What is a Balance Sheet?

A balance sheet is a statement of the assets and liabilities of a company as of a particular date. It’s among the best tools for accountants and businesses for presenting the company’s financial position at the end of a specific specified date.

The balance sheet conveys what the companies have at the moment. The creditors, for instance, will easily understand what the company owns and what they owe other parties at a specific point in time. The Balance sheet is an essential tool when bankers decide whether to allocate loans to the company.

The balance sheet conveys the assets of a company and the claims there off against the assets. This information is helpful for creditors, investors, company management, suppliers, and competitors in making various decisions.

A balance sheets entail:

- Assets

- Liabilities

- capital

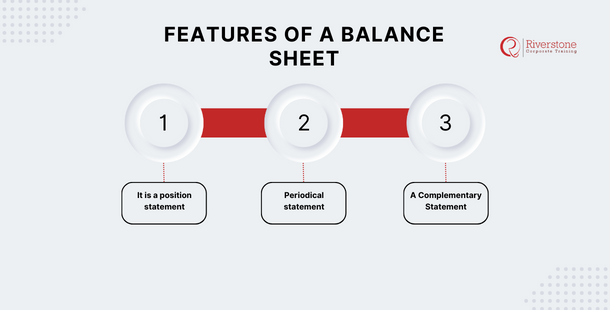

Features of a balance sheet

Features of a balance sheet

- It is a position statement:

What makes a balance sheet a position statement is that it contains the assets, liabilities, and the proprietors’ fund at a particular time.

- Periodical statement:

Balance sheets are prepared at the end of specific periods. It will declare a view of the financial position of a company at a point in time.

- A Complementary Statement:

It does not compete with the income statement. It is just a complimentary report to the income statement.

Application of a balance sheet

- A balance sheet helps the investors understand the dividend payout ratio, for it exhibits an accurate financial position.

- It exhibits an accurate financial position of a company by showing assets, liabilities, and capital. Its valuable information for owners and the stakeholders.

- It highlights the financial strength of the company hence helping the creditors in decision making.

- The information provided is valuable since it scrutinizes the financial ratios.

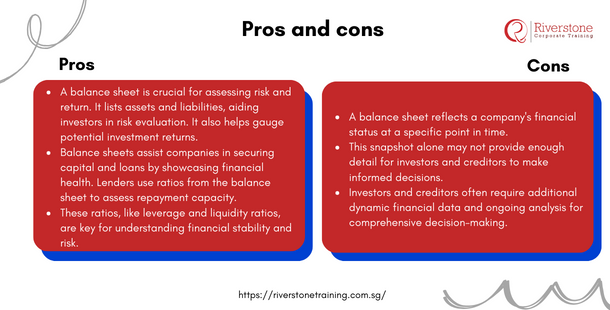

Pros and cons

Let us summarize the merits and the demerits of the balance sheet.

Pros

- A balance sheet is an essential tool in determining the risk and return. The listing of the assets and liabilities helps the investors evaluate the possible risk that the company might pose to them. They can also assess the potential returns on investment.

- The balance is a tool that can help the company in securing capital and loans. The loan suppliers use the balance sheet to determine the company’s ability to pay a loan but using the ratios!

- The ratios in the balance sheet are beneficial in determining the leverage rate, liquidity ratios, etc.

Cons

A balance sheet will give information about a company’s financial position at a specific period in time. This information may not be sufficient for investors and creditors in decision-making! A single balance sheet may not rightly help in decision-making.

Conclusion

To conclude, a balance sheet is an essential tool for all the users of accounting pieces of information. It presents an accurate picture of the company’s financial position at a specific period.

Features of a balance sheet

Features of a balance sheet