Structuring Business Valuation Workshops for Cross-Border Deals

Introduction to Accredited International Deal Valuation Program

Cross-border dealings have become characteristic of contemporary corporate expansion plans, although they are as well among the most intricate valuation scenarios in international finance. Valuation risks due to differences in regulatory environment, financial reporting standards, tax structure, cultural negotiation style and geopolitics is something that the domestic transaction is unlikely to encounter. That is why, the companies are more and more interested in specialised training programmes and the finance team, corporate development unit, and investment professionals are provided with practical tools to analyse, structure and execute international deals. The paper concentrates on one particular field: the ways to organize business valuation workshops that will ensure the professionals learn to deal with the complexities of cross-border deals through practical, case-based training.

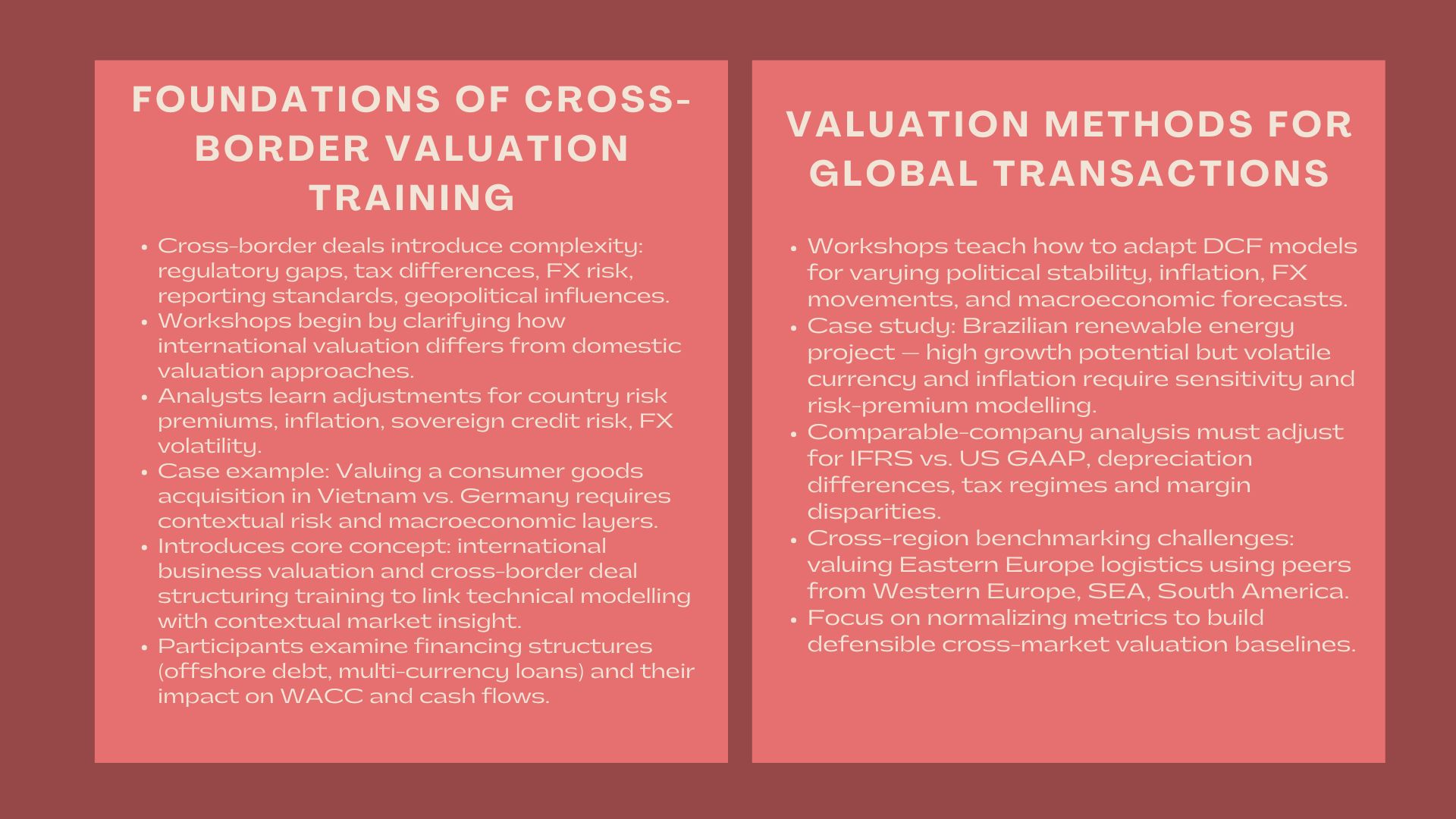

1. Bases of the Cross-Border Valuation Training.

1.1 In this case, one of the key issues to consider is the competence in international valuations.

A good workshop starts by orienting the participants on the principles on which cross-border valuation and regular domestic analysis differ. Although the mechanics of discounted cash flow modelling, similar company multiples, and transaction benchmarking are common to the majority of the finance professionals, the tools will need subtle redress in their application abroad.

Indicatively, the valuation model of acquisition of consumer goods in Vietnam cannot just replicate the assumptions that were utilized in a similar transaction in Germany. The layers that need to be added into the analysis are country risk premiums, inflation expectations, sovereign credit volatility and foreign exchange dynamics. The workshops therefore spend much time on the real-life situations, which include the evaluation of the cost of capital of a target when a parent company would like to finance the acquisition in terms of offshore debt or multi-currency financing structure.

