has two types: sum-of-year (SYD) method and double-declining balance (DDB) method.

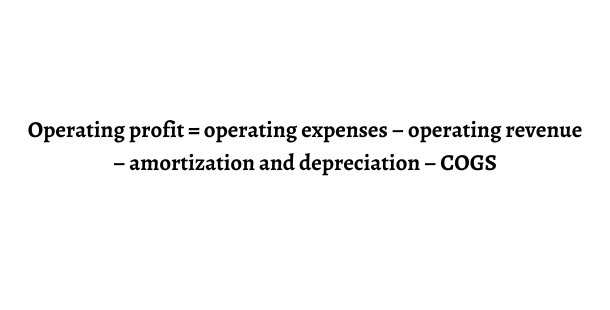

Operating Profit and Net Profit

These two terms are mostly used interchangeably. However, in accounting, each of them has specific meaning and are used in different context. The best way to understand operating profit and net profit is by understanding how they appear in the income statement of a business.

Operating profit is derived from the gross profit, and it summarizes the residual income after subtracting all the costs of running a business. The costs of running a business include rent, insurance, payroll, utilities, depreciation, freight and amortization of assets. In simple terms, the operating profit is the cash remaining after deducting all necessary expenses that keep a business in operation.

cost of interest payments on debts and extra income from taxes or investments in not accounted for in the operating profit.

Net Profit is also referred to as net income. Net profit summarizes all residual income that remains after accounting for all positive and negative cash flows. To get net profit from the operating profit, debt expenses, one-time expenses, taxes and other expenses such as bought equipment are subtracted. This makes a net profit the most important financial statement because it provides the real image of the ability of the company to generate profit for itself and the shareholders.

Balance Sheet

As earlier discussed, a balance sheet is a financial document that has the company’s record of shareholder’s equity, assets, and liabilities within a specific accounting period. A balance sheet has two main parts: assets and liabilities plus the shareholder’s equity on another side. These two must have a balance for a business to function well. The importance of this record is to give the investors an overview of what is owned by a company or an organization and the amount of shareholders investment. The main components of a balance sheet include assets, liabilities and shareholder’s equity.

The following are some of the key terms that are used in a balance sheet when providing financial summary within a given accounting period.

Accounting equation, assets = liabilities

The accounting equation indicates all assets that are being rented and those being bought with the shareholder’s capital. This leads to the following accounting equation.

Assets = Shareholder Equity + Liabilities

Any sale or purchase in a company affects the two sides of a balance sheet. This means the equation could also be expressed as:

Liabilities = Shareholder Equity – Assets

Or

Shareholder Equity = Assets – Liabilities

Liabilities is the amount of money that a business owes to creditors; whether short-term or long-term. Short-term liabilities are those to be paid off within 12 months (a year) while long-term liabilities are to be paid off for more than one year. To calculate total liabilities, the short-term is added to the long-term liabilities.

Total Liabilities = Short-term Liabilities + Long-term Liabilities

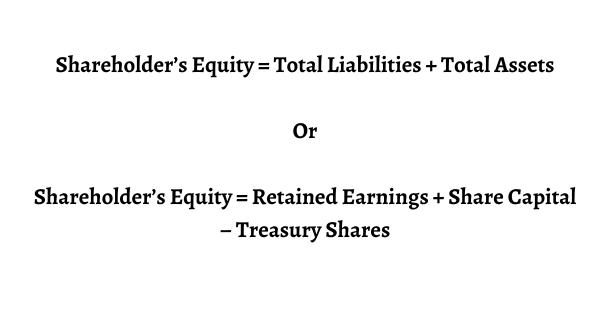

Shareholders’ Equity

It is also referred to as stockholder’s equity or book value. It is the section of a balance sheet that represents the money a business receives from investors in exchange for stock (commonly referred to as paid-in capital), donated money and earnings that are retained. It also represents the equity currently at stake. Shareholder’s equity has two calculations.

There are two sources of shareholder’s equity: first, it is the amount of money that was originally invested in the company and the investments made. The second source is the retained earnings that a business has been able to accumulate through its operations over time. For instance, companies that have been in business for many years have higher retained earnings as compared to the companies that have fewer years. Retained earnings grow with time as long as a business is in operation.

Preference Capital

Preference capital is also known as preference share or preferred stock. Preference capital is dividends that are paid out to the stakeholders before the stock dividends are given. In case of a bankruptcy crisis, the stakeholders with the preference share are first to be compensated. The preference capital is fixed, unlike the common stocks. There are four types of the preference capital.

- Cumulative Preferred Stock: It includes paying the preferred shareholders all dividends, as well as those who left before the common shareholders.

