Case Study: Insurance In-House Training Services Strengthening Capability and Regulatory Awareness

Background on Case Study Insurance In-House

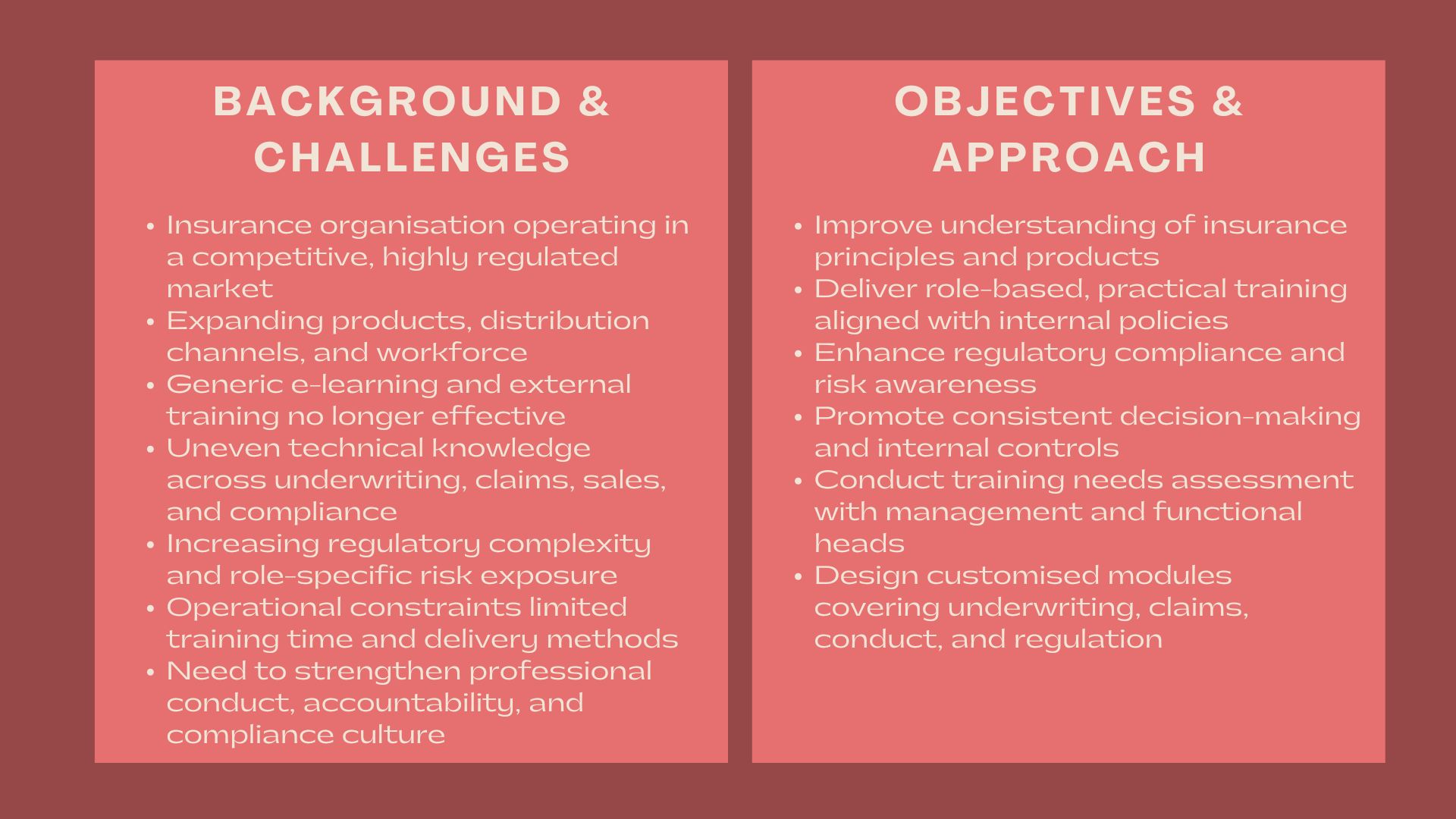

An insurance organisation was undertaking the expansion of operations and renewal of workforce and was functioning in a competitive and highly regulated market, which was licensed. The company was launching the new insurance product, advancing the distribution channels, and recruiting the personnel in the underwriting processes, claims, sales, operations, and compliance departments.

