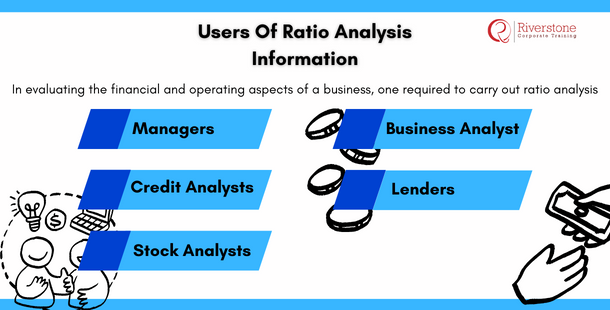

Users Of Ratio Analysis Information

Users of Ratio Analysis Information:

In evaluating the financial and operating aspects of a business, one required to carry out ratio analysis. The liquidity, solvency and profitability ratios in the financial statements offer useful information to investors, creditors and the management.

Managers

The managers of firms find this financial ratio analysis quite handy in analyzing, controlling, and improving the various operations of the firms they manage. They will use it to determine the strength s, weaknesses and comparison purposes with the other firms in the industry. Examples of such ratios include Return on Investment (ROI), Return on Assets (ROA) and the debt to equity ratio.

Credit Analysts

These are professionals who assess the loan applicant’s worthiness for qualification for a loan. Such professionals rely on ratio analysis to determine to what extent an individual or a firm is able to meet their financial obligations. If a company issues bonds for instance, the credit analyst will use the audited financial statements to determine the creditworthiness of the firm before recommending whether they qualify for the short term or long term loan they are seeking.

Stock Analysts

A stock analyst is a professional who evaluates trading instruments in a bid to predict its future behavior. The analyst will also assess the sector, market or tool using either technical or fundamental analysis. The only way to determine the performance, efficiency, return on equity or growth of a firm is the use of the stock analysis.

Business Analyst

Let’s say that an individual or a firm wants to buy shares of another company. The entities would want to be sure that the stock they are buying or planning to sell would offer the best return in terms of investments. It is the work of the business analyst to provide recommendations on the shares one should buy or sell based on the analysis.

Lenders

If you are a lender to a firm or an entity, you would need assurance that such concerns are in a financial position to meet their debt obligations together with the accrued interests. As such, you will need to scrutinize the ratio analysis in the financial statements to determine the extent to which you would commit your finances to the said entities.

You can also read – What is the Best Procedure to Understanding Horizontal Analysis?