Structuring Risk Management Training Programs for Banks and Financial Institutions

Introduction to Comprehensive Risk Management Training for Banks

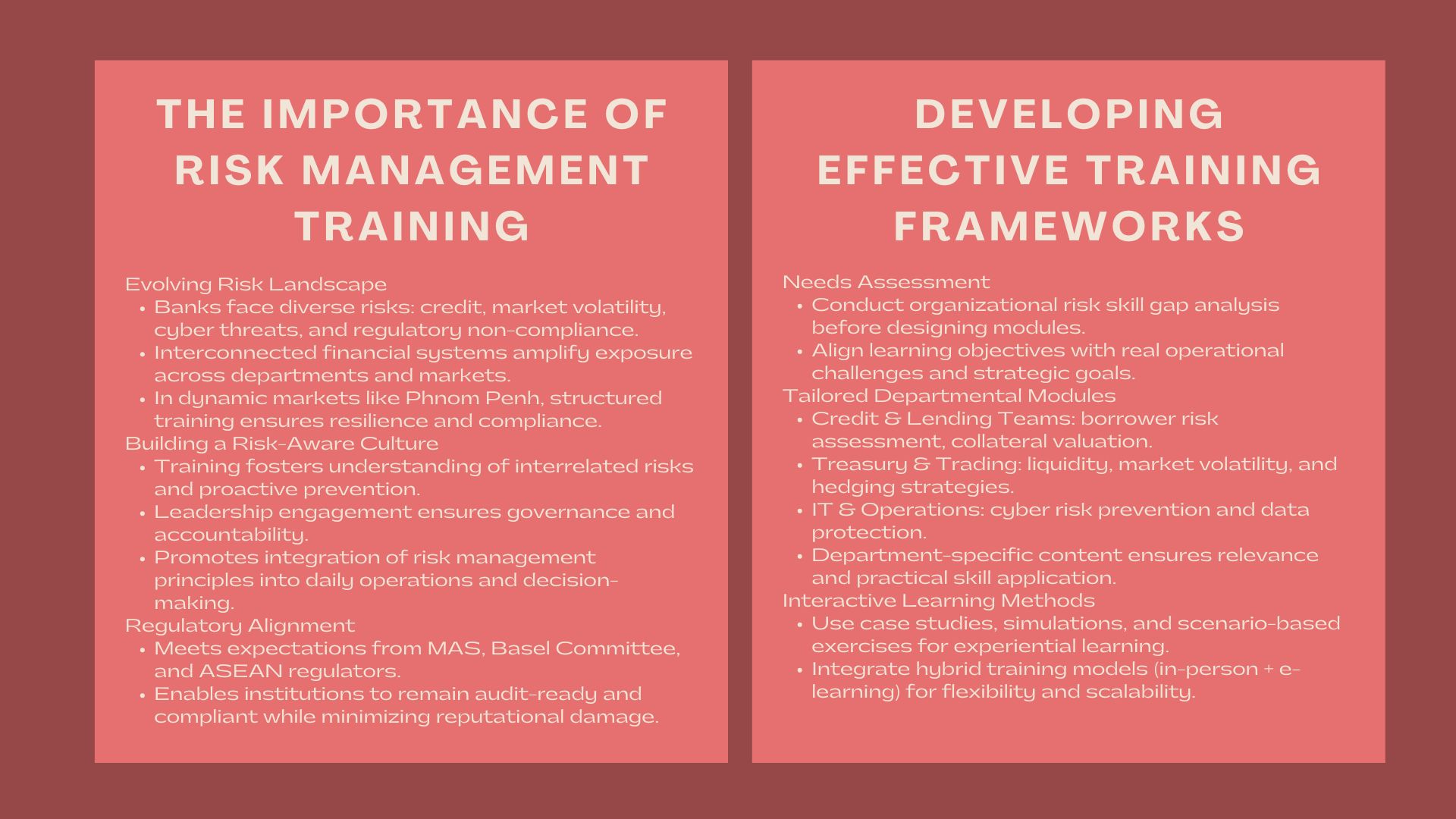

With the current unstable financial condition, financial institutions and banks experience a dynamic range of risks including credit and market volatility, computer attacks, and regulatory non-compliances. With the ever-growing interdependence of the financial sector, the need to learn structured, comprehensive and practical risk management training programs has never been as high. In the case of banks in a dynamic market such as Phnom Penh, systematic training may be the cure to its resilience, regulatory adherence, and sustainable development.

