What is the Sarbanes-Oxley Act?

Reform for the corporate financial reporting and accounting world came in 2002, with the enactment of the Sarbanes-Oxley Act. After several corporate scandals surprised the public and shook markets, Congress passed SOX. Word got out of corporate executives filing misleading statements about their finances; the biggest offenders being Enron and WorldCom. The integrity of corporate financial reporting and accounting needed reform, which is what Sarbanes-Oxley Act sought to bring.

The Enron Scandal:

Periodically, publicly traded companies file financial reports. Important information is provided to the public about each company’s cash flow, liabilities, revenue, assets, and business operations. Not only do investors rely on this data to be accurate for purchasing decisions, but so do partners and competitors to make proper business decisions, and so does the general market to analyze companies and statistics.

The stock price is directly impacted by these periodic financial reports, so when they’re misleading or downright fraudulent, the repercussions become widespread.

Which is exactly what brought about SOX. In 2001, Enron became entangled in an ugly scandal over accounting inconsistencies, and eventually imploded. Several investigations revealed massive efforts to keep the stock price where it was. Enron executives purposely misrepresented the company’s financial assets.

They also covered liabilities and represented Enron’s earnings as higher than they were. Criminal convictions befell many Enron representatives, and Arthur Anderson, Enron’s accounting firm, subsequently went out of business.

Key Provisions of the Sarbanes-Oxley Act:

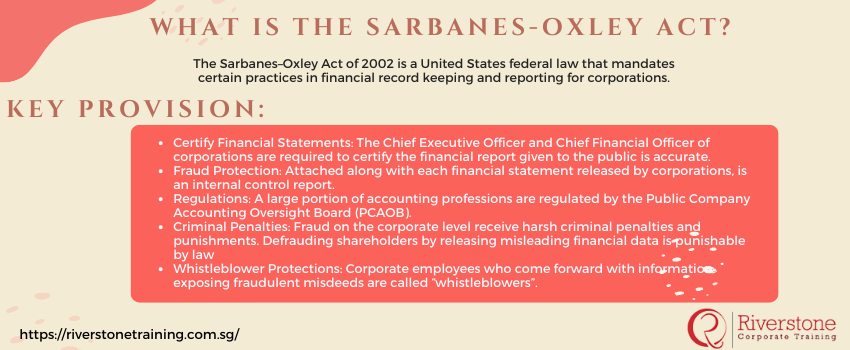

The Sarbanes-Oxley act is comprised of several different parts. The whole, designating a structure, and enforcing persecution of fraudulent manipulation of financial statements corporations release to the public. This is to protect shareholders, innocent employees, and other companies.

Under the Sarbanes-Oxley Act, corporate executives are required to certify the company’s financial statements confirming they’re accurate. Executives are to both maintain, and frequently assess internal controls to prevent manipulation of financial data. Corporate executives are now required to impose criminal charges or penalties for wrongdoings in representation of financial data.

Sarbanes-Oxley Act also helped put together a board of professionals to oversee the accounting profession, promote positive and professional relationships between accounting firms and corporations and the protection of any and all whistleblowers of corporations safe.

Provisions:

Certify Financial Statements:

The Chief Executive Officer and Chief Financial Officer of corporations are required to certify the financial report given to the public is accurate. These executives are required to review reports before they’re released for accuracy, as well as set in place and maintain internal controls to guarantee accuracy those reports.

Fraud Protection:

Attached along with each financial statement released by corporations, is an internal control report. At the end of every year, corporations release year-end reports; it’s required of corporations to check internal controls to make sure accuracy is clear.

Regulations:

A large portion of accounting professions are regulated by the Public Company Accounting Oversight Board (PCAOB). Sarbanes-Oxley Act helped put in place the PCAOB. This private sector board keeps watch over accountants performing audits on public companies.

Criminal Penalties:

Fraud on the corporate level receive harsh criminal penalties and punishments. Defrauding shareholders by releasing misleading financial data is punishable by law. Executives who fraudulently misrepresent financial statements can expect a decade or more in prison, and $1 million or more in fines. SOX also protects the misrepresentation of accurate data to any investigators checking in on the corporation.

Whistleblower Protections:

Corporate employees who come forward with information exposing fraudulent misdeeds are called “whistleblowers”. Retaliation against whistleblowers is a violation of SOX. Companies are prohibited from taking any action to release the whistleblower from employment, harass, or discriminate against employees divulging information to investigators. This goes through the trial. Whistleblowers being retaliated against have the right to sue their employer.