5 Steps Followed in Ratio Analysis

Before carrying out financial analysis, many steps should be followed. To begin, the information so prepared is for peer review. In other words, it would need to be used by other similar businesses in the industry. Since there are no two firms with precisely the same kind of financial data, you would have to standardize it to make it easier to compare and analyze with the industry standards.

Once you have standardized, the second item in the list would be the evaluation performance operations of the firm for current and future situations. We use liquidity, solvency and profitability ratios as benchmarks of the financial performance. If they are favorable, the firm is said to competitive, profitable and financially sound. Investors, creditors, lenders and other stakeholders would find such a firm highly attractive and would be willing to bet the bottom dollar on it.

The comparison of the future and current performance of a firm is the third and is crucial for continuity. Let’s take an example: If a firm had a high turnover three years ago but has declined to nearly half of the initial amount, the trend indicates that unless something is done, the firm will cease being a going concern.

Only the ratio analysis would help to make such a comparison. The performance is not just limited to the company but across the industry, it is operating. If for instance, the industry average is 1:2, but the firm is using 1:3 and the trend remains unchanged over time, it means that the firm is not in a favorable position for doing business.

As have seen above, a firm does not operate in isolation. It is dealing with goods and/or services offered by competitors. It is essential to know how such a firm is faring compared to the others. One would need to identify the strengths and weaknesses and how to strategize for purposes of profitability. This is the fourth step in ratio analysis.

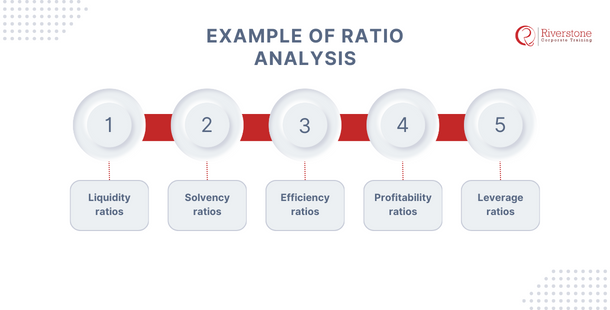

Example of Ratio Analysis

Example of Ratio Analysis

There are five significant categories used and include:

- Liquidity ratios

- Solvency ratios

- Efficiency ratios

- Profitability ratios

- Leverage ratios

NB: They are known as ratios because they compare more than one item and uses a fraction of one against the other. We use colons or division signs to express the ratios.

Lastly, one should always provide suggestions or recommendations to the firm, assuming that you are the financial analyst who has been hired by the firm. When carrying out the analysis, you will find areas where improvement required for better performance of the firm. For instance, if the firm has a weak financial management system, you would recommend several steps that would help the company improve its financial position for profitability. Some companies have a lot of their cash tied in stock, thus affecting their liquidity. Consequently, they are unable to meet their cash requirements in the short term.

Example of Ratio Analysis

Example of Ratio Analysis