Structuring Infrastructure Finance Workshops for Corporate Teams

Introduction to Designing Infrastructure Finance Programs

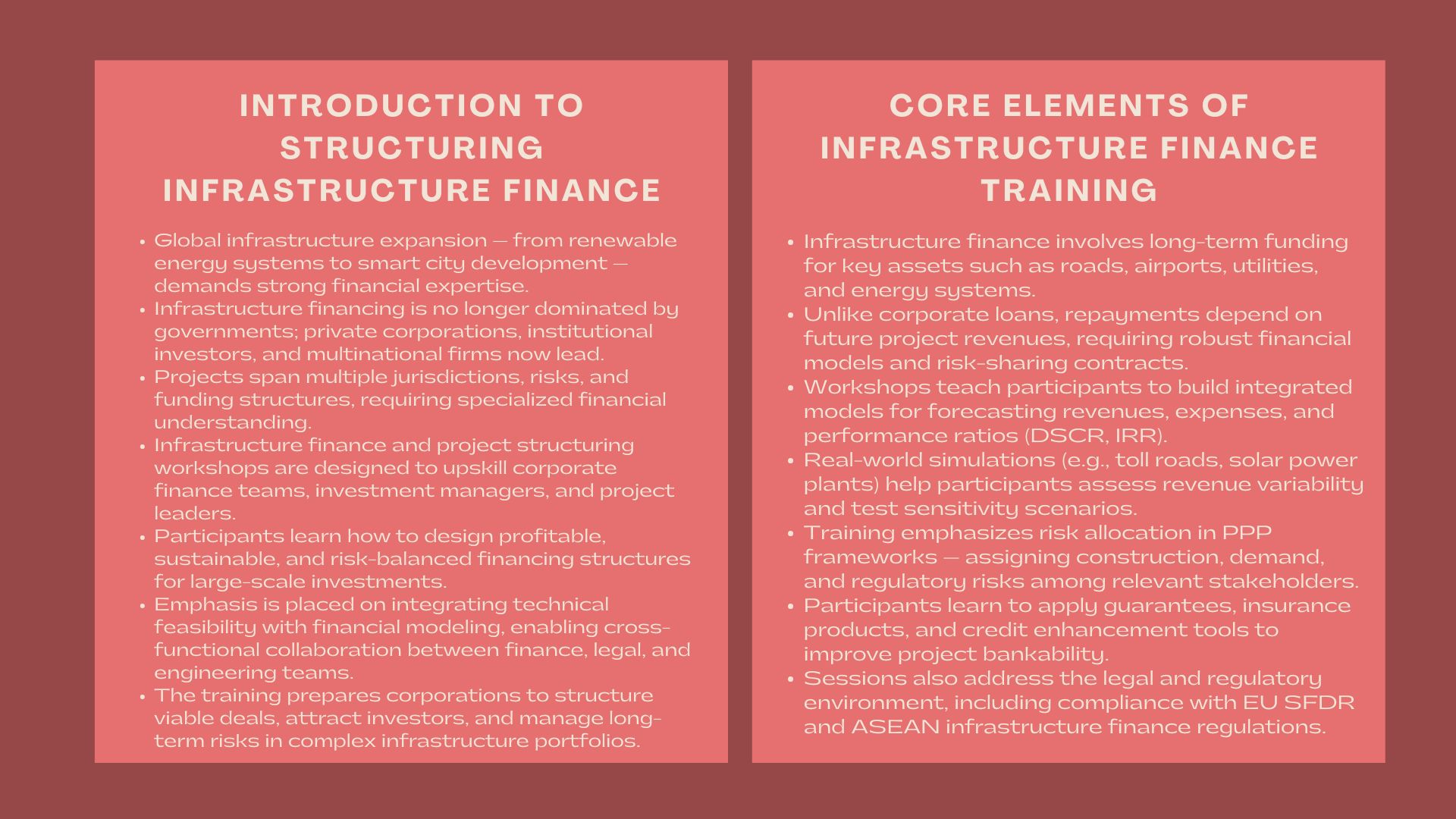

The capacity to organize and fund high-level investments has become a crucial competency of the contemporary companies as the infrastructure of the world requires expansion, such as renewable energy infrastructure, the implementation of smart cities, etc. Governments and development banks no longer dominate in infrastructure projects. More and more, such ventures are being designed, financed and run by the participation of private corporations, institutional investors and multinational enterprises.

