What are Diluted Shares Outstanding?

Diluted Shares Outstanding are the common shares in your company that can be put on the market and are made available to trade, once all the sources of conversion, like convertible stocks and bonds, have been exercised. Fully diluted shares include the bonds that have already been issued, along with those that could be claimed by conversion. This affects the company’s EPS or Earning Per Share because of when the Fully Diluted Shares of a company are applied, it extends the shared basis in the calculation while decreasing the money earned per share of common stock.

HOW THEY AFFECT THE EPS OF THE COMPANY?

Fully Diluted shares affect the EPS or the Earnings Per Share of a company, which is a common measurement for calculating the relative value and profitability. It represents the total income deducting the preferred dividends, divided by the weighted mean of common Diluted Shares Outstanding, in which the weighted mean of common shares outstanding is equal to (beginning period balance+ ending period balance)/2.

If a company can expand its earnings per common share, the company is considered to be more valuable, and the publicly traded shares price might expand as well. Even so, the number of outstanding shares effects this bar, and when the number expands, it increases the EPS.

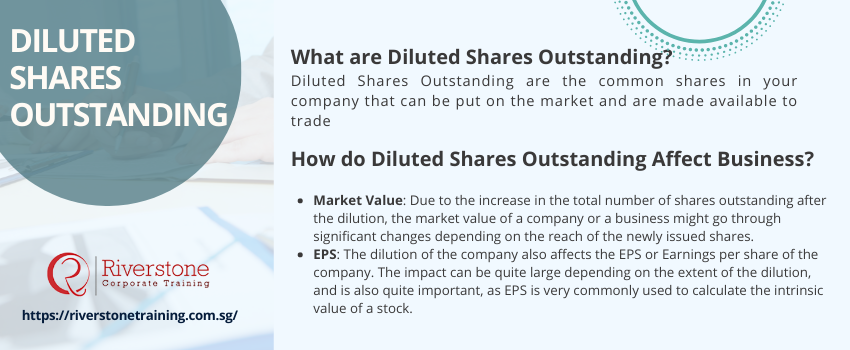

How do Diluted Shares Outstanding Affect Business?

Diluted Shares Understanding affects a company’s business in many ways. Mostly, it affects the company’s valuation of terms of its different calculations. Here is how this affects the business’s market value and EPS calculations:

-

MARKET VALUE

Due to the increase in the total number of shares outstanding after the dilution, the market value of a company or a business might go through significant changes depending on the reach of the newly issued shares. The formula to calculate the market value remains the same, but now we use is:

Market Value=Price Per Share Total Diluted Shares Outstanding.

-

EARNINGS PER SHARE OR EPS

The dilution of the company also affects the EPS or Earnings per share of the company. The impact can be quite large depending on the extent of the dilution, and is also quite important, as EPS is very commonly used to calculate the intrinsic value of a stock. Many professionals use the best tools for financial analysis used by professionals in Singapore to closely monitor how such dilution influences stock valuation.

As companies get a tax benefit for the interest paid on their liabilities, after the dilution, these benefits are no longer applicable, and the net income might get boosted by the after-tax amount of debt.

Another change that takes place is due to the dilution of the convertible preferred shares, in case the preferred shareholders were paid before the dilution occurred they need not be paid anymore since after the dilution they still have the same status ranks like the common equity holders in the company. These technical changes are often explored deeply in a analysts rely on to evaluate equity impact scenarios.

Why are Diluted Shares Outstanding Important?

Diluted Shares Understand important as it can increase the EPS or the Earnings Per Shares. This, in return, helps in increasing the business’s overall market value. Various types of securities can be converted into common stock, including a convertible bond, convertible preferred stocks, rights, and warrants. Full dilution presumes that every security that can be converted into common shares is thus converted, which lowers the earnings that are available per share of common stock.

Calculating Diluted EPS – A Step-by-Step Guide for Investors:

Calculating Diluted Earnings Per Share (Diluted EPS) is crucial for investors to assess a company’s profitability more conservatively. It implies an addition of basic EPS using the possibility that all the dilutive securities which are convertible to common stock may be converted including convertible bonds, convertible preferred shares, stock options and warrants. This step-by-step guide would walk investors through identifying dilutive securities, applying the “if-converted” method for convertible debt/preferreds, and the treasury stock method for options/warrants. Understanding Diluted EPS provides a more realistic picture of potential earnings available to each common share, preventing overestimation of a stock’s intrinsic value and guiding informed investment decisions.

Investors seeking deeper knowledge in this area may benefit from the best financial modeling course for professionals in Singapore or a business valuation training course for business owners in Singapore to strengthen their analytical decision-making skills.

CONCLUSION:

Diluted Shares outstanding is an important aspect of Stock trading strategies that can largely affect the business perspective and earning’s of a certain company. They generally refer to the stocks that are issued and authorized under the company, including various equities and other additional shares. As an important part of any business, one should place a focus on Diluted Shares Understanding as much as the other aspects.