Venture Capital Fund Management Explained: From Simple Definitions to Venture Capital Law Courses

Introduction to Learn Venture Capital Fund Basics

Venture capital is very important in developing innovation based economies as it provides capital that has high risk and high reward to the early-stage and growth firms. Any successful venture-backed company is surrounded by a well-organized system of investors, legal processes, governance, and professional experience. Venture capital fund management is thus crucial not just to fund managers and investors, but also founders, legal and finance executives who deal with venture capital institutions.

This article is dedicated to a single sphere, namely, the structure, governance, and management of venture capital funds in the legal and professional context. It starts with a venture capital simple definition and moves on to a detailed discussion of the duties of the fund management and the increased importance of taking formal education as demonstrated by a venture capital law course and a venture capital law course online course. It is an analysis that is designed to be used in business, finance and professional training situations and would be applicable in real-world situations in the global venture capital markets.

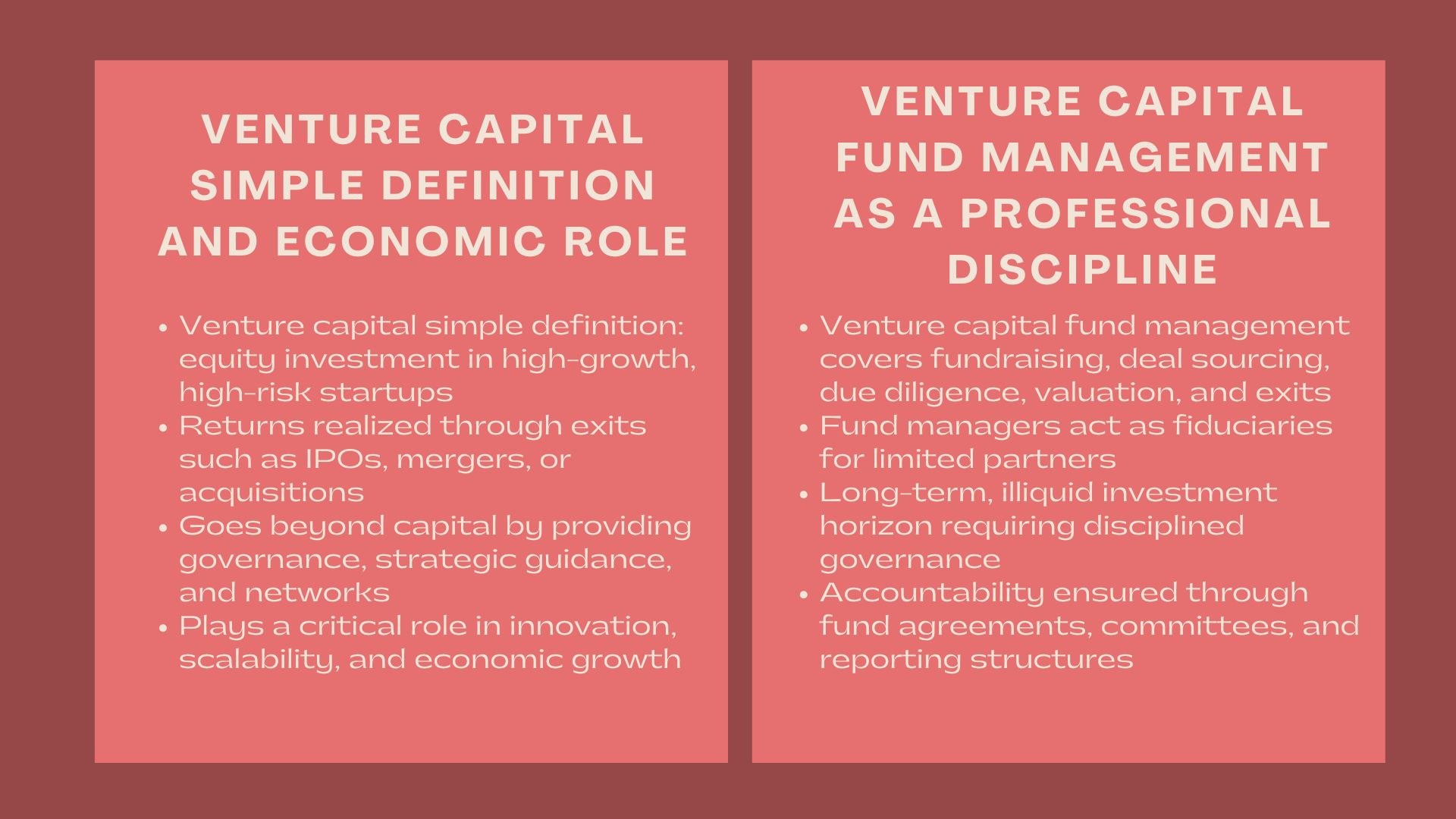

1. Venture Capital Simple Definition and Economic Purpose

1.1 Venture Capital Simple Definition in Practice

A simple definition of venture capital defines venture capital as equity funding which is offered to a start-up or a rapidly growing enterprise with a high potential of growth but with a high risk. Venture capital is not based on collateral or fixed repayment schedules, as opposed to traditional bank lending. Rather, what happens is the creation of returns as a result of capital appreciation as portfolio firms realize liquidity events in the form of IPOs, mergers, or acquisitions.

This cursory definition, however, is what it is all about. Venture capital is not the money but an organized investment model incorporating capital, governance power as well as strategic assistance. It is of much importance to know this larger context in order to value why this field of management of venture capital funds entails specialized skills and legal expertise.

1.2 The Role of Venture Capital in Business Growth

Macroeconomically, venture capital brings about innovation through the provision of capital to unproven and scalable ideas. On the micro level, it enhances the growth of a company by offering mentorship, networking, and discipline to run its operations. These activities are organized in order to have balance between risk, return, and fiduciary care by arranging fund management process.