This paper examines how institutions of financial expertise could strategically develop and execute efficient risk management education schemes in accordance with contemporary banking activities, specifically, pragmatic frameworks, multi-department training and quantifiable results.

The Risk Management at the Banking Importance.

Going through a complicated risk environment.

The current banks are vulnerable to a broad spectrum of risks, which are not limited to the old fashion lending and market practices. They are operational risks (in case of system malfunctions or fraud), reputational (related to the brand trust and client confidence) and regulatory risks (associated with breach of financial regulations). In the absence of an organized mechanism to detect and control such risks, institutions stand a high chance of incurring huge losses and a damaged image.

The training programs can help banking professionals to see how these risks are interconnected and preventive measures can ensure that problems do not arise before the situation goes out of control.

Empowering Governance and Accountability.

Risk management culture should start with the top. The leadership teams should not just be aware of the risk framework, but they should incorporate them in all areas of corporate governance. Through targeted risk management training for banks Phnom Penh, senior executives, compliance officers, and operational managers can learn to align risk management objectives with overall business strategy.

Through these programs, a culture of accountability is instilled – a culture in which risk awareness has become part of the day-to-day decision-making process, and no longer an annual compliance process.

Delivering to Regulatory and Compliance Expectations.

Financial institutions are also required by regulatory bodies not just to show compliance but also proactive risk management. The monetary authority of Singapore (MAS), Basel Committee on Banking Supervision and the rest of the Southeast Asian authorities are stricter on capital adequacy, credit exposure and operational resilience.

In the case of banks in Phnom Penh and other parts of ASEAN, tailor-made training is important in the sense that compliance teams remain abreast with the changing needs in order to minimise chances of being punished or their reputation dented.

Developing a successful Risk Management Training.

Evaluating Organizational Requirement.

Institutions ought to undertake a risk assessment prior to formulating a curriculum in order to establish areas that have skills deficiencies. Do staff have sufficient credit risk identification equipment? Are the middle managers familiar with stress testing and scenario planning? Diagnostic approach enables training coordinators to develop sessions that are directly related to real life challenges of the organization.

Such a preliminary assessment will help to check the relevance of each module, its measurability, and its correspondence to the priorities of the operational activity of the bank.

Tailoring Content to the Various Departments.

Risk management is not a concept that fits the book. The level of risk of an IT Manager or a treasury analyst is not as high as that of a credit officer. A well designed program makes the modules specific to the risk profile of each department.

For example:

- Credit and Lending Teams: Specialize in the evaluation of loans, the value of collateral and risk of the borrower.

- Treasury and Trading Teams: Focus on liquidity risk, market volatility and techniques of hedging.

- IT and Operations: Operations in Prevention of fraud, cyber security measures and data privacy.

This specialization makes every participant practice practical skills in his functional area.

Combining Case Studies and Scenario-Based Learning.

It is not enough to have theoretical knowledge. Risk management specialists should be capable of putting principles to the test. Through the use of real world case studies, simulation and scenario analysis, trainers can assist the participants to acquire decision making skills in a controlled setting.

The programs based on historical financial crisis or internal near-miss cases as a learning model have a greater understanding and a long-term memorization.

Integrating Hybrid Classrooms and Online Learning.

Blended learning model in the modern training programs is gaining momentum. Online collaboration tools, e-learning modules, and interactive workshops allow banks to connect with more people, and also keep them engaged.

