Project Finance Training for Energy, Infrastructure, and Construction Sectors

Introduction to Advanced Infrastructure Finance Programs

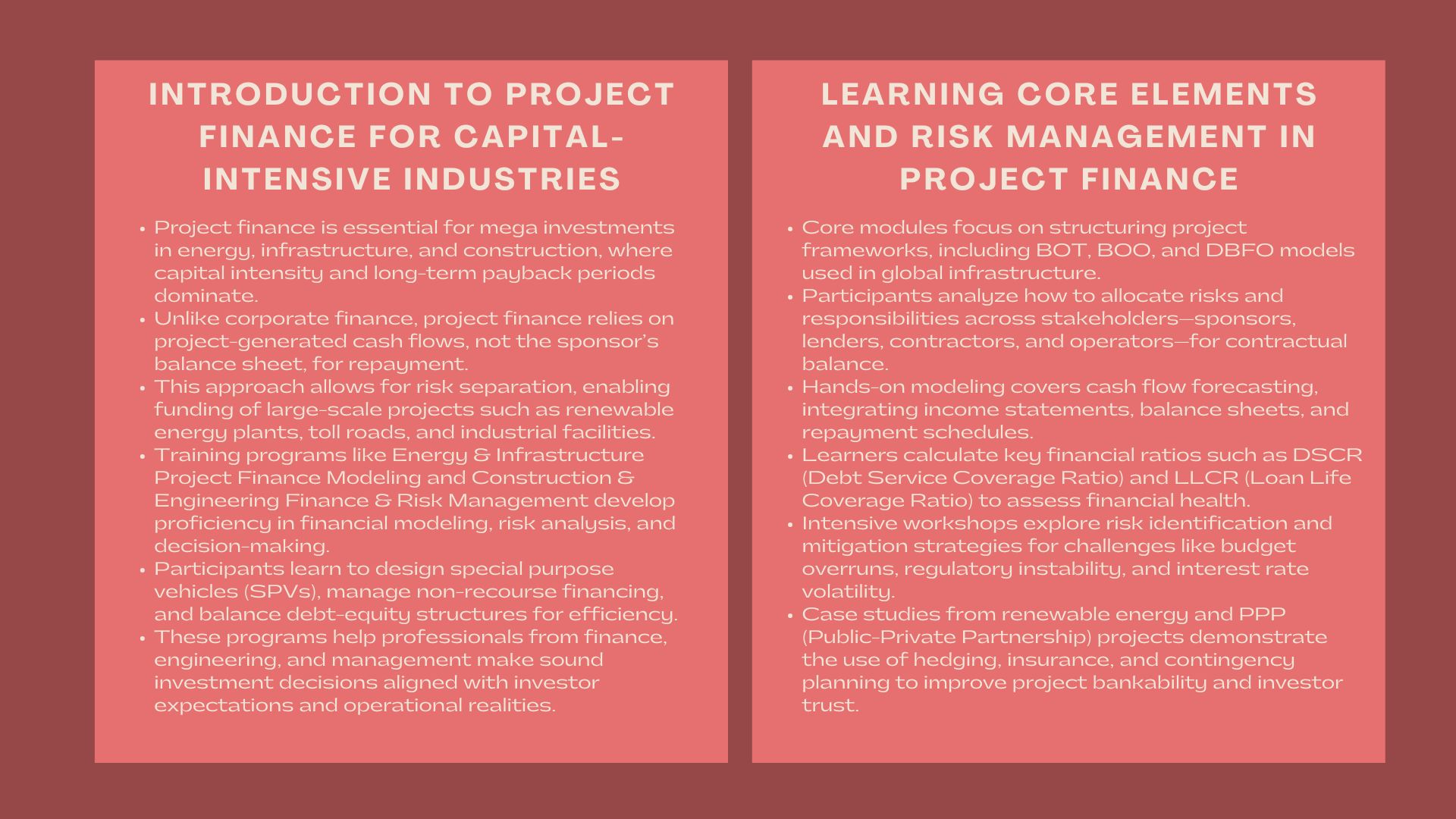

The core of mega investments in the energy, infrastructure, and construction industries depends on project finance. Renewable energy facilities and toll roads are just a few of the examples where these capital-intensive projects require the accurate financial planning, the division of risks, and the identification of the long-run design. Project finance is a niche field that is usually not adequately served by the traditional methods of financing corporations, balancing complexity, risk and strategic vision.

