What is a Ponzi Scheme?

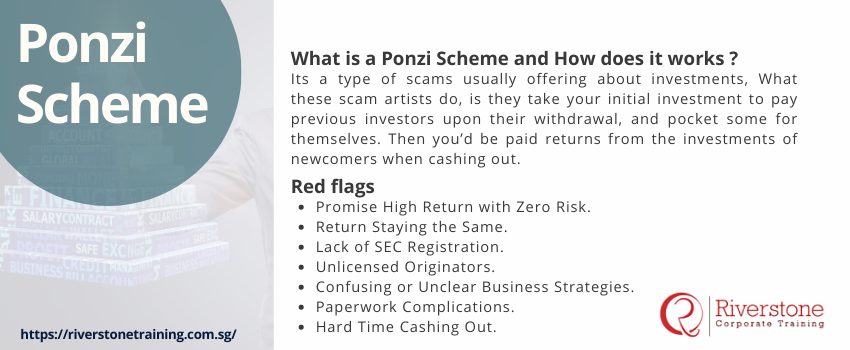

If you receive an e-mail or see an advertisement offering a high return on an investment with no risk, it’s probably a Ponzi scheme. What these scam artists do, is they take your initial investment to pay previous investors upon their withdrawal, and pocket some for themselves. Then you’d be paid returns from the investments of newcomers when cashing out. It sounds great until the whole system collapses.

The organizer of the Ponzi scheme is creating a fraudulent arrangement. Life savings, retirement funds, and hard-earned wealth were lost to these popular scams. Ponzi schemes victimize all walks of life, bank accounts big or small. From celebrities to the elderly, Ponzi schemes don’t discriminate.

This method of juking investment candidates goes back, way back. To over 100 years ago! The crook, Charles Ponzi, swindled countless people. And it all started with postal stamps. Ponzi figured out he could buy postage stamps in other countries for a lower price, then upsell them in the U.S to do fraud.

How Does a Ponzi Scheme Work?

Like a crash diet, a Ponzi scheme can show significant gains, but the leaves you worse off when it’s over. What these scammers do is take your money to pay previous investors when they’re ready to cash out. Then if you cash out at the right time, you could gain a good amount of money. But most investors involved in Ponzi schemes don’t know when’s appropriate to cash out, and call it quits.

But what happens is, your returns look great on paper for a little while, could be weeks to years, until there are no more new investors. The river has been run dry. When the whole system collapses, you can kiss your hard-earned money goodbye. It’s probably gone forever.

Red Flags

As the times have changed over the last 100 years, so has Ponzi scheme recruitment. Instead of dealing and duping in postage stamps, these savvy scammers utilize the ever-changing and evolving world of the internet. Making the right investments in the right businesses is essential to your investment success.

Watch out for these Ponzi scheme warning signs. Seeking professional advice before pursuing investments is always a good idea,

but if that’s not an option for you, look out for these red flags.

- Promise High Return with Zero Risk. Be wary of any investment opportunity offering ‘guaranteed’ returns. With any proper investment, there is risk involved.

- Return Staying the Same. Investment returns tend to fluctuate, especially the investments with possible high returns. Market conditions play a massive role in return numbers, so investigate if your profits are staying the same.

- Lack of SEC Registration. Investments registered with the regulators allow investors access to valuable information on the company you’re investing in. Ponzi schemes aren’t typically registered.

- Unlicensed Originators. Many individuals who orchestrate Ponzi schemes aren’t licensed, investment professionals. Security laws in most countries require investment professionals to be licensed.

- Confusing or Unclear Business Strategies. These schemes are often confusing and difficult to understand. The business strategy may seem too complicated, and your questions never really get answered.

- Paperwork Complications. If you’re lucky enough to receive anything in writing on your investment in a Ponzi Scheme, you’ll probably find errors and inconsistencies. But only if you’re fortunate enough to get any information at all.

- Hard Time Cashing Out. You’re all set, made some good money on return payments, but the money never comes in. Or, you’re ready to pull out, and they become increasingly difficult to work.

Don’t let the bad apples destroy your investment dreams and ambitions.

You have the choice to seek professional help, and many serious investors do seek counsel. If you’re a lone wolf, tackling the big world of investments solo, make sure you ask the right questions to keep yourself safe.

Making sure the seller is licensed, the investment registered, risks vs. rewards, and who you can connect with for any questions, are all quality questions for each investment opportunity you’re interested in pursuing.