Structuring Corporate Finance Workshops for Corporate Finance Teams

Introduction to Structuring Corporate Finance Workshops Teams

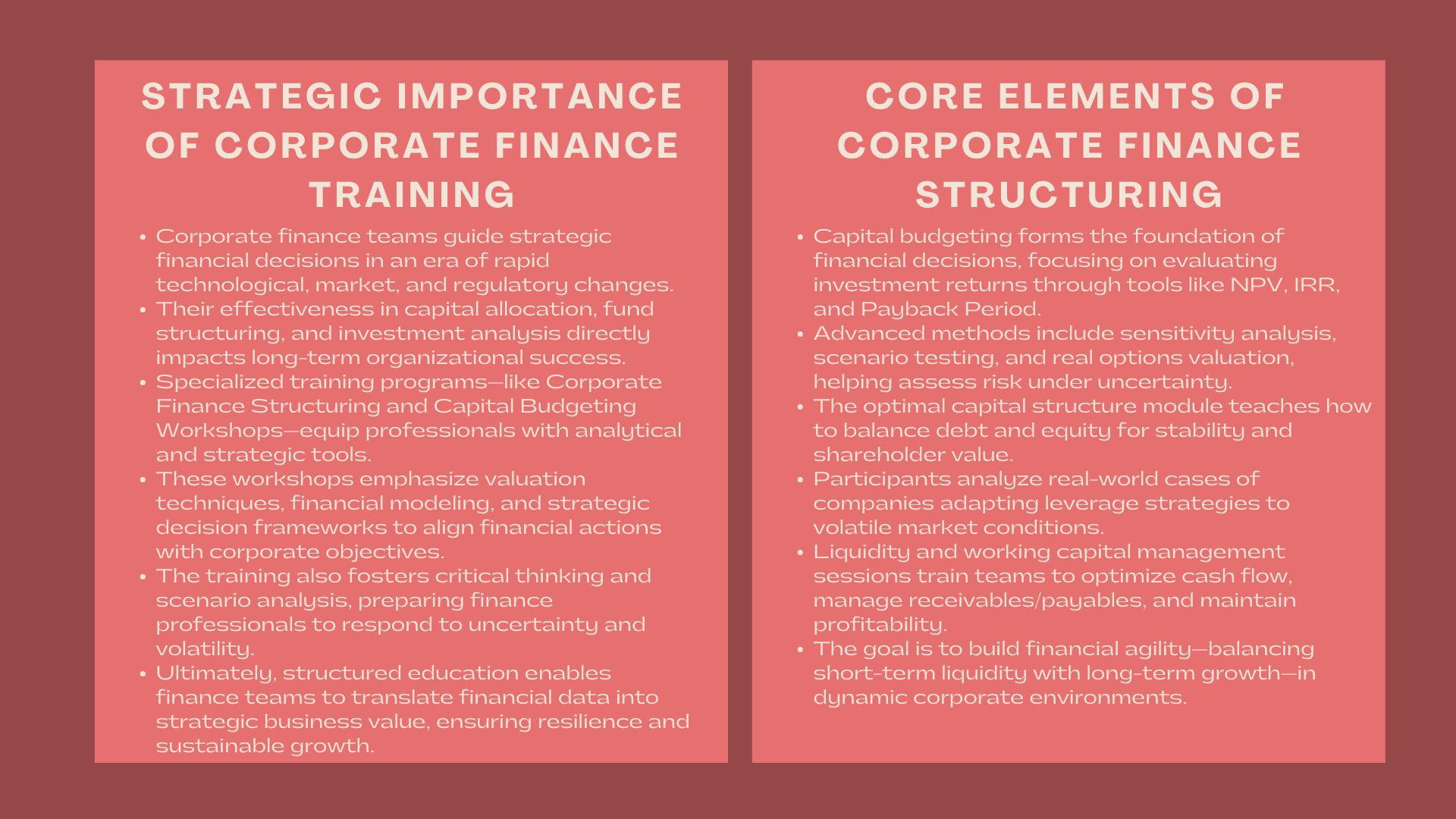

Corporate finance teams become particularly instrumental in providing direction to strategic financial decisions in a fast-changing business environment characterized by quick technological shifts, unstable market conditions, and the changing financial regulations. The quality of their fund structuring, capital allocation, and investment opportunity analysis may be the key to long-term financial success of an organization.

In order to satisfy these needs, special training courses to be offered include the corporate finance structuring and capital budgeting workshop and financial decision-making and structuring workshop in teams that deal with finance. The programs provide finance professionals with the tools of analytical skills; valuation techniques and the thought processes that make them make sound financial decisions that can contribute to sustainable corporate growth.

Corporate Finance: Its Strategic Role in the Contemporary Business.

Making Finance Strategy-oriented.

Corporate finance is much more than number management, it is the strategic process driving investment and growth decisions. Finance teams have the responsibility of ensuring that all capital allocations under its mandate are in line with the overall organizational goals whether in its market expansions or market digital transformation programs.

Properly designed finance training is aimed at integrating financial planning and strategic management. The participants are taught on how to evaluate business objectives, determine the financing needs, and how to develop structures that meet the expectation of the shareholders and at the same time enable flexibility in operations.

The Requirement of High Structuring Skills.

The contemporary organizations are undergoing more complicated financial environments, which demand delicate structuring capacities. These are dealing with mergers, acquisitions and divestitures; project finance structuring, debt refinancing or equity placements.

The corporate finance structuring and capital budgeting workshop provides hands-on experience in evaluating these structures. The participants get to understand how to maximize funding sources, risk/return ratio, and the long run effects of the capital allocation decision.