Intensive courses such as the energy and infrastructure project finance modeling course and construction and engineering finance and risk management training are geared towards producing professionals who are capable of becoming proficient in modeling of the projects, being in a position to evaluate such projects and manage them. Such workshops will enable finance, engineering, and management teams to make wise decisions that can meet the expectations of the investors and realities of operations.

Learning the Basics of Project Finance.

The Character of Project Finance.

Compared to corporate finance, project finance also depends on the cash flows of the project to be repaid and not the balance sheet of the sponsor. This model separates project risk and can allow large scale developments to be funded on the basis of estimated revenue streams.

The training programs are aimed at making the participants comprehend the main elements of the project finance: the structure of the special purpose vehicle (SPV), non-recourse financing, and the contractual structures in which the responsibilities of the stakeholders are defined. Participants get to know how to structure finances in such a way that they are debted and equity-based and contingent capital to achieve optimal financial efficiency and reduce risk exposure.

The importance of Project Finance in Capital-Intensive Industries.

Energy, infrastructure and construction projects are long gestation periods with high up front capital requirements. Such undertakings are also associated with complex risks – regulatory unpredictability, operational delay and environmental issues.

The energy and infrastructure project finance course equips the professionals in those challenging environments with tools to determine whether or not a project is financially viable. The participants will know how to predict cash flows, evaluate cost structures and sensitivity analysis to evaluate the resiliency of projects in various situations.

Project Finance Training Learning Areas.

Project Structuring and Frameworks of Deals.

Structuring is the art of project finance. The training programs will take the participants through the different project structures, including Build-Operate-Transfer (BOT), Build-Own-Operate (BOO) and Design-Build-Finance-Operate (DBFO) models.

Students learn to distribute the risks/liabilities and the responsibilities of the involved stakeholders such as the sponsors, the lenders, the contractors, the operators, among others to facilitate the contractual equilibrium. By using real case studies, the participants examine the role of well-designed structures in achieving project success, especially when they involve intricate cross border transactions.

Financial Modeling “ Cash Flow Forecasting.

Successful project finance is based on accurate financial modeling. The workshops provide the participants with skills of constructing integrated model to connect income statement, balance sheets and cash flow projection of long term projects.

The course of energy and infrastructure project finance focuses on the design of models in renewable energy and transport, as well as utility projects. Participants model project schedules, loan draw down and repayment schedules and performance ratios including DSCR (Debt Service Coverage Ratio) and LLCR (Loan Life Coverage Ratio).

Such models are used to assist decision-makers to look into the potential of a project to finance its debt and to deal with anticipated returns to investors.

Risk Identification and Risk Minimization.

Risk management is what defines the success or failure of infrastructure and construction projects. The construction and engineering finance and risk management training focuses on identifying and mitigating key risks such as:

- Budget increase and time wastage in construction.

- Exchange rate and interest rate risks.

- Counterparty defaults

- Political and regulatory instability.

The participants are taught how to use hedging techniques, contingency planning and insurance mechanism in order to lessen exposure and enhance project bankability. The examples of renewable energy and public-private partnership (PPP) projects are also provided in the case discussions to show how the financial instruments are applied to de-risk the complicated ventures.

Sector-Specific Focus Areas

Energy Sector: Investing in the Renewable Energy Process.

The international shift to cleaner energy sources like solar, wind and hydro has put more complexity in project financing. Renewable projects need knowledge of variable cash flows, power purchase agreements (PPAs) that are long term as well as understanding government incentives.

