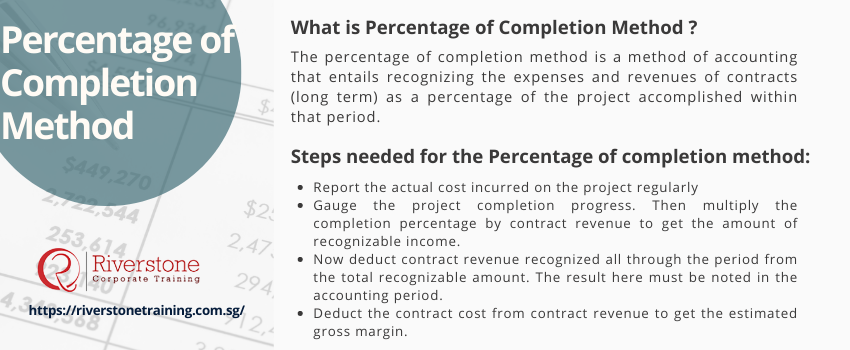

Percentage of Completion Method

The percentage of completion method is a method of accounting that entails recognizing the expenses and revenues of contracts (long term) as a percentage of the project accomplished within that period. This method is prevalent mostly in the construction industry. However, other sectors also make use of the percentage completion method, particularly those with recurring revenue models, where understanding progress over time is crucial—this is where insights like why ARPA is important for recurring revenue models come into play. The concept of this method is that businesses recognize revenues based on the project completed. The compelling information to note the percentage of completion method includes:

- Revenues and expense are reported relative to the project completed

- The percentage of completion method is applicable only if payment is guaranteed and also the estimation must be straightforward.

- On the other hand, this same method has been abused by companies to overbill or underrecord their bill to manage their books

In fast-evolving markets like Singapore, companies using this method alongside monthly recurring revenue tracking tools for Singapore business can ensure accuracy, transparency, and compliance in financial reporting.

Overview of the Percentage of Completion Method

One of the requirements of percentage by completion includes that reports of expense and revenue should be done periodically, i.e. period-by-period following the contract fulfilled.

For instance, if 20% of a project completed in the first year of commencement and the second year, 35% is completed. Incremental revenue of 15% was acknowledged in the second year. Income and expense recognition on the project mentioned above are reported in the income statement; however, the balance sheet is treated similarly as in the case of the completed contract method. This example illustrates the difference between revenue and income in financial reporting, where revenue refers to the recognized portion of the project’s progress, while income reflects the net result after expenses are accounted for.

The two conditions are necessary for the application of the percentage of completion. First, the company’s collection must be assured and the second is that companies must estimate cost reasonably and the project completion rate.

Steps needed for the Percentage of completion method

The steps involved in the Percentage of completion method include:

- Report the actual cost incurred on the project regularly

- Gauge the project completion progress. Then multiply the completion percentage by contract revenue to get the amount of recognizable income.

- Now deduct contract revenue recognized all through the period from the total recognizable amount. The result here must be noted in the accounting period.

- Deduct the contract cost from contract revenue to get the estimated gross margin.

Pros and Cons of Percentage of Completion Method

Pros:

- Cost and revenue allocated concerning the extent of project completion, hence, recognizing revenue and cost incurred does not have to wait till project completion.

- The proportion of the cost not allocated. However, the incurred percentage cost not put to use in the ongoing work, not charged to the income statement. Hence, real-time estimation of costs done in the project.

Cons:

- The method is always applied in the construction sector because construction takes time.

- If there is inaccuracy in the initial estimated cost and revenue, there might be a need for future adjustments, which might show fluctuation in the cost and revenue recorded in the accounting book.

Example of the Percentage of Completion Method

A bridge to be constructed by X group has accumulated costs of $8,000,000

X group billed the client $8,500,000.

Estimated gross margin of 20%

- Total expenses and gross profit estimated for the project will be:

- $8,000,000 expenses / (1-0.2 gross margin) = $10,000,000

- Since total expenses and gross profit estimated above is greater than the amount billed, then additional revenue of $1,500,000 would be added in the format below:

| Debit | Credit | |

| Unbilled contract receivables | 1,500,000 | |

| Contract revenue earned | 1,500,000 |

Advantages, Disadvantages, and Best Practices of Percentage of Completion Method

Per cent completion method (PCM) provides more precise real-time picture of the long term profitability of projects by purchasing revenue and costs as work is done. The major strengths associated with it are its easier presentation of earning, an augmented failing of revenue and effort, and enhanced monetary forecasting. However, PCM’s reliance on estimations can lead to inaccuracies if costs or progress are misjudged, increasing the risk of financial misstatements and administrative burden. These best practices include strict cost monitoring, frequent estimation update, really clear project milestones, and the use of excellent project management programs such that accuracy and adherence to accounting standards such as GAAP or IFRS are conformed to.

Businesses can further support implementation with custom interactive e-learning content development services in Singapore, which ensure teams are well-trained in PCM concepts, or enroll in a project finance modeling course for infrastructure projects in Singapore to gain hands-on experience in applying this method effectively in real-world scenarios.