The financial nature of these projects, however, the multiple jurisdictions, risk types, and fund formation make them more complex, and one has to be specialized. Infrastructure finance model preparation and project structuring training comes in handy at this point. The workshops are presented to corporate finance units, investment professionals and project managers enabling them develop a profound comprehension of how to implement viable financing structures that will balance between profitability, sustainability and long-term risk management.

1. Learning the Nuts and Bolts of Infrastructure Finance.

1.1 What Infrastructure Finance Defines

Infrastructure finance refers to long-term financing of critical assets, i.e. in roads, airports, energy systems and utilities, by use of elaborate mechanisms that match the cash flow profile of a given project. Infrastructure finance is not like the corporate loans because it is based on the future revenues of the project to be able to service the debt and give returns to the investors. This involves strict modelling, risk sharing and contract design.

An example would be a toll road project that is being based on the revenue projections of the traffic, and a solar energy plant where financing is being based on power purchase agreements (PPAs). It is imperative that these models be able to reflect complicated financial flows, regulatory settings, and performance assumptions to be able to make long-term sustainability.

1.2 The Use of Corporate Teams in project structuring.

Corporate teams are strategic in transforming the technical projects concepts into financial structures that can be realized. They are tasked with the design of the capital stack, negotiating lending, and matching financial forecasts with reality on the ground. Training workshops in infrastructure finance modeling and project structuring training emphasize cross-functional collaboration between finance, legal, and engineering departments. It is a multidisciplinary approach which makes projects sound financially and operationally viable.

2. Essentials of a Structured Infrastructure Finance Workshop.

2.1 Preparation of Long-run Assets Financial Models.

The key element in any workshop is the art of developing elaborate financial models. Respondents are trained to develop combined models that approximate revenues, expenses, funding conditions, and performance indicators (Debt Service Coverage Ratio (DSCR) and Internal Rate of Return (IRR).

As an example, an energy infrastructure finance department may model the various financing scenarios as the electricity tariff or fuel prices vary. Risk of testing sensitivities and predicting the project outcomes assists the decision-makers to understand the strength of the project in different market conditions.

2.2 Risk Allocation and Risk Mitigation.

Risk allocation is one of the hallmarks of infrastructure finance. Workshops emphasize on the method of allocating construction, demand risk and operational risk to the stakeholders in structured contracts. Public- Private Partnership (PPP) models are frequent subjects of case studies in which risk sharing is vital. An example would be a construction project given to a contractor to take construction risk, an operator to take the revenue risk and a government to take the regulatory risk.

The participants are taught to utilize the financial instruments, including guarantees, insurance products, or credit enhancement mechanisms as a way of reducing risk and enhancing the project bankability.

2.3 Legal and Regulatory Environment.

The jurisdictions have their own regulations of infrastructure finance, such as permitting, taxation and environmental compliance. Corporate teams should be aware of such structures in order to establish legal congruence. During workshops, the participants review the actual rules like the Sustainable Finance Disclosure Regulation (SFDR) by the EU or other infrastructure rules in Asia created by the ASEAN. Knowledge of these frameworks enables organizations to design projects that are in compliance with the requirements of both the investors and the regulators.

3. Combining Financial and Strategic Objective.

3.1 Corporate Strategy Infrastructure Investments.

In the case of corporations, infrastructure projects may be strategic: entering new markets, obtaining supply chains, or becoming sustainable. The training programs are aimed at educating the participants on how to match the infrastructure investments to the overall corporate goals. A manufacturing company may invest in renewable energy infrastructure, as an example, to stabilize the cost of energy and as an example to commit to ESG.

This alignment will make sure that financial models are not just technically valid: the financial models also have strategic significance in the long-term vision of the company.

3.2 Trading off between the Short-Term and Long-Term Returns.

The returns in infrastructure projects are usually slow but consistent. Therefore, the corporate finance departments have to create capital structures that would strike the right balance between the short-term liquidity requirements and the long-term performance. The examples used in workshops such as airport concessions projects or data centre developments can be used to demonstrate the way the blended financing- a combination of equity, senior debt, and mezzanine financing- can maximize the risk-adjusted returns.

