Understanding of Equity Accounts?

What are Equity Accounts?

- These represent to readers of financial statements the structure of the Equity funding in a business, making it an essential part of a comprehensive financial statement guide for Singapore businesses.

- The business, on inception, will have shares, and shareholders will be asked to pay an amount for those shares. This is often a nominal sum, $1 to $10 per share —as part of understanding financial statements for Singapore businesses.

- Over time, mainly if the business is thriving in raising new Equity funds, the company will issue further Equity Capital. It’s unlikely that this new capital raised on the same valuation as previous funding. To the extent that the new price for shares is higher than the original price, this is known as Share Premium.

- It’s also likely that as a business grows, it will have additional classes of shares. These too can be considered ‘Equity Accounts.’

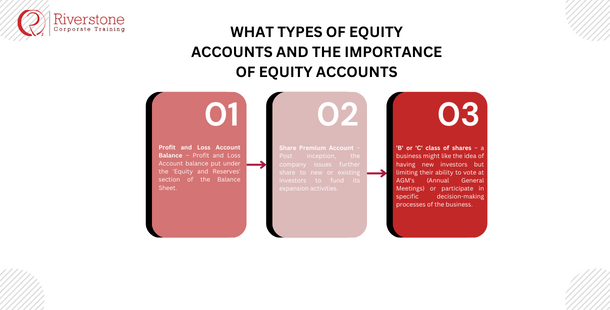

What types of Equity Accounts and the Importance of Equity Accounts

What types of Equity Accounts and the Importance of Equity Accounts

Profit and Loss Account Balance

Profit and Loss Account balance put under the ‘Equity and Reserves’ section of the Balance Sheet. This figure will represent the accumulated business profit or losses since a company’s inception.

It’s important to note that a business should not pay a dividend under many country’s legislation unless there is a sufficient positive balance in the Profit and Loss Account to do so.

Share Premium Account

Post inception, the company issues further share to new or existing investors to fund its expansion activities. These shares will most likely be given at a higher value than their nominal value, and this excess included in the Share Premium Account

‘B’ or ‘C’ class of shares

A business might like the idea of having new investors but limiting their ability to vote at AGM’s (Annual General Meetings) or participate in specific decision-making through game theory processes of the business.

Different classes of shares can be issued, offering subscribers of such shares additional voting and participation rights. These categories often stay in place even when the business is significantly larger. If you look at the financial pages of a newspaper, the Financial Times, for example, you will find different prices quoted for companies who have ‘A’ and ‘B’ shares

Application of Equity Accounts

The Equity Accounts collectively represent the Equity of a company. A company with a solid Equity base is often seen as a mature and financially reliable company.

A Guide for Singaporean Business Owners and Startups

Create a practical guide that deals with small and medium-sized enterprises (SMEs) and new startups in Singapore in terms of how they are supposed to set up properly, administer, and manipulate the way the equity in their accounts is handled. This information may discuss the particular equity accounts applicable to various legal forms (e.g. sole proprietorships, limited private companies in Singapore), the typical problems in equity transactions, the consequences of various kinds of equity actions (such as issuance of new shares or declaration of dividends) and how a good equity position can bring in investors or afford finance in the local market. This information will be of tremendous value to your intended audience after giving them valuable advice that can be followed in a Singaporean environment. For those looking to enhance their financial expertise, enrolling in comprehensive finance courses for Singapore startups and SMEs or pursuing business valuation certification for Singapore startup founders can provide essential skills and knowledge to better manage equity and attract investment.

Interactive Equity Impact Calculator/Scenario Tool

Develop an interactive Scenario tool on the web, where users can enter hypothetical financial events and the effect will instantly be seen across various equity accounts. as, when one types in a statement like, issue 10,000 new shares at 1 dollar each, or, declare 5000 in dividends, the device would indicate the resulting adjustments of common stock, retained earnings, or owner capital. Such practical working would assist in letting users understand that the nature of equity accounts is dynamic, accounting of how a number of business decisions influence ownership and financial stability of a given enterprise, and how these facets can be evidenced in financial documents of a company, simplifying and attractive bland accounting principles. This tool complements learning about understanding brand equity in Singapore and how to calculate return on equity effectively.

What types of Equity Accounts and the Importance of Equity Accounts

What types of Equity Accounts and the Importance of Equity Accounts