Operational Risk Management Training for Banks and Financial Institutions

Introduction to Certified Operational Risk Management for Banks and Financial Institutions

One of the most critical aspects of concern by the banks and other financial institutions is now operational risk. The accelerated process of digitization, changing customer needs, multifaceted products and tightening of regulatory policies around the world have wider the boundaries and ramifications of operational collapse. Nowadays, institutions are forced to deal with risks such as cyberattacks and fraud, system failures, data breaches, internal control failures, and third-party vulnerabilities.

Such risks are not only dangerous to financial stability but can also cause a loss of trust, reputation damage, and cause significant regulatory fines. Operational risk training within a structured framework in this setting is important in order to enhance institutional resilience and to make sure that the teams can understand, evaluate, and reduce risks successfully.

The essentials of operational risk training, competencies that should be acquired by the professionals, and practical examples that demonstrate the necessity of the competency training in the financial industry are outlined below.

1. Developing an Operational risk Competence Foundation.

1.1 Visibility of the Growing landscape of Operational Risk.

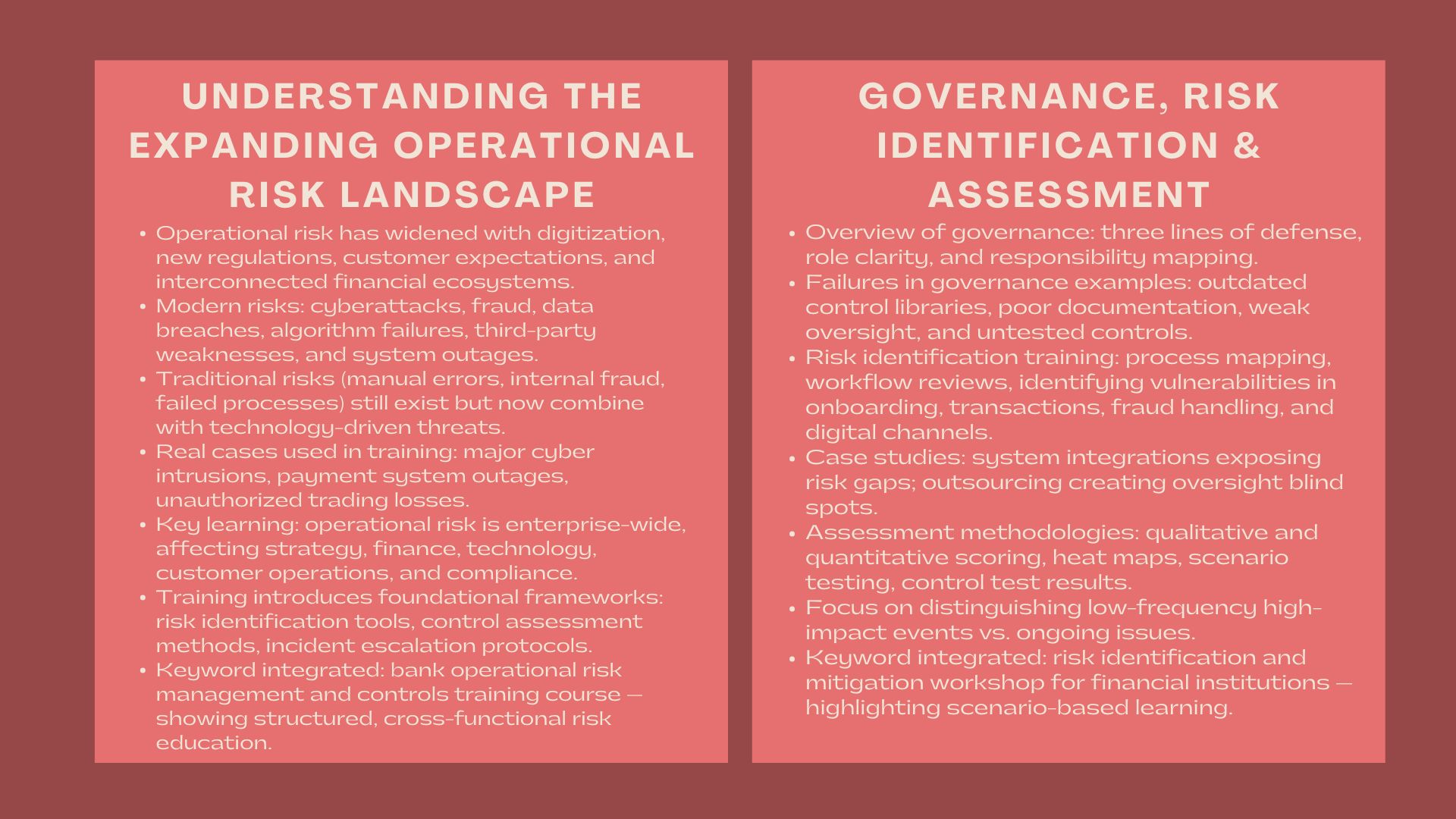

The environment of operational risk is broader and more dynamic than ever before in the case of banks. Classical risks experienced such as fraud, system failures and internal errors are now joined with new risks such as cyber intrusions, system downtime, regulatory breaches, algorithm errors and outsourcing problems. The training programs assist the participants to identify these risks and see how each of them can influence the financial stability, confidence of the customers and performance in terms of compliance.

The participants will find themselves being taken through historical events like major payment system outages, high profile cyber attack and losses caused by unauthorized trading to learn how the operation may go awry when controls are weak or when the governance structure is not clear. In these case studies, teams can discover that operational risk is not just a back-office problem, it is an enterprise-wide challenge that impacts the strategy, finance, technology, and customer operations.