- Non-cumulative Preferred Stock: Those who left are paid under the unpaid dividends category. In case the company refuses to pay such dividends, the individuals have no right to claim for the dividends.

- Participating Preferred Stock: it provides the stakeholders with a right to receive dividends and bonuses.

- Convertible Preferred Stock: this type of preferred capital allows the stakeholders to convert their shares to common shares.

Debt/Loan – also add types of debt

Debt or a loan is money that has been borrowed by a company from another institution. A business is likely to get a loan when in need of buying bulk items and cannot afford to finance the entire purchase. A debt arrangement allows the borrower to refund the money within a given period is returned with interest. The interest makes sure that the lender’s risk is taken care off. Interest rates are also a way of encouraging the borrower to pay off the debt quickly to reduce extra interest expenses.

The most common forms of loans that are debts include auto loans, mortgages and credit card debt.

Sometimes on the balance sheet, debts are also considered as liabilities since it is a cost that is constantly paid by a business within a specific time until it clears the entire loan. In case of any deviation, the company will incur a greater cost.

There are two main types of loans

- Short term loans

- Long-term loans

Short-term Loans

Most of the businesses take both short-term and long-term loans which are recorded as liabilities on the balance sheet. Both types are either categorized as operating or financing liabilities.

Short-term loans are also referred to as short-term liabilities. These loans are due within a maximum of 12 months or within a short accounting period. The following are examples of short-term loans:

- Bank loans that are short-term: the need for such loans arise when a business needs urgent operating cash. This loan is payable within a year.

- Payable accounts: these are debts owed by a business to service providers and suppliers. It includes invoices, bills, and utilities from businesses that supply electricity and water or other products that a company needs to operate.

- Wages: these are salary payments to the employees and members of staff.

- Payments at lease: most of the lease agreements are considered as long-term debts. However, those payments that need to be paid within 12 months are considered as short-term

- Payable income taxes: these are government taxes that have not yet being paid. Usually, these taxes are due within a period of fewer than 12 months.

Long-term Loans

Long-term loans are debts that exceed beyond a year or exceeds beyond the company’s accounting period. The following are some of the long-term debts:

- Bonds: these types of loans are given to the public and are paid within seven years.

- Payable individual notes: these are loans in the form of instruments that are given to an investor and the payment terms differ from one note to another.

- Convertible bonds: these bonds allow a business to redeem them as shares of the common stock.

- Lease contracts or obligations: a lease obligation or contract that exceeds beyond 12 months becomes a long-term loan or debt.

- Postretirement and pension benefits: some companies or organizations offer long-term pension benefits to employees during retirement.

- Contingent obligations: these are obligations that may come up in business depending on how future events unroll. An example could be pending lawsuits that the company has not yet settled.

Fixed Assets Financial Statement

A fixed asset is also referred to as a capital asset which is a tangible property that a business or a company owns and uses it to generate more money. The word fixed means that the asset may not be sold or used up within a given accounting year. Note that fixed assets are not likely to be converted into money within 12 months; it is a long-term investment of a business. Fixed assets are such as plant, land property, and equipment. Assets are included on the balance sheet and help in determining the net worth of a company.

There are two types of assets current and non-current assets. Current assets are also referred to as liquid assets because they can be converted into cash within a period of less than a year. On the other hand, non-current assets are not easily converted into cash. They take more years to be converted as compared to the current assets. The non-current assets include intangible assets, deferred charges, fixed assets and long-term investments.

When a business decides to dispose or to buy a fixed asset, it is usually recorded in the cash flow statement

Importance of fixed assets is that it provides useful information to help in providing accurate financial reports and business valuation during financial analysis.

Current assets and Liabilities – also add types of current assets and liabilities

Current assets are accounted in the balance sheet as the value of all assets that can be converted into cash within 12 months or a year. Current assets are also referred to current accounts. Current assets include the following:

- Cash and cash equivalents

- Receivable accounts

- Inventory

- Marketable securities

- Prepaid expenses

- Other liquid assets that can be easily converted to cash

A business uses current assets to run day-to-day activities and pay recurring expenditures depending on the type of the business. Current assets can range from foreign currency, crude oil to baked goods. The current assets are usually displayed in the order of how easily they can be converted into cash. In other terms, in the order of liquidity of the assets. Assets that can not be turned into cash within a year they are listed under the long-term assets category.

What are Key Components of Financial Statement Current Assets ?

For instance, bills that have not yet been paid are said to be current assets as long as they are expected to be paid within one year. Therefore, the main component of a current asset is the ability of the company to pay a bill within a year. Alternatively, if a company or an organization is unable to pay a bill within one year, it becomes a bad debt expense. To fully understand how these transactions impact financial records, the best financial modeling for financial statement analysis is essential, especially for forecasting and evaluating a company’s short-term financial health.