Training modules under the energy and infrastructure project finance modeling course help participants model tariff structures, capacity factors, and investment tax credits. They also discuss the financial options such as green bonds, climate funds as well as blended finance models which involve combining both public and private funds to invest in sustainable energy.

Infrastructure Sector: Construction of Long-Term Property.

Long-term commitments in terms of cash flows are required in infrastructure projects like toll roads, ports and railways. The participants get to know how to assess concession deals, demand risk, and costs of maintaining lifecycle.

Workshops also focus on incorporating economic and social return measurements, and professionals are trained to prioritize financial goals together with the goals of public policy – which is a key issue in infrastructure investments.

Construction Sector: Managing Complex Engineering Projects

The construction and engineering finance and risk management training provides professionals in engineering and construction firms with financial frameworks to manage multi-phase projects.

The participants investigate the interplay between financing structure and the model of project delivery, subcontracting, and project supply chain risks. They also discuss the effects of performance bonds, milestone payment and cost-plus contracts on project profitability and financial sustainability.

Practical Tools and Techniques of Financial Professionals.

High Level Modeling Methods.

Students will have practical experience in financial modelling in Excel such as methods of circularity resolution, waterfall debt modelling and dynamic scenario modelling. The models are useful in predicting the performance in various operation and financial scenarios aiding the strategic choices made on pricing, funding, and time.

Measuring Project Bankability.

The workshops also offer training to participants on how to evaluate the project bankability by looking at the lender requirements and the covenant structures and credit metrics. With actual case activities, the students learn to recognize what drives a project to secure finances on behalf of the banks, export credit agencies, and the institutional investors.

Organizing Public-Private Partnerships (PPP).

The public sector has numerous infrastructure and energy developments. The training programs include the way to organize PPPs to coordinate the objectives of the public policy and the incentives of investors. The participants introduce case studies with the PPP frameworks in transportation, water, and renewable energy fields, and obtain the information about the mechanisms of risk-sharing and compliance with the regulations.

Project Finance Sustainability and Integration of ESG.

ESG as a Fundamental part of Project Assessment.

The ESG criteria are becoming more and more central to investment decisions. Participants get to know how to incorporate ESG implications in financial frameworks by measuring sustainability indicators and evaluating their effects on the cost of financing and investor interests.

Training programs exemplify the way the mechanisms of ESG-linked financing, like sustainability-linked loans and green bonds, are changing the environment of the infrastructure and energy investment.

Long-Term Value Creation

The principles of sustainable finance promote development of projects with long term value in addition to short term profitability. Workshops assist the participants in determining how projects can create social benefits, environmental impact and economic resilience to enable organizations target their investment strategies toward global sustainability objectives.

Project Finance Training Institutional Benefits.

Developing Cross-Disciplinary competencies.

Such training programs do not apply only to finance experts. The knowledge of the financial aspects of project execution is also useful to engineers, project managers, and legal advisors. The alliance between technical, financial, and strategic expertise helps establish cooperation between departments and enhance interaction with investors and lenders.

Improving Investor Confidence and Decision-Making.

Companies that invest in project finance training programs are able to produce a team that can analyze an opportunity thoroughly and implement it cost-effectively. Better financial literacy levels among functions would lead to the accuracy in the planning of the projects, reduce costly overruns, and increase the confidence of the investors in the company in terms of project management skills.

Conclusion

Project finance is now an important field to master in a world where there is a high rate of economic growth and sustainability in areas where the large scale energy, infrastructure and construction works are taking place. Other programs like the energy and infrastructure project finance modeling course and the construction and engineering finance and risk management training enable professionals to organize, model and manage projects in a financially rigorous and strategically clear manner.

These workshops enable organizations to provide sustainable infrastructure solutions that can add value to the investors, communities, and even future generations through a combination of financial modeling, risk assessment, and sector-specific insights.