2. Venture Capital Fund Management as a Professional Discipline

2.1 Core Responsibilities in Venture Capital Fund Management

Venture capital fund management can be understood as the overall procedure of raising funds, investing funds, carrying out of portfolio firms and finally giving back funds to investors. The general partners or fund managers are generally fiduciaries of limited partners like institutions, family offices and sovereign funds.

Practically, the management of venture capital funds is an activity that entails sources of investments, due diligence, valuation, deal structuring, portfolio management, and exit. All decisions should be in line with the mandate, risk profile and legal requirements of the fund. Venture capital decisions are long-term and illiquid unlike the investment decisions in the public market, which may take up to ten years.

2.2 Governance and Accountability in Fund Management

Venture capital fund management is characterized by governance. Fund managers have to work within the limits of fund agreements, regulation and ethics. There are investment committees, advisory boards and reporting frameworks that are in place to promote transparency and accountability.

This is, for example, the management of conflicts of interest, transactions involving related parties as well as valuation judgments should be well controlled to safeguard the interests of investors. These aspects of governance are the reasons why legal literacy is a vital part of the venture capital career.

3. Legal Foundations of Venture Capital Fund Management

3.1 Why Law Matters in Venture Capital

Venture capital is carried out in the borderline of corporate law, securities regulation, contract law and occasionally the cross-border investment regulations. All legal provisions such as term sheets, shareholder agreements, liquidation preferences, and exit rights have direct impacts on the economic results.

In the lack of a very clear recognition of these frameworks, professionals dealing with venture capital fund management may make incorrect calculations of investments and place money at risk of regulatory violations or cause conflicts between investors and founders.

3.2 Regulatory Environment Across Jurisdictions

The laws governing venture capital differ greatly in different jurisdictions, although certain commonalities are that funds must be registered, shareholders must be able to access information, and that money laundering must be prevented. Fund managers have to go around these regulations and still have the flexibility to invest in fast moving markets.