This is also where participants are introduced to the first long-tail keyword, international business valuation and cross-border deal structuring training, as part of a broader understanding of why technical modelling must be supported by contextual insight.

1.2 Teaching Participants to Interpret Global Regulatory Environments

Regulatory and legal considerations are also not part of any cross-border valuation workshops. Capital controls, restrictions on repatriation, restrictions on foreign ownership, licensing, and market-entry restrictions are some of the factors that affect the process and nature of international transactions.

These concepts are cemented using practical examples. An example is that a workshop can look at the impact of data localisation regulations in the Asia-Pacific region on the valuation of a digital services firm or how EU antitrust regulations need to be taken into account to assess a merger between two market-dominant participants. It is aimed at making sure that participants are able to perceive regulatory landscapes not merely as compliance-constraining aspects but as valuation determinants that have a significant influence on deal economics.

2. Valuation Methods on Cross-border Scenarios.

2.1 This paper aims to adapt the DCF models to capture the country risk.

Learning to make adjustments to cash flow projections and discount rates to different amounts of country risk is one of the most important technical aspects of a cross-border valuation workshop. The trainees delve into the discussion of how the rating of sovereign risks, the political instability and macroeconomic forecasts can be converted into quantifiable valuation inputs.

Countries that have growth but high volatility profiles are common features of case studies. To illustrate, a renewable energy venture in Brazil can indicate a long-term upward trend, which is on the other hand appealing, but the uncertainty caused by inflation and a variable currency can seriously affect cash flows. The participants learn to put together country-specific risk premiums, real changes against nominal changes in cash flows, and sensitivity analysis that indicates the uncertainties of the new markets.

This strategy goes beyond textbook modelling whereby participants are taught to perceive numbers in terms of global uncertainty.

2.2 The Multinational Comparable Multiple Analysis Teaching.

Multiples used in cross-border acquisitions should reflect similarities in the competitive setting of the target, despite the similarities with peers in disparate accounting regimes and markets. In this case, the trainers can take the trainees through activities which include modifying EBITDA values to reflect variations between IFRS and U.S GAAP, reconciliation of depreciation policies and conversion of enterprise value indicators across currencies.

The real deal examples can be used to demonstrate these challenges. An example of this is that in valuing a logistics company that is based in Eastern Europe, peers in Western Europe, southeast Asia, and South America may take part in valuing the logistics company since they have different capital structures, tax systems, and margin profiles. The participants are taught how to normalise these differences in order to come up with reliable benchmarking information.

3. Combining the Strategic, Tax, and Structural Concerns.

3.1 The effects of tax structuring on valuation results.

Tax optimisation strategies have tended to play a key role in cross-border transactions especially when multinational organisations are in play. Workshops thus take time to comprehend the effects of transfer pricing, the treaties on dual taxations, withholding taxes, and the international tax reforms on the valuation models.

The participants analyse the situation when a U.S. based private equity fund buys an asset of manufacturing in India in which the organizational structure of the transaction by a Singapore holding company can change the results of cash repatriation and eventually its valuation. The training shows that valuation is not some technical modelling business but a strategic planning process, which integrates the efficiency of taxes with business goals.

3.2 Teaching Deal Structuring for Multijurisdiction Transactions

The second long-tail keyword, global m&a valuation modeling and transaction analysis course, becomes relevant when workshop participants shift from pure valuation mechanics to full deal structuring. They are made aware of how such measures as joint ventures, earn-outs, minority share, asset acquisitions, and multi-stage acquisitions can reduce risk in new markets.

As an example, an earn-out model would be applicable in the acquisition of a high-growth African-based fintech where revenue visibility is not known. Instead, a partial acquisition can enable a multinational company to take note of the regulatory changes in the long-run before investing in the complete ownership. With such scenarios, participants can understand how structuring choices can be used to supplement valuation logic.

4. Transforming Training into Deal-Ready Capabilities.

4.1 Simulations in Real Deal and Scenario.

In order to reflect high-pressure setting in cross-border valuation applications, workshops are designed to include deal simulation exercises, which mimic the volatility of cross-border negotiations. Under such exercises, teams have to update valuation models as new information comes to light, e.g. an abrupt change in regulations, macroeconomic interference, or even competition introduced by foreign investors.

An illustration is a simulation where a European acquirer is going to seek a target in Middle East and players are required to revise modelling assumptions on hearing news about a major regulatory change in the area that will impact foreign ownership rights. Such dynamic situations assist professionals to acquire the dynamism needed in actual cross-border transactions.

4.2 Enhancement of decision-making by integrating the multidisciplinary.

In the last aspect of a workshop, the participants will be taught how to integrate financial modelling and qualitative strategic assessment. This involves consideration of possible risks of cultural integration, geopolitical exposure analysis and harmonisation of valuation findings and strategic reasoning.

Among the frequently used cases is based on famous acquisitions, including those of large technological corporations that have purchased AI companies in Asia, whose valuation is not only a matter of financial indicators but also the integration of intellectual capital, employee retention, as well as globalization of innovation.

Conclusion

The valuation of cross-border business is a complex combination of technical modeling, understanding of regulations, strategic thinking and pragmatic deal structuring. By incorporating these elements in workshops designed by organisations, finance professionals will be more capable of tackling the challenges of international M&A, which is why going forward with increasing geopolitical uncertainty, more changing global tax systems, and the growing digitalisation of assets, specialised training will become all the more important. Businesses that invest in developing such capabilities will be in an ideal position to carry out global transactions more accurately, resiliently and at the strategic level.