Leadership Training Programs for Banking, Insurance, and Corporate Teams

Introduction to Professional Banking Leadership Certification

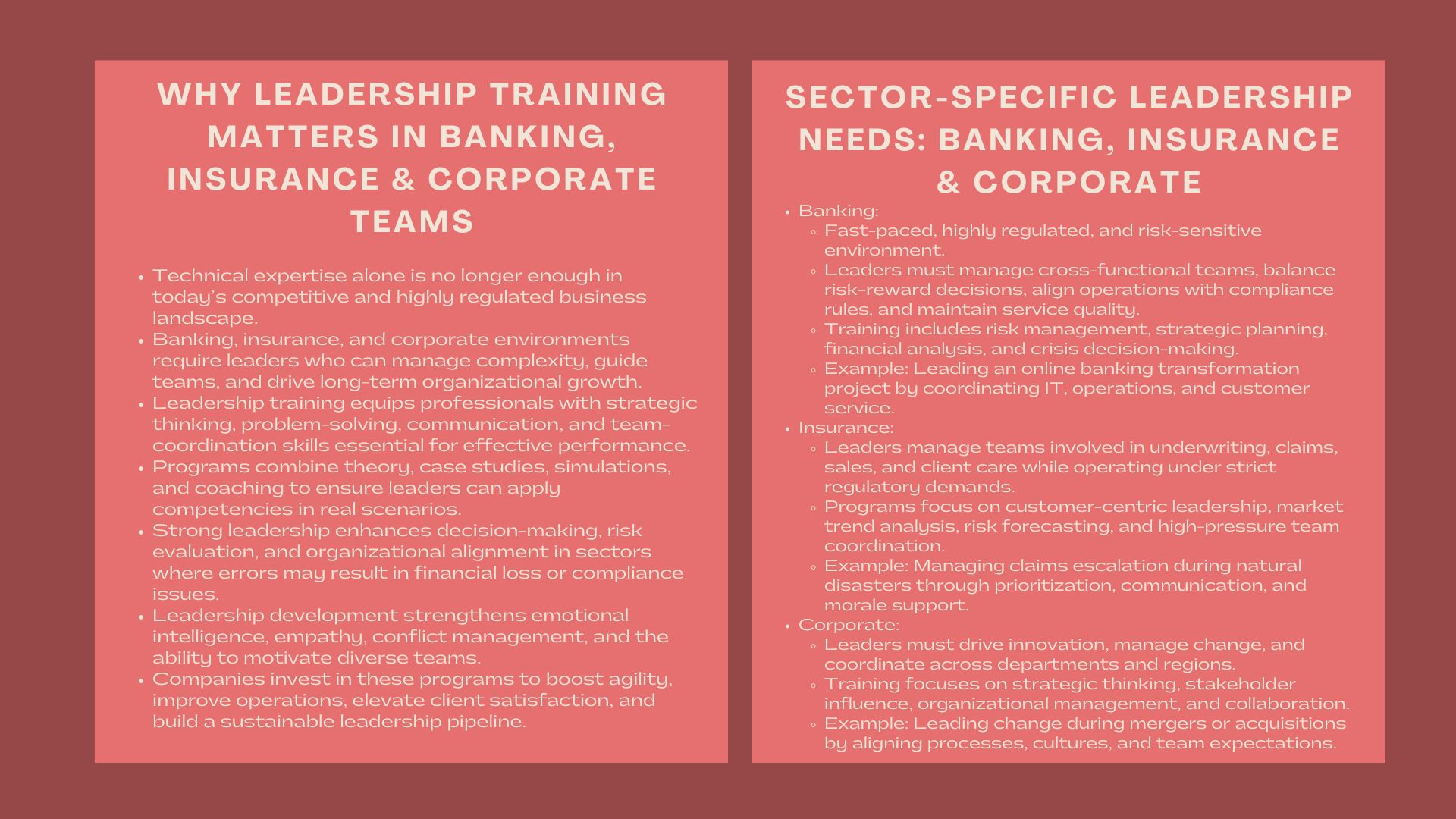

Technical skills have since become insufficient in the current business environment characterized by a lot of competition. In industries such as banking, insurance, and business undertakings among others, leadership qualities are critical in strategizing, building cohesiveness among members of staff, and realizing expansion over a long period of time. Companies are putting more money into specialized leadership training courses that aim at giving the professionals the skills, knowledge, and resources that they need to be effective in complex and fast-moving settings.

To corporate managers and other financial experts, it is essential to build leadership abilities that could help them coordinate teamwork, resolve issues and present organizational objectives with the operational processes. Leadership training programs offer formal learning experiences that involve both practical activities, interactive learning opportunities, and the advice given to the participants through professionals in order to make sure that the knowledge acquired in the programs can be implemented in the real world.

The Importance of Leadership Training

Enhancing Strategic Decision-Making

Good leaders can make such decisions that can accelerate organizational growth and sustainability. In the banking and insurance sectors, the stakes of the decisions made are typically high, and the regulations are often complex, and clients need to be satisfied with the operations and their leaders. Introduction of leadership programs reflects strategic thinking; this allows an individual or business organization to evaluate a complicated situation, foresee difficulty and make a sound decision.