The trend of expanding venture capital across borders has made the regulation complex across borders, which justifies the importance of structured legal education.

4. Venture Capital Law Course as a Skill Accelerator

4.1 Purpose of a Venture Capital Law Course

Venture capital law course is developed to fill in the communication gap between commercial deal-making and legal framework. The areas of such courses are often how the transactions of venture capital are organized in the legal framework, how the rights and obligations are distributed, and how the risks can be minimized by use of documentation.

To individuals who are managing venture capital funds, a venture capital course would offer valuable experience in the mechanics of the term sheet, the formation documents of the fund, and regulatory oversight. It improves the negotiating skills with the founders, co-investors and attorneys.

4.2 Real-World Application of Legal Knowledge

Law confusions in the real world may have a huge impact on returns. As an example, incentive alignment may be distorted by creating poorly drafted liquidation preferences or anti-dilution preferences. Those professionals who have attended a course in venture capital law are in a better position to spot these problems at the beginning and organize transactions in a more efficient way.

5. Venture Capital Law Course Online and Professional Accessibility

5.1 The Rise of Venture Capital Law Course Online Programs

This experience is indicated by the increasing number of online venture capital law course courses that are being provided. The programs enable fund managers, lawyers and financiers to develop legal expertise without having to move out of active deal settings.

An online course in venture capital law is a combination of recorded lectures, case studies, and exercises, which makes complicated legal principles available to non-lawyers working with venture capital funds.

5.2 Advantages of Online Legal Education for Venture Capital

Accessibility is the main benefit of taking a venture capital law course online. Experts within the new venture ecosystem or the less developed market will be exposed to the international best practices. Also, through online formats, it is possible to engage in life-long learning as regulations, market norms, and deal structures change.

This is especially useful to the professionals who have been operating in the field of corporate finance, consulting or entrepreneurship and have moved to venture capital.

6. Integrating Legal Knowledge Into Venture Capital Fund Management

6.1 Improved Decision-Making and Risk Management

Legal literacy is also powerful in enhancing judgment in venture capital funds management because it allows managers to evaluate risks not just based on financial forecasts. Investors are more balanced in terms of their investment judgment because legal downside protections are understood, and their governance rights and exit mechanisms.

As an illustration, two investments that have equal financial potential can have completely different regulatory risk profiles across jurisdictions, shareholder rights and regulatory risks.

6.2 Enhancing Credibility With Investors and Founders

Limited partners and portfolio firms trust fund managers who are proven to be legally competent. Investors can feel confident that they are investing wisely and founders enjoy improved communication and equitable deal terms.

One of the indications of professionalism and best practice is frequently the completion of a venture capital law course or venture capital law course online program.

7. Career Implications of Venture Capital Education

7.1 Expanding Career Pathways in Venture Capital

The excellent knowledge in venture capital funds management with a formal education in law provides a variety of career options. These consist of venture fund roles, corporate venture capital units, family offices, accelerators and advisory firms roles.

Lawyers and investors who are professionally endowed are more welcome in a setting where the bargains may be complicated and the rivalry over good assets may be stiff.

7.2 Lifelong Learning in a Dynamic Industry

Venture capital is a changing sector which is influenced by technology, regulation and international capital movements. Professionals can keep up with time through further training on advanced courses and stay relevant and effective. Therefore, online courses in venture capital law are increasingly seen as a continuing professional need and not an occasion-based degree.

Conclusion

To sum up, a simple definition of venture capital is just a step on the way of working with such an advanced investment structure. Management of venture capital funds requires financial expertise as well as an understanding of the legal frameworks, the duties of governance and legal borders.

Since venture capital is yet to reach its maturity world-wide, systematic training in venture capital law course and online courses in venture capital law has become indispensable. Such professionals are better placed to handle risk, generate value, and win in a more complex venture capital environment, as they invest in this knowledge.