Continuous learning is also possible on digital platforms, as professionals can re-read the materials, pass tests, and monitor progress during their own time. This mixed-methodology has been particularly successful in the case of multinational financial institutions that aim to have uniformity within the regional offices.

Fundamental issues in Risk Management Training.

Credit and Counterparty Risk.

These participants are taught how to assess the creditworthiness of borrowers, enter into loan agreements and apply exposure limits. Knowledge of the probability of default (PD), loss given default (LGD) and expected loss (EL) models is a basis of credit risk analysis.

Market and Liquidity Risk

The module is interested in overseeing rate of interest, currency as well as commodity changes. The trainees are taught the application of stress testing, Value-at-Risk (VaR) and how to model scenarios to determine the possibility of losses. The driving force of liquidity risk training focuses on the sufficient funding during both normal and stresses situations.

Reputational Risk and Operational Risk.

Operational risk modules deal with internal process failure, technological failure and human error. Meanwhile, in reputational risk training, crisis management, ethical behavior, and social media management are trained.

Risk of Regulation and Compliance.

This field maintains that the participants are aware of the new regulations, such as the Basel III/IV as well as the anti-money laundering (AML) systems and the protection of data. Periodic compliance refresher courses enable the teams to keep their eyes on the prize and keep with the changing law.

Action and Evaluation of Performance.

Engaging Expert Trainers

The collaboration with the representatives of the industry, regulatory specialists, and experienced risk managers would guarantee that the participants acquire insights that are based on the experience, which is grounded in practice. A lot of organizations work with professional trainers such as Riverstone Training that provides regional experience in developing programs specific to local banking systems in southeast of Asia.

The Assessment of Learning Outcomes.

The key performance indicators (KPIs) to use by the institutions to measure program effectiveness include:

- Lessening in the non-conformity violations.

- Better internal audit outcomes.

- Increased scores in employee confidence.

- Faster risk response time

Measures that can be quantified enable training managers to defend their budgets and be able to show their leadership real ROI.

Life Long Learning and Update.

Risk management is a changing profession – the emergence of new technology, new regulatory issues, and changing economic times necessitate continual change. The periodic refresher workshops, simulation and renewal of certification make sure that the professionals stay competent and informed.

Application of Technology in Risk Management Training of the present day.

The digital transformation has transformed the way banks handle and oversee risks. In the current world, automation, artificial intelligence and analytics tools are being used in many institutions to anticipate any potential issues before they grow out of proportions

Effective financial risk management workshops Phnom Penh often include training on digital tools such as risk dashboards, predictive analytics software, and enterprise risk management (ERM) systems. The mastering of these technologies allows the participants both to increase their efficiency and precision in reporting risks.

Banks can also centralize data collection and flow interdepartmental communication through technology and make risk management proactive and data-driven.

Creating a Risk-Conscious Organizational Culture.

Structured training provides employees with technical skills; however, it is a long-term success that relies on developing a risk-conscious approach in the whole organization. It is the duty of the banks to make sure that all employees, be it front office staff or senior management, should be aware of the impact of their actions on the overall risk profile of the bank.

Promoting easy dialogue on the risks, rewarding responsible actions, and addressing risk awareness in performance reviews are some of the methods of reinforcing this culture. When employees on every level of the organization realize that they are involved in risk management, the institution will be more resolute and flexible.

Conclusion

Formulating systematic risk management training is not just a compliance issue but a strategic need by the banks to create resilience and earn the confidence of its stakeholders. Organizational goal orientation, reliance on digital learning material, and performance measurement can enable financial institutions to build more robust risk frameworks and improve overall performance.

At a financial hub such as Phnom Penh, tailor-made and functional training programs enable specialists to foresee, evaluate, and avert risks successfully. Due to the increasing speed of change, the competence to handle the risk intelligently will continue to be the hallmark of the institutional success.