Project Finance and Infrastructure Fund Management Training Programs

Introduction: Certified Project Finance Training

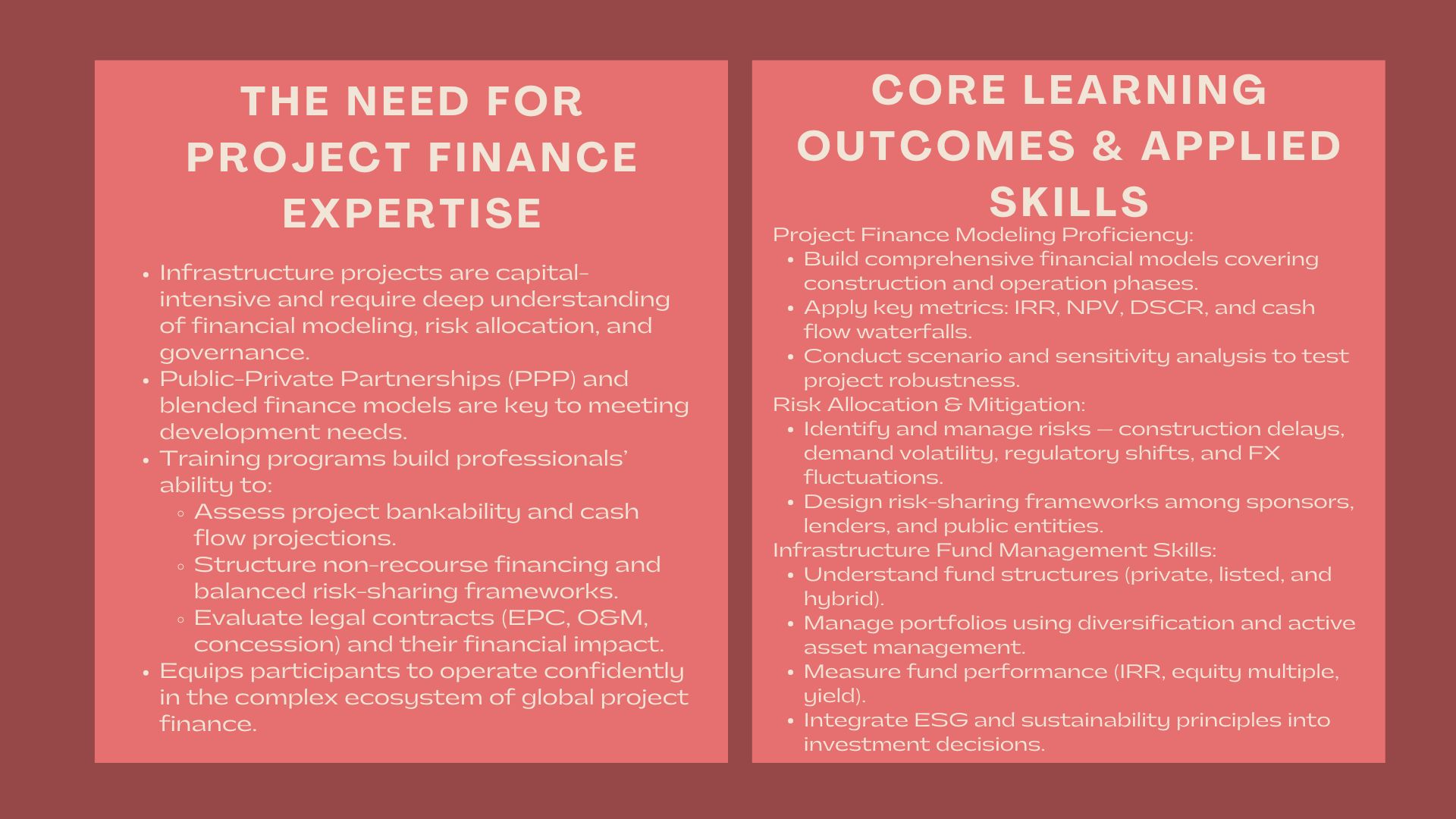

The need to create sustainable infrastructure globally in terms of transport, energy, water, and digital connection is booming and has presented a myriad of opportunities to financiers, developers, and investors. However, these capital-intensive projects are not only to be structured and managed technically but it must be accompanied by a thorough comprehension of financial modeling, risk distribution, funding sources, and governance processes.

Specialized project finance modeling and infrastructure fund management training course will make the professionals possess technical; analytical, and strategic abilities that can be applied to structure complex projects, attract investors, and use funds effectively. These courses combine theory and practice and equip the attendees to operate in the complex world of project finance and infrastructure investment.

The Increasing Significance of Project Finance Expert Knowledge.

Infrastructure as Investment Frontier.

The infrastructure is now an essential part of the worldwide economic development, and both governments and investors work together more and more through Public-Private Partnerships (PPP) and blended finance frameworks. But it takes great financial structuring expertise to finance such massive scale projects – balancing long-term earnings with short-term capital outlays.

Individuals who have been trained in project finance learn to assess the bankability of projects, create the most appropriate capital structures, and match investor expectations with the risk profile of their projects.

Incorporating Financial and Operational Approaches.

Project finance contrasts with corporate finance in that the assets and liability of a project are separated in an independent structure usually by limited or non-recourse debt. The training programs are focused on learning how to analyze the projections of the cash flow of the project, learning about the risk transfer mechanisms, and building up the financial models that can reflect the contractual agreements between the stakeholders properly.

