What is Earnings Before Tax (EBT) vs EBITDA vs PAT?

We often find it challenging to understand the meaning of those terms. However, I will explain those terms shortly, so we all know what they mean and how they work.

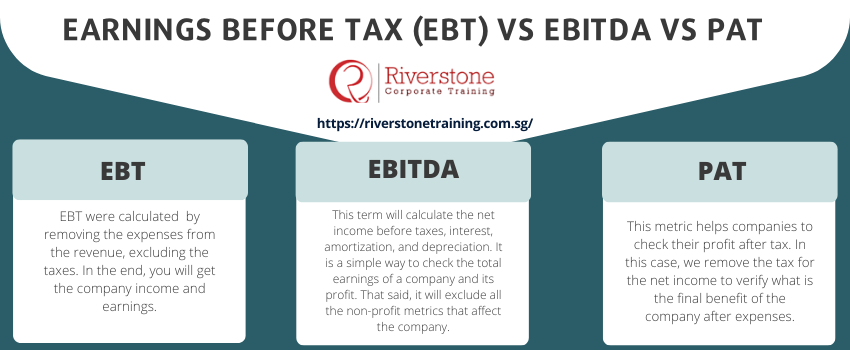

When we talk about Earnings Before Tax or EBT, we refer to the performance the company has before taxes. Therefore, you can calculate this by removing the expenses from the revenue, excluding the taxes. In the end, you will get the company income and earnings.

Now let’s move into EBITDA. This term will calculate the net income before taxes, interest, amortization, and depreciation. It is a simple way to check the total earnings of a company and its profit. That said, it will exclude all the non-profit metrics that affect the company.

Let’s talk about PAT. This metric helps companies to check their profit after tax. In this case, we remove the tax for the net income to verify what is the final benefit of the company after expenses.

All of them help the company to verify the net income after adding or remove some fees. EBT is a variation of EBITDA as it will only exclude the taxes, but it will include interest, depreciation, and amortization. PAT is the one different, as it will calculate the net income after all the expenses.

How to calculate Earning Before Tax (EBT) vs EBITDA vs PAT ?

To calculate the earnings before tax, we have to take the total sells minus the cost of productions of the goods. For example, a company sells 50 phones in one month. Each one costs $500 for a total of $25000. The company pays $250 to produce the phones, so for 50, they have to pay $12500.

The earnings before taxes = $25000 – $12500 = $12500 before taxes.

That’s how you calculate the EBT.

To calculate the EBITDA

You should take the net income of the company plus interest plus taxes plus depreciation plus amortization. So as you can see, it takes out all the expenses to calculate the total revenue and profit. For example, a company gets $1 million in earnings, but they spend $300.000 in materials, resources, and production. The depreciation and the amortization expenses will be $100.000. Therefore, we have the company’s profit of $600.000. Interest expense is $100.000, which is equivalent to $500.000 earnings before taxes.

After all that, we need to remove the tax rate of 15% (it may vary depending on your state). In this case, the net income after tax will be $425.000. Now we need to add the depreciation, amortization, interest, and fees to get the total EBITDA.

EBITDA = net income ($425.000) + Depreciation Amortization ($100.000) + Interest Expense ($100.000) + Taxes ($75.000) = $700.000

The investors use this metric to calculate how profitable a company is so that they can make the right investment.

Let’s calculate the PAT. It is the simplest one as you have to remove the taxes and other expenses, as we did above. In this case, the net income described above ($425.000) will be the PAT.

PAT Margin = (Total Revenue – Total Expenses)/Total Revenues

Conclusion:

All those terms are used for investors to check how profitable a company is. It helps them understand how liable a business will be, and it is worth to put money on it.

EBITDA is the one that will help them to check which company is better. That said if an investor checks two different companies and the EBITA on one is $20000 and on the other, the EBITA is $17000. The analyst will summary the expenses to check the net income of each company after taxes. After adding the costs, the analyst realized that both companies have the same net profit. Therefore, the investor will have to pay less on the $17000 company and still earn the same as in the other company.

That would be the end of those terms. Keep in mind that EBITDA is the first term to get real income before expenses.