In this introductory module, experts present structures that are foundations of operational risk management, such as risk assessment forms, control assessment techniques, and incident escalation process procedures. It is also the stage where a core concept like bank operational risk management and controls training course is contextualized to emphasize the structured, multidisciplinary nature of operational risk learning.

1.2 Strengthening Governance and Control Architecture

The success of operational risk management is determined by the existence of a vivid governance model that is backed by clear responsibilities. The three lines of defense framework are described in training modules, with the three collaborating on how frontline teams, risk oversight functions and the internal audit to ensure risk discipline. These applications show too that the failure of governance procedures like bad documentation, lax oversight, or unequal control testing can form systemic weaknesses.

The examples in the real world are situations when banks could not update libraries of controls, resulting in the failure to monitor the emergence of risks, or when a process change was made without sufficient consideration of the impact downstream. The trainees are taught the need to have strong oversight, written policies, and frequent reviews of controls to ensure operational resilience in the complex settings.

2. Determining and Measuring Operation Risk Effectively.

2.1. Conducting Risk Identification Exercises in a Comprehensive manner.

Risk identification is an art that needs to be judged, detailed and cross-functional. Trainings empower employees to learn to map processes, assess the critical systems and be able to recognize exposure points in customer onboarding, transaction processing, fraud management and interactions digital. Such sessions are usually accompanied by practical work where the trainees examine both the workflows end to end in order to identify any weak places in the operation.

The case studies may include situations whereby system integrations have brought to light some risks, or situations where outsourcing arrangements have created gaps in oversight. These are some examples that make the participants sharpen their questioning assumption, process design and predicting risk trigger before they become an incident.

2.2. The Implementation of Quantitative and Qualitative Approaches to Risk Assessment.

After the identification of the risks, the teams should examine their likelihood and the magnitude of their impact. Training modules provide the explanation of how to distinguish between low-frequency high-impact risks and ongoing operational issues that have to be addressed instantly. The participants are taught to prioritize risks in a systematized manner through the use of scoring models, heat maps, scenario assessments, and control-testing results.

Cyber vulnerability assessment Workshops usually involve real-life exercises of assessing financial exposure as the result of fraud incidents or looking at near-miss reports to see patterns. Such tests are useful in helping institutions to distribute resources effectively, strengthen key controls and introduce risk based monitoring measures.

Here, instructors introduce the second required keyword naturally, describing how trainees learn advanced evaluation techniques within a risk identification and mitigation workshop for financial institutions, emphasizing practical, scenario-driven training.

3. Strengthening Risk Mitigation and Control Execution

3.1 Designing Effective Internal Controls

One of the fundamental results of operational risk training is the provision of the training participants with the skills to engineer effective controls that can be used to prevent, detect, and act in the event of an operational failure. The training focuses on the concept of segregation of roles, automated controls, reconciliation operations, and exception management. These can be the usage of multifactor authentication to digital banking channels, establishing approval limits of high-risk transactions, or using automated monitoring systems to identify suspicious patterns.

The participants will discuss actual examples of cases where poor controls led to significant breaches, including the situation when old systems were used and could not identify the unauthorized access, or situations when manual procedures provided a chance to commit fraud internally. These lessons would guide the trainees on the importance of operation resilience based on strong controls.

3.2 Applying and Overseeing Mitigation Measures.

Control design is not the final step in operational risk management, and it should be observed. The participants are taught during the training programs on the ability to monitor the key risk indicators (KRIs), analyze the control performance, and upscale the emerging issues. The areas where monitoring practices are of particular importance include cybersecurity, payment operations, and the dependencies on third-party services, where the risks change often.

A workshop can be a simulation of control tests or incident reporting drills where it is shown how protocols on escalations and timely communication can help solve a problem quickly. Cases where the response to incidents was slow and aggravated the financial and reputational outcomes are also researched by participants to emphasize the essence of disciplined monitoring.

4. Using Operational Risk Competencies in Practice in an Organization.

4.1 Cyber, Data and Technology-based risk management.

With the implementation of cloud computing and customer-interfaces, as well as advanced analytics by financial institutions, the operational risks of technology also continue to rise. Some of the issues addressed during training programs include cybersecurity controls, data privacy compliance, resilience testing and disaster recovery planning. Participants are taught that there are small vulnerabilities that can result in massive disruptions such as poor password policies or systems that have not been patched.

Examples might be actual cases of payment gateway failures due to the overloading of the system, or hacking by third-party technology providers. Trainees examine the way these incidents occurred, uncovering the control lapses and ensuring the prevention measures are proposed based on the institutional risk appetite.

4.2 Strengthening Risk Culture and Frontline Awareness.

Risk culture is a strong condition that is critical in managing operational risks. The training programs focus on behaviors, communication channels and leadership expectations that build a culture of transparency and accountability. Frontline staff should not be afraid to communicate incidences, point out areas of control and confront unsafe behaviors without the fear of being blamed.

Examples are banks that had proactive reporting that prevented big fraud incidents, or banks that had frontline feedback to enhance monitoring systems. These examples show that operational risk management does not exist as a technical task only but rather it is an organizational culture based on teamwork and collective responsibility.

Conclusion

Management training on operational risks is not a compliance practice anymore, but it is a strategic investment to enhance the safety, reliability, and resilience of banks and financial institutions. Having acquired competencies in terms of risk identification, assessment, mitigation and control monitoring, professionals become confident enough to find the way through emerging risks and ensure stability in operations.

With the digital transformation in full force, and with tougher regulatory pressures, organizations investing in constant training will be more prepared to avoid disruption, secure customers, and maintain long-term trust. Operational risk management in future will involve more analytical capabilities, enhanced governance and seeking out new threats proactively and so good training programs are necessary in current contexts that change very fast as far as the financial world is concerned.