What is Financial Auditing?

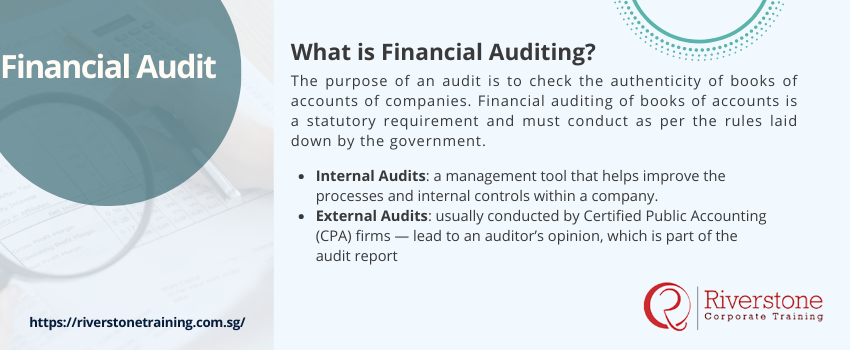

The purpose of an audit is to check the authenticity of books of accounts of companies. Financial auditing of books of accounts is a statutory requirement and must conduct as per the rules laid down by the government.

Auditing can be said to be a thorough examination of the financial auditing well-being of a company by someone independent of the company.

Auditing is a regular — and usually annual — affair. This objective examination and evaluation of a company’s financial statements ensure that the financial auditing records are a true and accurate representation of the financial health of the company. For those looking to fully understand such financial processes, enrolling in a beginner to advanced finance course in Singapore can build the right foundation and enhance practical financial literacy.

Types of Audits:

Audits may be internal — conducted by employees of the company — or external — done by certified professionals. There can also be special audit conducted by Tax and regulatory authorities

Internal audits are mostly a management tool that helps improve the processes and internal controls within a company. These usually have little statutory value and hold low legal weight.

External audits — usually conducted by Certified Public Accounting (CPA) firms — lead to an auditor’s opinion, which is part of the audit report. Clean audit opinions mean that the auditor has found nothing like a ‘material misstatement’ in the process of reviewing the company’s financial auditing statements.

The most significant difference between external and internal auditors is that external auditors are independent and therefore the opinions the external auditors express can be frank and honest.

Understanding the Auditing Process:

During an annual audit of financial accounts, the following financial statements analyzed.

- Income statements

- Balance sheet

- Cash flow statement

- Statement of changes in equity

Since the audit is performed to ascertain the accuracy of information, auditing involves the examination of books of accounts as well as supporting vouchers and relevant documents.

The primary purpose and function of auditing are to prevent fraud as well as detect honest mistakes and genuine errors.

Companies undertake audits as part of regulatory or statutory requirements or as part of their debt agreements with lenders.

Auditors face the constraints of time. Hence, an auditor only provides reasonable assurance that the statements made to them are free from material error. As it pertains to financial audits, a set of financial statements become accurate and fair when they are free of material misstatements.

In most countries, audits adhere to generally accepted auditing standards laid down by governing bodies. Having a set of rules gives reasonable assurance to third parties and eternal users regarding the reliability of the auditor’s opinion on the accuracy of the financial statements or other matters which are within the purview of an auditor.

Audits of publicly-traded companies in the US governed by rules laid down by the Public Company Accounting Oversight Board (PCAOB). These statutory audits, known as integrated audits, require that the auditor express an opinion regarding the effectiveness of the company’s internal control over financial reporting.

What Auditors Don’t Do:

Auditors have a limited scope of work, and they don’t audit the directors’ report nor do they check every single figure in the financial auditing statement. Auditors don’t comment on a company’s business activities or strategies. Auditors also cannot predict the future nor be present there all the time.

Navigating Singapore’s Statutory Audit Requirements: What Every Business Owner Needs to Know

Are you legally required to get your Singaporean business checked through a financial audit? Depending on certain conditions provided by the Companies Act and ACRA, there are many companies. The book will unravel the mystery behind statutory audit regulations and make it clear what types of businesses are entitled to exemption and what businesses have to hire an independent public accountant. These obligations are very important as they will make you know how to stay compliant without getting fines and your financial statements will be accurate and reliable among other stakeholders. Acquire this critical information to climb out of the hook in the Singapore regulatory environment. To better interpret the outcomes of these audits, it’s essential to understand the auditor opinion classification guide Singapore businesses rely on to assess financial health and regulatory standing.

Beyond Compliance: How a Financial Audit Strengthens Your Business in Singapore (and Attracts Investors)

Financial audit is much more than a regulatory formal present. In case of Singapore businesses, it is a tool of growth and credibility. The present article will unveil how an external audit can also bring a lot of changes in the way investors, banks, and partners trust each other so that it becomes subsequently easier to receive funding and grow. In addition, audits usually bring forth the chances of enhancing internal controls, rectifying inefficiencies in operation in addition to avoiding fraud, which eventually brings sound financial management and informed strategic decisions towards the sustainable prosperity of your business in the stiff competition of Singapore market. For professionals aiming to strengthen internal governance and regulatory standards, enrolling in a corporate compliance certification course Singapore can provide valuable insights that complement financial audit practices.

Understanding Singapore’s Auditing Standards (SSAs): What They Mean for Financial Reporting Accuracy

Do you ever suspect what makes audited financial statements of Singapore reliable? The short answer is the Singapore standards on auditing (SSAs), published by the Institute of Singapore chartered accountants (ISCA). This material will deconstruct what SSAs are, how they meet the best practices in the world and why it is extremely important to comply with them. Find out how these standards help auditors to ensure a financial report takes a true and fair view, creating transparency, and instilling the confidence of the people, as well as protecting the integrity of the financial reporting environment in Singapore. To keep your team aligned with Singapore’s audit regulations and financial reporting standards, customized in-house training for Singaporean can be a powerful way to build internal expertise and stay fully compliant.