The process of simulation exercises educates the participants to make changes in financing parameters to realize sustainable profitability without putting liquidity at risk or over-levering the balance sheet.

4. Developing Analytical and Strategic Competencies.

4.1. Improving the Decision-Making With the Scenario Analysis.

Economic cycles, change in regulation, and disruption in technology are subject to infrastructural projects. As such, scenario analysis is important. In training sessions the teams model the different market results that include the alteration in the interest rates, inflation, or demand patterns and study the consequences of these changes on the viability of the project.

As an example, the participants in a model of a renewable power project can investigate the impact of variations in carbon pricing or renewable subsidies on the returns of the project. This future looking ability makes informed investment decisions.

4.2 Making a comparison between Project Bankability and Investor Appeal.

The perceived risk-return profile of a project is important in whether it will receive financing or not. Through workshops, the participants are instructed on how to evaluate bankability using such measures as the loan life coverage ratios, debt-to-equity ratios, and sensitivity margins. The case examples usually include successful cases of transactions where strong financial structuring sought the interest of institutional investors or sovereign wealth funds.

These evaluations help corporate teams to negotiate financing conditions better and make strong investment propositions by learning to master them.

5. Infrastructure Finance: Sector-Specific Focus.

5.1 Energy and Utilities

Projects in the energy sector, especially in renewable sectors, need special modeling. The workshops show how to assess the long-term PPAs, capacity factors and renewable incentive mechanisms. The participants create a model of solar, wind, or hydro projects, with variability in the generation, and policy-driven mechanisms of pricing.

These sessions align closely with corporate infrastructure investment and finance workshop frameworks, emphasizing sustainable energy transition as a core financial and operational challenge for corporations.

5.2 Transportation and Logistics

Infrastructure: such as transport infrastructure as airports, seaports, and toll roads require genuine forecasting of demands and estimation of their cost of maintenance. The participants study concession agreements and usage-based revenue models to guarantee the uninterrupted cash flows.

As an illustration, modeling elasticity of the relationship between the toll rates and the volume of traffic is critical in toll road projects. By these analyses, finance departments gain knowledge on the best ways of pricing and financing projects, which will make them last.

5.3 Digital and Social Infrastructure.

The emergence of digital transformation has made an infrastructure finance cover data center, broadband network, and healthcare facilities. Seminars are discussed on how these new sectors are appealing to the corporate and institutional capital. The participants learn the financing models of technology-based projects which need quicker capital recovery and are more flexible to structure than the traditional physical infrastructure.

6. Corporate Infrastructure Finance Training: the Strategic Value.

6.1 The sixth improvement is that of Cross-Functional Collaboration.

There are several disciplines that are combined through corporate infrastructure projects which include finance, engineering, legal and sustainability. These teams are promoted to work together to develop mutual awareness of the project goals and risks through training programs. As an example, combining the technical expertise of the engineers and the risk analysis by the financiers increases the accuracy of the model and execution of the project.

6.2 Development of the Organizational Agility and Competitive Edge.

Firms which master infrastructure finance enjoy competitiveness. They are able to explore such strategic opportunities like joint ventures, greenfield development and asset recycling development.

Alumni of such workshops tend to sit on corporate investment or internal infrastructure investment committees, where they use structured finance methods to finance real world projects. Institutionalization of such capabilities offers organizations a resilient and confidence in scaling infrastructural portfolios.

Conclusion

With the added investment in infrastructure across the globe, corporations must come up with their own in house facilities to design, appraise and fund complex projects. Training programs such as infrastructure finance modeling and project structuring training and corporate infrastructure investment and finance workshop are the basis on which these important skills can be mastered.

The corporate teams can adapt to the changing infrastructure finance environment through structured workshops through which financial modeling, risk assessment, and strategic alignment are combined. In the future, companies investing in the said training will be in a better position to take advantage of upcoming opportunities in the fields of sustainable energy, digital infrastructure, and resilient supply chain networks- spurring growth and the ability to create long-term value.