What is Auditor Opinion?

An auditor’s opinion is a document that accompanies a client’s financial statements. It delivers an opinion as to whether material misstatements exist in the financial statements. The audit report starts with an introduction section that outlines the responsibility of management and the audit firm.

The features of Auditor Opinion

An auditor’s opinion includes four different types of auditor’s opinion that are listed below:

Unqualified Opinion

An unqualified opinion is also referred to as a favorable opinion. The auditor gives an unqualified opinion report if the financial are presumed to be free from materials’ misstatements. Also, unqualified opinions are given based on the internal controls of an entity. If management has claimed responsibility for its creation and maintenance, the auditor must perform fieldwork to test its effectiveness.

Qualified Opinions

Generally, a qualified opinion is given when a company’s financial records have not followed GAAP in all business transactions. Although the wordings of qualified opinions are similar to unqualified opinions, the auditor provides an additional paragraph that includes deviation from GAAP in the financial statements and points out why the auditor report is not unqualified.

Adverse Opinion

The most unfavorable opinion a company can receive from an auditor is an adverse opinion. An adverse opinion includes financial records not prepared as per GAAP and grossly misstated. The adverse opinion may be an indicator of fraud, and the company may be forced to re-audit its financial statements. Lenders, investors, and other financial institutions do not accept financial statements with adverse opinions.

Disclaimer Opinion

If, in any event, the auditor is unable to complete the auditor’s report due to the absence of financial records or insufficient cooperation from the management, the auditor issues a disclaimer opinion. This is a sign that no view over the financial statements was able to be determined.

Why is it important?

An auditor’s opinion is used to determine the business’s financial records. The type of auditor’s opinion a company receives will impact the reliability of investors. This means that companies should always strive to get a reasonable opinion. A qualified opinion is the second-best option, and disclaimer and adverse opinions have a negative impact on the businesses.

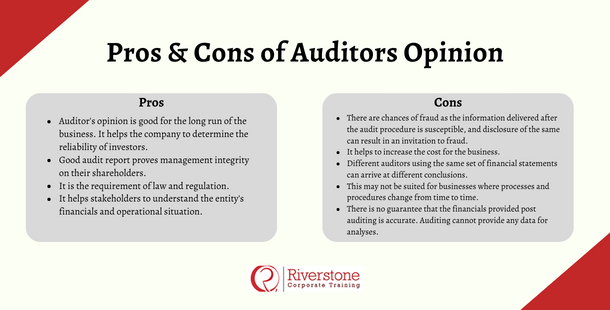

Pros & Cons of Auditors Opinion

Pros & Cons of Auditors Opinion

Pros of Auditors Opinion

- Auditor’s opinion is good for the long run of the business. It helps the company to determine the reliability of investors.

- Good audit report proves management integrity on their shareholders.

- It is the requirement of law and regulation.

- It helps stakeholders to understand the entity’s financials and operational situation.

Cons of Auditors Opinion

- There are chances of fraud as the information delivered after the audit procedure is susceptible, and disclosure of the same can result in an invitation to fraud.

- It helps to increase the cost for the business.

- Different auditors using the same set of financial statements can arrive at different conclusions.

- This may not be suited for businesses where processes and procedures change from time to time.

- There is no guarantee that the financials provided post auditing is accurate. Auditing cannot provide any data for analyses.

Conclusion

Auditor’s opinion is a valuable tool to engender confidence in a business. However, a company needs to meet all the GAAP guidelines if they want to avoid a poor auditor’s opinion, which could negatively impact business.

Pros & Cons of Auditors Opinion

Pros & Cons of Auditors Opinion