An executive leadership development program for financial professionals is a set of business assessment tools, initiative prioritization, and the streamlining of team performance with the overall corporate objectives. This promotes the flexibility of the organization and also guarantees the ability of the leaders to adapt successfully to the dynamic market environment.

Building Emotional Intelligence and Interpersonal Skills

Having good leadership skills does not just involve being a good analyzer but also emotionally intelligent, the ability to communicate with people and to provide them with motivation. Leadership training programs assist a person to be empathic, a good listener and resolving conflict skills. These are the competencies required to prevent more disintegration among the team members, establish trust and develop a working culture.

Provided that leaders are well communicative people who know the needs of teams in the corporate settings, they are more likely to raise loyalty, decrease turnover, and improve the overall performance of the organization. Training programs focused on soft skills and technical knowledge of leadership allow making sure that the leader will be able to lead the team to success even in the settings that require building a positive relationship with employees.

Leadership Training for Banking Professionals

Addressing the Unique Challenges in Banking

Bankers have a very regulated fast paced profession. Leaders are required to deal with cross-functional teams, financial operations and other complex regulatory requirements. The flubs may cause inefficiency in the operation process, financial loss, or defiance.

Banking leadership programs are aimed at developing competencies selected specifically to overcome such challenges. Among the things that the participants are taught are how to balance the leadership of teams in high-pressure situations, how to make decisions according to the analysis of risk and rewards and how to align departmental goals with corporate strategy. This is with the aim of developing leaders that can facilitate performance without compromising on compliance and operational integrity.

Executive Leadership Development Programs

A financial professional executive leadership development program can also have modules on strategic planning, financial analysis, risk management, and uncertainty-based decision-making. They take part in simulations as well as in case studies that simulate the banking environment and therefore participants can apply the principles of leadership in such a simulated environment. By having the training in real life, the participants gain self-confidence and expertise in team management in a complex financial business.

Example: Leading a Bank Transformation Project

An example that can be considered is that of a banking case where a new online banking service is being introduced. The leaders should align IT, customer service, and operations teams so as to facilitate a successful roll out. The sole difference between the two programs focuses on empowering the managers through a leadership training program which enables them to communicate effectively, solve interdepartmental conflicts, and facilitate cross-functional coordination. When these skills are applied, project delivery is on time, and project adoption is high, as well as, the level of client satisfaction is elevated by the leaders.

Leadership Training for Insurance Professionals

Unique Challenges in the Insurance Sector

Uniqueness of insurance teams is imposed on them having to deal with client expectations, regulatory requirements and high-stakes financial decision-making. The leaders should also inspire the groups that handle complicated claims, policy managing actions and client care activities.

Corporate leadership and management training for insurance teams presents the means of dealing with these issues. Training focuses on strategic leadership, team management and leadership that is customer-driven. The participants are taught how to discuss the market tendencies, predict the risks in business, and create various strategies that will help to optimize the work of teams and keep clients satisfied.

Building High-Performing Teams

Insurers usually deal with very diverse teams composed of underwriting and claims management to sales, and compliance. Leadership programs educate managers on the importance of promoting collaboration, effective distribution of responsibilities, and solving conflicts. Through the creation of high performing teams, the leaders will increase efficiency in operations and elevate the levels of services delivered to clients.

Case Example: Managing a Claims Escalation

Consider the case in which several claims are urgent because of the result of a natural disaster. A well-planned leadership system will make sure that teams work their schedules and concentrate on urgent cases, as well as stay in touch with clients. Corporate leadership training will provide managers the decision-making structures and interpersonal skills they will need to manage such situations of high-pressure without the morale of the team and client trust.

Leadership Development for Corporate Teams

Developing Strategic Corporate Leaders

Corporate organizations work in very dynamic surroundings and the groups cut across several departments, geographical, and functional areas. A leader needs to be capable of driving change in his or her teams, aligning projects and organization strategy, and developing innovation. Corporate team leadership programs include the training of strategic thinking, organizational management, and presence as leaders.

Such programs enable leaders to comprehend their strong points, adaptability to changing business requirements, and having impact on the stakeholders. Corporate leadership training by incorporating practical activities and scenarios training allows those engaged to be ready to make sound decisions and motivate teams and succeed in the organization by relying on data.

Enhancing Collaboration Across Departments

Teamwork is essential in the business world. Leadership programs also educate managers on how to dismantle silos, ensure inter-departmental communication and establish a shared vision of the team. The participants get to understand how to facilitate teamwork, conflict management, as well as make collaborative solutions that can balance the competing priorities.

Example: Leading a Corporate Change Initiative

Recall a merger or acquisition of a corporation in which several departments are required to merge processes, teams and cultures. Through good leadership, communication will be easy, coordination will be effective, and the employees will be involved in the transition. Leadership training prepares managers with the knowledge to head change implementation, control the expectations of the stakeholders and ensure that the productivity does not go through the roof in times when organizational change is taking place.