Inventory is a current asset, but sometimes it may not be easily convertible to cash as compared to other current assets. Therefore, it depends on the accounting methods that a company uses to liquify assets.

Prepaid expenses are considered current assets because the bills are already taken care of. This helps in freeing money for other business operations. Prepaid expenses include insurance payments and contractors’ payments. Sometimes an asset does not become a current asset because it can be converted to money, it can come a current asset because the bill is already taken care of.

Current Liabilities are a business’s obligations or debts that appear in a business’s balance sheet that is due within 12 months. Current liabilities that are featured on the balance sheet include accounts:

- payable,

- short-term loans/debts,

- other debts and

- accrued liabilities.

Basically, these bills are due within or less than a year. A business can cash or withdraw current assets to get enough money to pay the current liabilities.

In accounts, current liabilities are categorized into two; quick ratio and current to help in knowing whether a business can pay its current liabilities or not.

Goodwill

Goodwill is an immaterial or intangible asset that comes when a business buys another business. In this case, goodwill represents the brand name, good customer relations, patents, solid customer base, proprietary technology and good employee relations.

Unlike other physical assets such as equipment and buildings, goodwill is intangible. It is accounted for in the balance sheet under the long-term assets. For example, if Company A is worth $22 billion, and Company B buys Company A at $25 billion, the $3 billion extra is the goodwill.

Usually, a company or a business is sold at a higher price than the net worth. If the company agrees to be sold at a lower price, it is referred to as negative goodwill. This will rarely occur, but it is a sign of a distressed sale which has been influenced by the economic environment.

Investments

An investment is an item or an asset that a company buys with the aim of generating income or hoping that the asset will appreciate. In simpler terms, an investment is a good bought and cannot be consumed, but it is aimed at increasing wealth in the future. Maybe the product can be sold at a higher value in the future to generate money for the business. Investments include real estate property, bonds or stocks. All these investment types are aimed at increasing income for the business in the future.

Having good investments will help in achieving economic growth because it increases production. Hence the nation’s gross national product increases. Items bought in the form of investments are recorded under long-term assets on the balance sheet. This is because the company intends to hold the asset for many years before disposing of it. Professionals looking to deepen their expertise in this area can benefit from investment and financial training programs, or enroll in the best finance course for professionals to gain practical and strategic skills for managing investments effectively.

Cash Flows Statement

Cash flow statement is a must to any financial reports of a company or an organisation. It is key because it records the amount of money and cash equivalents that enter and leave the company or the organisation. This information helps the investors and shareholders understand how a business is operating, where it gets money and how the money is spent by the company.

The cash flow statement is different from the balance sheet and income statement because it does not include future incoming and outgoing money. It summarises the current incoming and outgoing cash in the company, not cash that is under the credit category.

Cash flow is determined by examining three factors:

- Operations

- Investing

- Financing

Cash flow from operating activities

Monitoring the incoming and outgoing is a critical business operation because it helps a business to know how much cash it has generated from selling products and services. Operations include changes that occur in depreciation, accounts payable, accounts receivable, and inventory.

To calculate cash flow, the net income needs to be adjusted by subtracting or adding differences in credit transactions, expenses, and revenue that appear on the income statement and balance sheet. These adjustments are made because cash flow does not involve the future expenses and incoming cash. Therefore, many factors need to be re-evaluated when calculating the cash flow from operations.

For example, depreciation is not a cash expense, but it’s cash value that is deducted from an asset as years progress. This value is added to the net sales when cash flow is being calculated. On the contrary, if the asset is sold, the cash is accounted for in the cash flow calculations.

Accounts receivable changes on the balance sheet need to be included in the cash flow calculations. If the accounts receivable decreases, it means that more cash is entering the business from clients who are paying their credits. If the accounts receivable increases, it means more customers are taking credit. Therefore, cash flow operations cannot account this because it is not cash but credit.

Cash Flow from Investing

Cash flow from investing is related to investments, assets, and equipment. When a business decides to invest, the cash moves to outgoing money because the company uses the cash to buy new assets such as buildings and equipment, as well as short-term assets like the marketable securities. When the company uses the asset to bring in cash, it is documented under the incoming cash in the cash flow statement. It becomes cash from investing.

Cash flows from financing

Dividends, loans, and debts are summarised in cash from financing section. They fall under the incoming cash when money is being raised and falls under outgoing when the company is financing the loan, debt or dividends. Also, when a company issues out bonds to the public, it gets cash from individuals and businesses that buy the bonds. This is referred to as cash flows from financing. When paying loan and dividends, cash in the business is being reduced.

Uses of Financial Statement

The main use of a financial statement is to give information about the financial statement