Essentials of Corporate Finance Structuring.

The basics of Capital Budgeting.

The core of financial decisions is capital budgeting. It assists organizations to decide on projects or investments to be undertaken depending on the returns they are likely to receive and the risk involved.

Some of the techniques to be applied include Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period analysis, which the participants are trained on. More developed modules deal with sensitivity analysis, scenario testing and real options valuation-tools, which can give more information about the feasibility of the project under uncertainty.

Optimal Capital Structure

Making the appropriate decision of debt and equity is pivotal in ensuring that the company is financially stable and shareholder maximum value achieved. In the workshops, the participants are taught how to work out the most appropriate leverage ratio considering the cost of capital, taxation, and the risk tolerance of the financial status.

Practical case studies show how businesses change their capital structures to adapt to the fluctuating market conditions to maintain its financing strategies to be both competitive and sustainable.

Liquidity Management and Working Capital.

Good management of the working capital guarantees that a company has enough working capital to cover the short term commitments without affecting the long term profitability. The finance professionals are provided with training sessions on the strategies to enhance the efficiency of the cash flow, the management of the receivables and payables, and the increase in the efficiency of the inventory turnover.

With these principles, the finance teams will be able to find the appropriate balance between profitability and liquidity, which is a necessary skill in the fluctuating market environment.

Enhancing Analytical and Decision-Making Competence

Quantitative Modeling and Financial Forecasting

Accurate forecasting is crucial for informed financial decisions. The financial decision-making and structuring course for finance teams focuses on developing robust financial models that project future cash flows, assess risks, and evaluate investment outcomes under varying scenarios.

The participants become skilled in manipulating the changes in economic variables, interest rates and market conditions by using the Excel-based financial models. This aids the decision-makers to test the assumptions and discover the possible potholes as well as what to do in case of contingencies prior to investing capital.

Assessing Financing Alternatives.

Professionals in corporate finance have to consider the different financing instruments available such as term loans, bonds, convertible debt and preferred equity to figure out the most suitable financing instrument to apply in a particular business case.

The training programs take the participants through the trade-offs of every financing choice based on their cost, implications of controls, and their impact on the balance sheet. They also discuss other financing strategies like lease agreements and project financing that may provide flexibility of a capital intensive project.

Investment Appraisal when there is Uncertainty.

Perfect information is hardly ever the case of financial decisions. Workshops highlight the use of scenario planning, Monte Carlo simulations, and decision trees in obtaining an estimate of how to evaluate investment opportunities in an uncertain situation. The methods of risk analysis will leverage risk awareness and enable finance teams to make sound and evidence-based judgments.

Corporate Governance and Financial Accountability.

Governance in the financial structuring role.

Good corporate governance practice will make financial decisions transparent, ethical, and interest shareholders. Training sessions focus on the effect of governance structures on capital distributions, dividend policies and debt management policies.

Participants get trained on how to incorporate governance concepts in their daily financial decision making processes, hence, becoming accountable and credible in the long term by the organization.

Legal and Regulatory Conformance and Compliances.

Financial structuring shall be held in line with the local and international accounting standards, taxation, and corporate regulations. Seminars discuss the impacts of guidelines like the IFRS and Basel on the corporate finance policies.

Using the case studies, the participants examine the potential impact of non-compliance or regulatory changes to the financial strategy and corporate reputation, which confirms the necessity to ensure regulatory awareness at all levels of decision-making.

Strategic Communication and Stakeholder Engagement.

Effective Financial Decision Communication.

Powerful finance departments do not just crunch numbers but present financial plans in a clear manner to both internal and external parties. The training modules are related to the development of effective and convincing communication, especially in the presentation of investment recommendations or reorganizing offers to the senior management or investors.

Participants train making executive summary, investor briefings, and board presentations in an exciting and convincing way communicating relevant financial information and strategic reasoning.

Togetherness Beyond Business Departments.

The branch of corporate finance does not work in a vacuum. The proper structuring involves cooperation with other departments like the operations, strategy, and risk management. Through workshops, professionals are taught how to promote cross-functional conversation to make sure that financial choices are supported by business facts and corporate objectives.

This team-based strategy makes finance a strategic agent in the performance of the enterprise.

Embarking on Sustainability and Value Creation over the Long term.

The role of ESG in Financial Structuring.

Financial decision-making is increasingly being influenced by sustainability concerns. Training modules include the elements of how to incorporate environmental, social and governance (ESG) considerations into capital allocation and funding decisions.

Embracing a combination of sustainability goals and financial indicators, the participants will be taught how to construct buildings that will enhance long-term sustainability and stakeholder confidence. This progressive mindset will equip the finance units to the changing demands of investors and regulators.

Professional and institutional Advantages.

Companies investing in specialized corporate finance training enjoy enhanced financial governance, increase in efficiency of capital and management of risks. Financial departments acquire expert analytical and strategic capabilities, which allow them to:

- Critically analyze investment opportunities.

- Efficiency of capital structure.

- Make strategic and sustainability decisions.

- Improve financial transparency and reporting.

These capabilities enable organizations to be quick in reacting to the changes in the market and taking advantage of the new opportunities.

Conclusion

At a time when corporate competitiveness is characterized by financial agility, formal education in capital budgeting, financing strategy and decision analysis is essential. The corporate finance structuring and capital budgeting workshop and financial decision-making and structuring course to finance teams are among the programs that equip finance professionals with the technical knowledge and strategic understanding to make high-impact decisions.

Organizations can increase financial resiliency, as well as make sure that all decisions promote sustainable growth, and long-term value creation, by improving analytical, governance, and strategic capacities of finance teams.