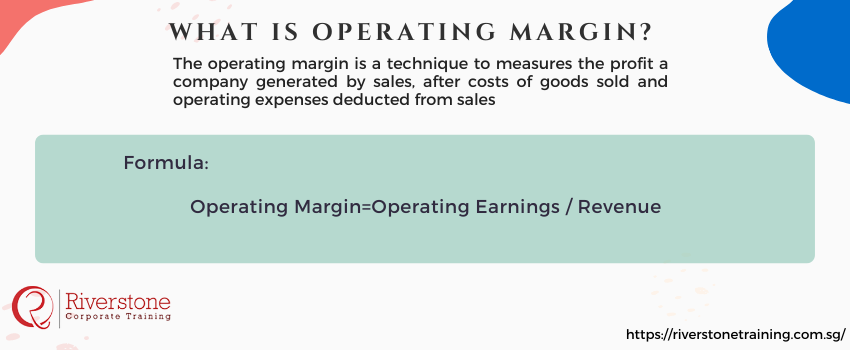

Definition of Operating Margins

The operating margin is a technique to measures the profit a company generated by sales, after costs of goods sold and operating expenses deducted from sales

The formula of operating margin

The operating margin calculated by dividing an organizational operating profit by its total sales. The Formula of Operating Margin is:

Operating Margin=Operating Earnings/Revenue

When an organization is calculating EBITDA margin which is Earning before interest and taxes, the earning is the same as the operating earnings. Operating earnings is revenue subtracted cost of sold goods and the consistent general selling and administrative costs of ongoing the business activity, excluding interest and taxes.

Calculation of Operating Margin:

Operating margin of a company calculated by dividing its operating income by its total net sales revenue:

Operating Profit Margin=Operating Income/Total Revenues

Operating income called before interest and tax earnings (EBIT) or Earning Before Interest, Depreciation and tax earnings (EBITDA).

EBIT or Operating income is the income that is gone out on the income report; after operating costs and overhead, like selling prices, the cost of goods sold and administration expenses are subtracted.

EBIT=Total Income − Operating expenses – Depreciation and amortization

EBITDA = Total Income − Operating expenses

Understanding how EBITDA functions in financial reporting is crucial for evaluating core profitability. Particularly for local enterprises, understanding EBITDA for business valuation in Singapore helps stakeholders determine the company’s performance independent of capital structure and non-cash expenses.

Importance of Operating margin:

An operating margin of an organization is also known as return on sales, and it is a good indicator of how well a business managed and how risk factors are the organization having. It represents the proportion rate of revenues that are accessible to cover non-operating prices, like paying interest. That is why lenders and investors pay keen attention to the operating margins. Operating margins are highly variable and a significant indicator of risks in a business. The operating margin represents the past workings and achievements of the company and is an excellent way to measure whether a considerable improvement in earnings is likely to last.

Limitations of Operating Margin:

Following are some of the Operating margin limitations:

- Operating margin only used to associate businesses that operate in the same industry and, preferably, have the same annual sales and business models.

- It makes it easy to compare the profitability ratio between industries and companies, and many analysts use a profitability ratio, which excludes the effects of financing, accounting, and tax policies.

- EBITDA used as operating cash flow because it excludes non-cash expenses, such as depreciation.

Practical Strategies to How to Improve Your Company’s Operating Margins

Improving your company’s operating margins is crucial for sustainable profitability and financial health. By carefully handling income on revenue generation and operation costs, businesses can earn higher margins. Some specific plans of action would be to maximize the net sales revenue of the company through pricing strategy, negotiate with suppliers to ensure that costs of goods sold are low and establish leaner processes so as to lower the operating expenses. It is also essential to streamline the cost of administration, boost production efficiency, as well as manage overheads, such as fixed costs. Devoting attention to these operable spheres, the companies can increase their operating profits much more, which is an indication of the improved control and tributing to the attraction of more investor confidence. To further support this, enrolling in the best corporate finance training course Singapore or an advanced financial modeling course Singapore for operating margins can equip finance professionals with sharper tools for managing profitability in real-world business environments

Understanding the Key Differences of Operating Margins vs. Net Profit Margins

While both Operating Margins and Net Profit Margins indicate profitability, they measure different aspects of a company’s financial performance. Operating Margin places track of the fundamental business activities only and defines the percentage or the percentage of earnings on the revenue remaining after it has been minus the operation expenses and costs of good sold, yet before counting the interest and taxation (EBIT). On the other hand, Net Profit Margin indicates the final profitability that indicates the proportion of income that is left after all costs, such as interest, taxation, depreciation, and what is amortization in accounting for Singapore businesses have been excluded. Understanding these distinctions is crucial for investors and analysts to accurately assess a company’s operational efficiency versus its overall bottom-line success.

Conclusion:

An excellent operating margin is compulsory for a company that enables the company to pay for its fixed costs, like interest on the debt. A higher operating margins indicates that the company has less financial risk. Operating margins can be considered as total revenue from production sales all costs lessees before the adjustment of taxes, shareholders dividends, and interest on the debt.