What is Monthly Recurring Revenue (MRR)?

Monthly Recurring Revenue, stated as MRR, is undoubtedly the basic measuring unit at any subscription business. MRR is the money paid monthly to you for subscriptions of your product or service. It makes a great business model When you secure a new customer, you got expected revenue, which indicates that you do not need to worry about sales every month. It is different from customary sales; it gives you new challenges such as retention and turns over.

“MRR stands for monthly recurring revenue, those measures of the predictable and recurring revenue components of your subscription business.”

MRR tells you how much customers pay you for subscriptions each month and reveals your business and motion growth and motion are justifiable. To understand how MRR fits into broader financial performance, it helps to review revenue versus net income explained simply—highlighting the difference between top-line sales and bottom-line profitability.

Importance of MRR

Successful organizations track their MRR for two main reasons:

1. Financial planning and forecasting

An organization has to make accurate financial estimates because of the subscription, and a large part of that is because MRR is consistent and predictable. As the company gains subsequent months of regular revenue, you can begin to model estimates of where you’ll be and then can plan your business accordingly.

2. Measuring Growth

If you want to take over the world track, the growth in your MRR month over month is critical. MRR is a vital indicator of the growth of a business, and the month-over-month growth percentages will indicate whether you’re generating a healthy profit or you’re still at the start point.

MRR formula

Once you collect all the business information, you can assume plenty of methods to calculate your true MRR:

Standard MRR + Grown MRR – Lost MRR = True MRR

Here the standard is how much MRR you had at the start of the month; grown MRR is added revenue earned from new customers during the month, and lost MRR is the loss in revenue.

How to calculate monthly recurring revenue

There are two ways to calculate your monthly recurring income.

- The first is, to sum up, the amount of all paid subscriptions. Although the customer-by-customer process is simple in theory, it becomes pretty dull when put into practice, precisely as your business scales up to serve a much larger customer base.

- The other option is to multiply the number of customers you have by the average of their monthly fees.

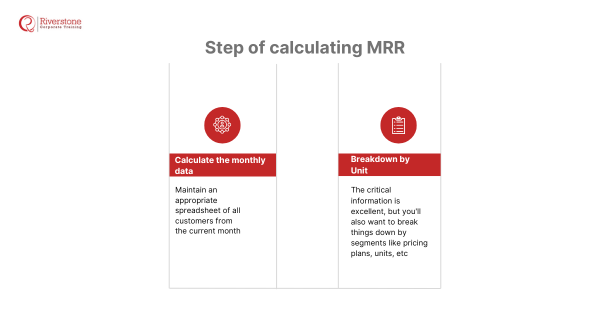

Step of calculating MRR

MRR can be calculated in four easy steps accurately, and they are as follow:

1. Calculate the monthly data

Maintain an appropriate spreadsheet of all customers from the current month. Maintain the subscription value of every customer and convert the annual contract to monthly revenues by dividing the yearly agreements by the number of months. Then, sum up all the subscriptions. That will be the current month’s total MRR.

2. Breakdown by Unit

The critical information is excellent, but you’ll also want to break things down by segments like pricing plans, units, etc. follow the same process but only include data from the interested segments.

Calculate MRR growth

Once you know your MRR, then the next step is to know your MRR growth as well. You can have this by dividing the incremental MRR data divided by last month’s MRR numbers. The formula of total growth MRR is:

Growth MRR = (Incremental MRR)/ Last Month MRR

Example:

If the last MRR is $1,000 and the company has ten new customers in the standard plan at $20 per month, and 15 new customers in the premium plan at $20 per month, your total MRR would be:

Growth MRR = (Incremental MRR)

Growth MRR = (10 x $20) + (15 x $20)

Growth MRR = $ 500.

Total New MRR = $ 1,000 + $ 500 = $ 500

Growth in MRR = $500/$1000 = 50%

Common Mistakes while calculating MRR

MRR is an essential metric for subscription businesses, but you also ensure some common mistakes while calculating MRR.

Including annual contracts at a total value in a month

If someone pays you all the money for a yearly subscription, their subscription value in MRR should be divided by the planned subscription length. This is because you’re not trying to measure cash flow infect you’re trying to measure how quickly and efficiently you’re growing. Including everything at once throws off many of your other metrics, including customer count, etc. For better clarity on revenue recognition versus actual cash movement, refer to a guide to reading cash flow statements to understand how financial timing impacts your metrics.

Subtracting transaction fees and delinquent charges

It can be appealing for an organization to deduct transaction fees and delinquent charges from their MRR. However, this approach is very conservative and accurate in calculating their metrics. By doing this, the results are, unfortunately, incorrect and misleading.

Including one-time payments

In the subscription business, you don’t expect to receive recurring regularly, which indicates that including them in your MRR will expand your revenue prospects and neglect your financial model. Attending a banking and finance modeling workshop can help professionals better structure accurate revenue forecasts and avoid these common modeling pitfalls.

Not Including Discounts

An additional egregious error is not including discounts in total calculations. If you offer your customer a discount on a monthly plan, so they’re paying the discounted amount, your MRR isn’t the actual amount. You have to use a lowered amount. Finally, if you don’t add the discount, your MRR would jump higher and not actual.

Strategies to Drive Sustainable Recurring Revenue Growth in Singapore

The key thing after computing MRR is to learn more about its components in order to spur sustainable growth. This article would explore practical ideas on how you can grow your New MRR by effective customer acquisition, boost your Expansion MRR by smart upsells and cross-sells and most importantly, reduce Churn MRR with better customer retention strategies. We will also see how businesses in Singapore can apply the concept of value and how they can improve their products to make sure that they are able to generate the right amount of recurring and predictable revenue. Understand how to cease just seeing and find a way to influence the direction of your MRR, as a means to achieve financial health in the long term. Understanding average revenue per user metrics is also essential to evaluate how much value each customer brings and where you can optimize pricing or product tiers.

Connecting Monthly Recurring Revenue with Key SaaS Metrics in Singapore

MRR is a valuable metric that can reveal its indisputable value when considered along with other key metrics of SaaS. This material would dive into the key aspects of relations among MRR, Customer Lifetime Value (CLTV), Customer Acquisition Cost (CAC), and churn Rate. We will show how an expensive CAC that leads to a low CLTV can eat away at change in MRR, or how exactly lowering churn will directly raise your recurring revenue level. Know how SaaS and subscription companies in Singapore can use this cross-functional analysis method to make wiser strategic decisions, maximize monetary gain, and guarantee sustainable success in the competitive non-tech environment. To take your SaaS revenue strategy to the next level, consider exploring tools from a financial modeling course tailored for recurring revenue businesses.

Conclusion

Most of the companies that operate on a subscription basis can attain their success upon sustainable MRR. It’s essential not only to measure and track MRR but also to interpret and address any fluctuations in recurring revenue. Partnering with an interactive elearning content developer Singapore can help educate internal teams on recurring revenue strategies through engaging, tailored training modules.