Although the organisation has been using the existing onboarding and training programs, the management realised that the generic e-learning modules and the course offered by external trainers no longer provided the necessary results. Various teams were under different regulation, technical and operational demands, and the need for differentiated in-house insurance training, in accordance with the internal policies, risk appetite, and regulations of the company was increasing.

In order to enhance the internal capacity, maintain the level of consistency in the understanding of the functions as well as facilitating the regulatory preparedness, the organisation contracted our Insurance In-House Training Services to design and deliver custom-made training programmes.

Issues and Challenges

The organisation had a number of issues which brought to focus the need of systematised and position-specific insurance training.

Uneven technical knowledge between teams was one of the obstacles. The employees represented a wide range of professional backgrounds and thus their knowledge of the insurance basics, policy form, and risk concepts was at different levels. This complicated the consideration of internal standards being uniformly applied.

The other challenge was on regulatory complexity. Insurance regulations, standards of conduct and compliance requirements kept on changing. Employees required realistic information on how the regulatory provisions were used on underwriting decision making, claims management, selling practices, and dealing with customers.

Relevance of the roles also became a problem. Underwriting, claims, sales and support functions had dissimilar responsibilities and risk exposures that were not properly covered in the generic training programmes. The management needed training that was reflective of real working situations.

The training was also complicated by operational constraints. The organisation required dynamic training formats that it could provide effectively without interfering with business continuity or the levels of services.

Lastly, the management wanted to enhance professional conduct and accountability. The in-house training was considered to be one of the most important instruments to strengthen ethical behaviour, risk awareness, and compliance with internal controls.

Objectives

The key aim of engagement was to create and implement insurance in-house training programmes to increase technical ability, regulatory understanding, and operational predictability.

In particular, the organisation planned to:

- Enhance the knowledge of staff regarding the insurance principles and products.

- Provide job-related training that is in line with internal operations.

- Enhance compliance with regulations and create awareness.

- Enhance similar decisions and risk control.

- Encourage continuous capacity building within the organisation.

The interaction was geared towards practical learning outcomes and knowledge transfer that was sustainable.

How We Helped

We embraced an organised and participatory in-house training on insurance, which is based on the different business model and regulatory settings of the organisation, as well as the profile of its workforce.

The process commenced with a training needs assessment. We also collaborated with the top management, compliance teams and functional heads to establish areas of priority training, target audiences and learning outcomes. This also made certain training material consistent with regulatory expectations as well as operational realities.

According to this analysis, we established our tailor-made training modules to address major areas of insurance including the insurance basics, underwriting, claims, regulatory requirements, code of conduct, risk management and internal control. Everything was customised according to the internal policies, procedures and real-life situations of the organisation.

There was a high level of focus on practical use. The training sessions covered case studies, discussion based on scenarios, work-flow walk throughs and interactive activities to assist the participants apply the concepts to their day to day duties.

We encouraged adaptable modalities of delivery such as in-person workshop, e-learning and hybrid learning methods. This helped the organisation to be balanced between training effectiveness and operational needs.

We created supporting materials and reference guides to support the learning process based on internal documentation. These aids gave the participants an opportunity to revisit what was learned and with some consistency to be practiced after the training sessions.

During the engagement, we collaborated with the management and the participants to answer questions, explain the regulatory requirements and refined the training content in response to feedback. This participatory method guaranteed relatability, involvement and efficacy.

Value Delivered

The case study depicts that the organisational capability, regulatory awareness, and operational discipline can be energyful through the enhancement of professional Insurance In-House Training Services.

The engagement assisted in increasing staff confidence, improving knowledge of insurance operations and regulatory requirements, and standardisation across teams in the case of customised and role specific training. A tighter compliance culture and a better internal alignment were also promoted through the in-house training approach.

This engagement had created the insurance training framework, which offered the scalability of staff development, regulatory preparedness, and operational excellence sustainability.