Fundraising and Investor Relations Training for Private Equity and VC Funds

Introduction: Certified Fundraising Training Singapore

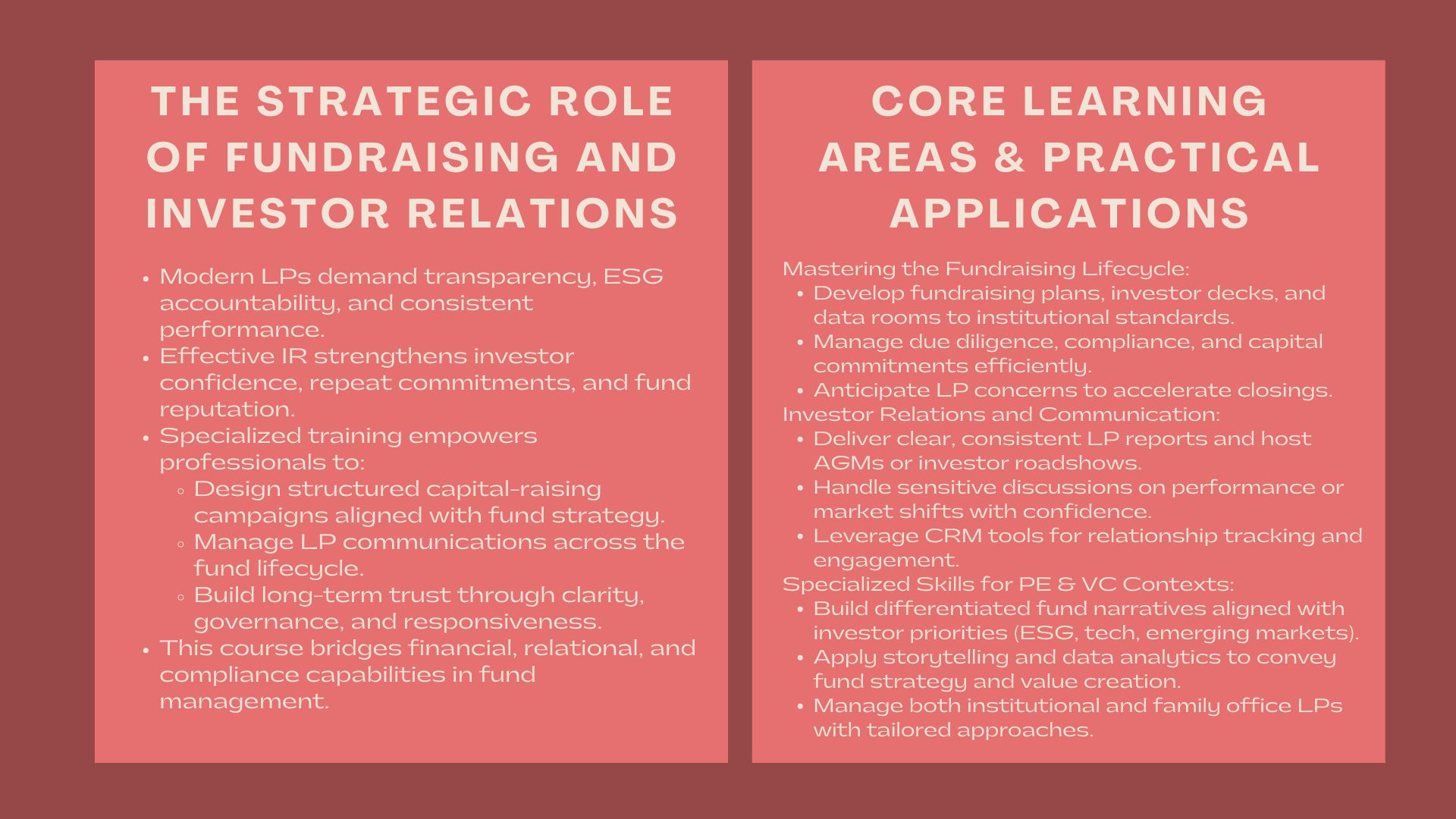

In the competitive world of the modern alternative investment, fundraising and investor relations (IR) are now being used as strategic assets by private equity (PE) and venture capital (VC) companies. This is because it is the capacity to raise capital effectively, have open communication with the Limited Partners (LPs) and the establishment of long-term trust that separates successful fund managers and the others. As investors are increasingly demanding increased transparency, performance stability and ESG responsibility, fundraising and IR professional responsibilities have transformed to strategic leadership roles after being the administrative support team.

To outperform the pack, fund managers, analysts, and investor relations employees are resorting more to specialized training opportunities, which combine technical knowledge, relationship management, and awareness of compliance. Through such workshops, participants are equipped to manage the challenges of capital raising and LP engagement, and fund life cycle communications- of aligning the investment strategy and stakeholder expectations.

The Increasing Significance of Fundraising and Investor Relations.

A Change of Direction in the Transactions and Relationship-Based Capital Raising.

The days, when fundraising was based on track record and financial results only, are gone. In the present day, investors are interested in convergence of interests, reporting transparency and strategy of funds. The art of investor relations is to build trust and create value throughout the entire life cycle of the fund.

The professionals who know how to handle the relationships using the structured communication plans, investor reporting and updates on the performance are critical in getting the repeat commitments and long term relations. An effective IR plan can increase the raising results, as well as improve the reputation of a company in the circle of investors.

Combining Fundraising and Strategic Positioning.

Raising now goes beyond the pitch to investors- it is about making your fund a differentiated investment. Participants in a private equity fundraising and investor relations management training program learn to develop compelling value propositions, design targeted fundraising campaigns, and apply data-driven strategies to attract the right LPs.