Key Components of Effective Leadership Training

Strategic Thinking and Decision-Making

Strategic thinking is a key element that must be developed as a part of leadership programs. Leaders are also instilled in such a manner that they analyze complex business situations, evaluate risks and opportunities and make good decisions. This capability will allow managers to foresee the future, work with limited resources, and streamline team activities with strategic objectives of the company.

Emotional Intelligence and Team Management

The focus of the leadership training is put on emotional intelligence and team dynamics comprehension and management. Leaders get to understand how to inspire different teams and conflict should be dealt with constructively and a culture of trust and accountability should be encouraged. Emotional intelligence makes sure that the leaders are able to react sensitively to the needs of the employees and challenges facing an organization.

Communication and Influence

Good leaders should be clear and have the ability to convince. Through the leadership programs, the people involved in the programs learn to provide effective presentations, communicate with the stakeholders and have influence in the decision-making processes in teams and departments. The good communication skills will help the leaders to gain credibility, build on the collaboration, and advance organizational agendas.

Practical Application Through Case Studies and Simulations

Successful leadership programs involve a balance between the theoretical part of the training and the practical one. The participants use a case study, case simulation and scenario based exercises which are simulated to reflect real challenges in the world. These practices assist the leaders in gaining problem solving skills, implementing decision making models and gaining confidence in handling complicated situations.

Benefits of Leadership Training Programs

Improved Organizational Performance

Leadership training enhances the capability of the managers to lead teams, make attentive decisions and come up with results. Trained leaders make more productive, efficient, and innovative teams that have a direct impact on the performance of the organization and competitiveness.

Enhanced Employee Engagement and Retention

Leadership development also indicates to the employee that the organisation cares about its own development, which will encourage participation, loyalty, and motivation. Teams who have competent managers have a great amount of morale, less turnover as well as have increased commitment to organization objectives.

Stronger Client and Stakeholder Relationships

Effective leaders are inclusive and managers of teams approach their management responsibilities effectively, thus are placed in a better position to create trust in the eyes of clients and other stakeholders. Effective leadership in the sphere of banking and insurance is a guarantee of proper, time-sensitive, and customer-oriented service, increased customer satisfaction, and retention.

Career Advancement Opportunities

Leadership programs expose the professionals with skills that can be transferred across jobs, departments and industries. The participants have confidence, strategic awareness and management skills, which take them to promotions, executive positions as well as long-term career developments.

Choosing the Right Leadership Training Program

Assessing Organizational Needs

Organizations need to assess the needs of their teams before use of leadership training. Banking practitioners might require courses in risk management and decision making when under stress. The insurance teams can be trained on customer centric leadership and adherence to the rules. It is not rare that corporate teams need a mix of strategic thinking, cross-functional teamwork, and leadership.

Selecting Tailored Programs

The Executive leadership development programs available to the financial professionals and the corporate leadership and management training programs available to the insurance teams are created to meet these special needs. Uniqueness guarantees the applicability, interest and relevance and enables the learner to be able to apply learned skills almost instantly in the job.

Ensuring Practical Outcomes

Quality leadership curriculum will focus on practice. Interactive workshops, role-playing exercises and simulations assist the participants to train their leadership skills in a real life situation. Learning is carried out through post training support, coaching and follow up assessment to ensure long lasting enhancement of leadership effectiveness.

The Long-Term Impact of Leadership Training

Building a Culture of Leadership Excellence

Development of leadership programs instills a culture of responsibility, team work and constant development. Well trained leaders provide greater engagement levels, productivity, and innovation levels to a team. With time, such competencies get integrated to form a part of the organizational culture, which guarantees a continued performance and growth.

Enhancing Organizational Agility

Powerful leaders can make organizations responsive and prompt in responding to changes in the market, changes in regulations as well as competitive threats. Leadership training also provides managers with the ability to balance uncertainty and secure their outcomes in the presence of risks as well as tapping new opportunities that can provide the organization with sustainability in the long term.

Strengthening Talent Pipelines

Organizations can also build leadership abilities within the company, which helps in recognizing high potential workers and condition them to take a higher position. Leadership programs provide systematic career development, succession, and talent retention opportunities to have a strong stream of able leaders in case they are required in the future.

Conclusion

Leadership plays a critical role of success in banking, insurance and corporate surroundings. The employing of well-designed executive leadership development programs aimed at financial professionals and corporate leadership and management training among insurance teams give the participants the abilities, knowledge as well as confidence to lead positively, as well as inspiring others to collaborate and drive positive organizational changes.

The training on leadership skills, strategic thinking, emotional intelligence, and practical application is likely to inform managers to be able to navigate tricky business issues and be successful in motivating their teams, as well as getting outcomes. Companies, which invest in the development of leaders, provide the culture of excellence, and improve employee motivation, the relationships with clients and long-term success.

To any financial, insurance and corporate professional interested in developing leadership potential, joining a executive leadership development programs for banking and insurance professionals specific leadership training course would be a calculated investment with tangible positive returns, both to individuals and companies.