A project finance and infrastructure investment course to train professionals explores the complexity of concession arrangements, off-take contracts, and debt service coverage ratios and equips the trainees with the ability to judge tricky dealings with a degree of confidence.

Key Learning Outcomes

Learning to use Project Finance Modeling Techniques.

The participants will have practical training of developing complete project finance models. Training will deal with all elements of an effective financial model, which include:

- Assumptions of construction and operation phase.

- Sizing of debt, interest schedules and sculpturing.

- Cash flow waterfall structures.

- Project risk sensitivity and scenario analysis.

- Financial indicators like the IRR, NPV, and the DSCR.

Such exercises make professionals ready to analyze the viability of the project, negotiate with lenders and create the models that will be scrutinized by investors and credit committees.

Knowledge Risk Allocation and Mitigation.

Proper reallocation of risks among sponsors, lenders and government entities is required to have an effective project finance. The participants are taught how to identify and plan mitigation on important risks including:

- Time wastage and overbudgeting in construction.

- Volatility and loss of revenue and uncertainty of demand.

- Regulatory or political risks.

- Exchange rate fluctuations and interest rate fluctuations.

By learning how to handle and price these risks, the professionals are able to improve the general bankability of the infrastructure projects.

Assessment of Project Structures and Legal System.

Project finance is based on legal and contractual frameworks. The major agreements training deals with, e.g., EPC (Engineering, Procurement, and Construction), O&M (Operations and Maintenance), and concession, are also involved to guarantee that the participants will be able to evaluate their influence on the financial results and creditworthiness.

This information enables the analysts and fund managers to foresee possible bottlenecks and coordinate the interests of the stakeholders at the initial stages of the project lifecycle.

Fund Management: Infrastructure Fund Management: Construction of Long-term Value.

The Development of Infrastructure as an Asset Class.

Infrastructure funds have transformed to become a mainstream institutional portfolio targeting a niche to institutional investors due to the certainty of cash flows as well as inflation sensitive returns. Training programs examine the way infrastructure funds are organized, managed and assessed- give information on models of private and listed funds.

Portfolio Management and Performance Analysis.

The participants are taught to use infrastructure investment fund management principles, like:

- Sector and geographical diversification in terms of assets.

- Optimization of returns by means of active asset management.

- Following such measures of performance as IRR, equity multiple, and yield on invested capital.

- Controlling exit strategy and resell.

This is a two-year track of financial modeling and strategic portfolio management that prepares graduates to either head an infrastructure investment fund or guide institutional clients.

Integration of ESG and Sustainable Investing.

As the world pays increased attention to the idea of sustainability, nowadays, the ESG (Environmental, Social, and Governance) factors become instrumental in the context of infrastructure investment. Training programmes focus on the ways of incorporating the consideration of ESG in the project appraisal, financing decisions, and fund management strategy- to make the financial performance go hand in hand with the social impact.

Who Are the People that Should be Attended to These Programs.

Infrastructure training Project finance and infrastructure investment is suitable in case of:

- Structured finance investment bankers and analysts.

- Infrastructure portfolio managers in the private equity sector.

- Utilities, energy, or transport corporate finance and treasury department.

- The officials in the government that undertake projects related to PPP.

- Investment institutions in need of increased infrastructure exposure.

Newcomers to the industry and old hands who are trying to hone their skills, these programs offer operational models that can be used instantly in their companies.

Hands-On Training Features

Real-World Case Studies

Case studies based on infrastructure projects around the world (renewable energy, toll roads, airports, and digital infrastructure) are usually part of courses. The participants appraise transaction structures, construct financial models and estimate major project risks.

Interactive Deal Structuring Exercises and Simulations.

Simulation workshops represent live deal meetings, which allow participants to put financial and legal concepts to work together. Such exercises are a replica of real-life situations which build technical and communication capabilities needed in deal execution.

Mentoring and industry wisdom.

Practical trainers and visiting speakers with careers in the banking, investment and advisory sectors provide an insight on the latest trends, financing and regulatory innovations that have influenced the shape of infrastructure.

Strategic value of Project Finance Training.

Enhancing Analytical and Technical Competence.

Professionals learn to analyze project returns and credit worthiness through the intensive modeling and risk assessment methods. This level of analysis makes them more valuable in the field of deal origination and execution.

Expanding Career Opportunities

Global infrastructure investment is projected to exceed trillions of dollars in the coming decades. Individuals who complete a project finance modeling and infrastructure fund management course position themselves as specialists in one of the fastest-growing segments of finance.

Enhancing Strategic Decision-Making

Professionals trained in infrastructure investment and project finance training for professionals can assess projects holistically—balancing financial returns with long-term sustainability and policy considerations. This multidimensional perspective strengthens institutional investment strategies and supports responsible capital deployment.

Conclusion

The nexus of finance, strategy, and sustainability is project finance and infrastructure fund management. With the growing economies and increased pace in the infrastructure requirements, there will be demands of skilled individuals who can organize, finance, and control such undertakings.

Through thorough training, the participants are able to master finance modelling, risk management, and investment strategy and become able to churn infrastructure growth in a responsible and profitable manner.

Running a renewable energy project or also running a multibillion-dollar fund the practical experience in a specialized project finance education is a priceless resource that the current financial professional can have.