The practical sessions also help the professionals to understand how they can segment the investor using profile, design communication materials, and credibility using regular engagement.

Fundamental Building Blocks of Fundraising and IR Training.

Mastering the Fundraising Lifecycle.

The participants will have an opportunity to travel through the entire fundraising process, including pre-marketing to fund close. Training modules normally consist of:

- Planning a fundraising plan in line with fund goals.

- Developing the data rooms and investor decks to institutional standards.

- Addressing due diligence and compliance needs.

- Organizing capital engagements and closing transactions.

Knowing such an end-to-end process will enable professionals to foresee concerns of investors and deal with their concerns proactive, which will result in short delays and a high closure rate.

Learning to be an Investor Communicator and Relationship Manager.

Good communication is therefore a requirement in the management of LP expectations. Training emphasizes:

- Good investor reports and quarterly.

- Dealing with difficult performance or market change discussion.

- Holding annual general meetings (AGMs) and roadshows to investors.

- Using CRM software to monitor investor contacts.

These features aid the IR professionals in giving a sense of clarity, consistency and confidence- which are among the virtues that the investors find very precious when they are committing their capital.

Establishing Trust by Transparency and Governance.

Investor relationships are based on trust. Training sessions emphasize the importance of transparency of reporting, implementation of ESG principles, and having strong compliance systems to increase investor confidence.

The participants are taught to use best practices in governance and disclosure as one of the main differences in a very competitive fundraising setting.

Fundraising Strategies of the private equity firms.

Placing the Fund in the Competitive Market.

The nature of the private equity fundraising environment has become more and more congested, with LPs comparing dozens of funds at a time. Training programs enable professionals to acquire methods of establishing a distinct fund story, whether it is sector, geographic, or value creation strategy.

Another skill acquired by the participants is the ability to align fund goals with the existing priorities of investors, including sustainability, digital transformation, and exposure to new markets.

The Institutional and Family Office Investor Management.

The various classes of investors have their own expectations and decision making process. As a business example, institutional LPs are more concerned with governance, whereas family offices are usually relationship and alignment oriented. Training examines such subtleties so that a professional can adjust their engagement strategy to efficiently match the profile of an investor.

Adjustment to Regulatory and ESG Requirement.

As the regulatory environment continues to increase in international markets, IR teams should also make sure that fundraising documentations are in line with disclosure laws and ESG-based reporting guidelines. This makes it compliance and credible, which is paramount in attracting advanced investors and long-term commitments.

Fundraising of Venture Capital: A Special Dilemma.

Operating in the Early-stage Investment Environment.

When fundraising a venture capital, one has to strike a balance between optimism and realism. Startups are riskier and have longer payback period and, therefore, require both vision and discipline in influencing LPs.

Participants in a venture capital fundraising and lp communications workshop learn how to communicate fund strategy, portfolio value creation, and exit opportunities in ways that resonate with institutional and private investors.

Storytelling techniques are also addressed in training as a way of translating innovation and disrupting the market into investment narratives that resonate with the expectations of the LP.

Creating and maintaining LP Confidence.

Being engaged by the LP continuously is essential since venture funds tend to have multiple rounds with various vintages. The participants will have a practical understanding of dealing with investor expectations by being transparent with them, providing updates on time, and demonstrating quantifiable portfolio progress.

Applied Skills and Tools Acquired.

Premier Presentation and Pitching Tech.

Role-based simulations and simulation of mock investor meetings are part of the training programs wherein the participants are involved in honing their presentation and persuasion skills. Professionals are taught to tailor their messages to different audiences, i.e. how to pitch to institutional investors, development finance institutions, or sovereign funds.

Investor Data and Analytics

IR in the modern world is information-dependent. The participants get to know how to use analytics to track investor sentiment, commitment, and fundraising performance. This statistical methodology allows maximizing the targeting strategy and tracking high-potential LP associations.

Relationship Management Technology.

The application of CRM systems and investor communication platforms are discussed thoroughly. Professionals get to know how to automate their outreach, keep compliance records, and track the effectiveness of their engagement, all without sacrificing their personalized high-touch communication.

Advantages of Fundraising and IR Training.

Building Credibility and Investor Trust.

Well spoken professionals with the ability to effectively deal with investor relations develop good reputations -the key to successful long-term fundraising.

Improving Strategic Awareness.

Through their knowledge of the interactions between market conditions, fund performance as well as investor sentiment, participants are provided with a sense of strategic awareness that enables them to position their funds competitively.

Fast Tracking Promotions and Career Growth.

The technical knowledge of fundraising and relationship management expertise that is enhanced by training separates trained professionals. They are in a better position to head investor relations departments, consult fund managers or oversee investor portfolios in the arena of private equity and venture capital.

Selecting the appropriate Training Program.

The professionals must take into account the following when assessing a training program:

- Instructor Knowledge: Trainers that have a practical background in PE/VC funds that have fundraising training.

- Curriculum Breadth: There is a balance between technical, strategic as well as soft skills.

- Interactive Learning: Case-studies and role-playing: Application is increased through case-studies and role-playing.

- Networking Opportunities: Programs and links with participants to LPs and industry peers are value added.

The choice of a balanced course will help make the participants have practical, applicable knowledge that will address real-world issues in fundraising.

Conclusion

Effective fundraising and investor relations involve more than financial ability it involves genuineness, accuracy in communication and ability to think ahead. By training, the individual in the private equity and venture capital can know how to acquire the skills required to entice capital, build trust with the investors and maintain the performance of the fund in the long term.

In a world that is characterized by transparency and empowering investors, relationship builders and nurturers will characterize the future of the alternative investments.