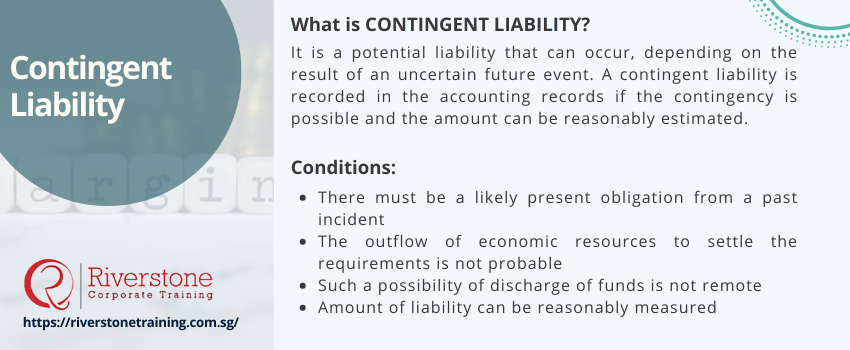

DEFINITION OF CONTINGENT LIABILITY:

It is a potential liability that can occur, depending on the result of an uncertain future event. A contingent liability is recorded in the accounting records if the contingency is possible and the amount can be reasonably estimated.

EXAMPLE OF CONTINGENT LIABILITY:

Your company may be in the mid of a lawsuit, and your lawyer has faith in the other party that has a solid case that could result in damages worth Rs 10 million. Here, in this case, the company would note this amount as a potential liability in its financial accounts alternatively, if the legal department believes that the opposition does not have a solid case in hand. They would recommend the company not to predict any potential liabilities.

Recording of Contingent Liabilities:

Contingent liabilities never recorded in the financial statements of a company. These obligations have not yet occurred, but there is a possibility that they will happen in the future.

We follow a conservative method for accounting; we must follow the practice of the disclosure. A contingent liability disclosed in the concluding statements of a company as a footnote. i.e., notes to accounts.

CONDITIONS:

- There must be a likely present obligation from a past incident

- The outflow of economic resources to settle the requirements is not probable

- Such a possibility of discharge of funds is not remote

- Amount of liability can be reasonably measured

Such contingent liabilities reviewed every year. And the accountant, management, auditors, etc. must decide based on the information they have, whether it is still a contingent liability or if it is now a provision or even a commitment.

Contingent Liability and Provisions:

A provision is a liability that can only be measured using a significant grade of an estimate. It means that the obligation is previously present, but we cannot regulate the exact amount of the obligation, it is possible to determine only an estimate.

Unlike contingent liabilities, provisions recorded in the accounting books. They are debited to the profit and loss account.

If the liability is probable but cannot be consistently measured or estimated, this liability must be documented as a contingent liability. It is not possible to record it in the accounting books if it cannot be measured. However, such cases are very infrequent.