Understanding of Average Revenue Per Account Formula

Understanding of Average Revenue Per Account Formula

The average revenue per account is a valuable tool for businesses to measure. It can help the company understand which of its products or services are the most profitable in revenue. The average revenue per account, commonly abbreviated as ARPA.

What is the Average Revenue Per Account?

ARPA is calculated over a specific period—typically either a daily, weekly, month or quarterly or year. It is a calculation that allows businesses to work out which products are the biggest generators of revenue; this can be beneficial for letting the company know where to focus its time and resources.

There are two types of ARPA:

The average revenue per new account and the average revenue per existing account. These two figures can help a business determine what its customers want, which can help to improve the business’ profitability and stability.

The average revenue per account is calculated based on both new and existing customers. These allow businesses to focus attention on more specific types of customers and products.

Applications of the Average Revenue per Account

ARPA is calculated by a simple equation of monthly recurring revenue calculation formula divided by the total number of accounts to give a figure; this figure estimates the amount of money each account will generate for the business.

This equation can also be tweaked slightly so that it can measure a change over time. If you want to analyze how the business’ profitability has changed since this time, you could use the same equation with minor differences last year.

To work out the average revenue per new account, divide the MRR for the current year/period by the number of accounts. To work out the average revenue per existing account, you do the same but for the previous year’s statistics. An analyst can compare two figures to see if each account on the business’ system is bringing in more, or less, on average than it used to.

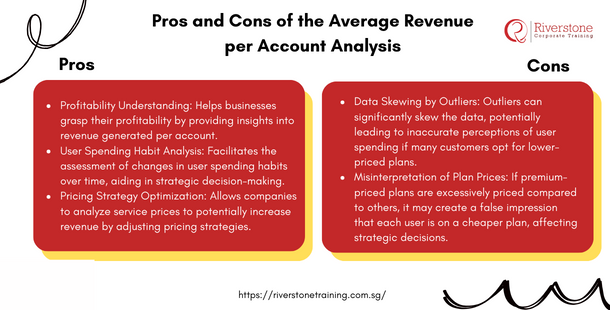

Pros and Cons of the Average Revenue per Account Analysis

The average revenue per account is helpful for a business to understand its profitability. It also allows the company to see how user spending habits have changed over time, on average. The figures produced can also enable the company to analyze the prices of its services to bring in more revenue if desired.

However, the average revenue per account is not perfect. The biggest concern is that outliers can mostly skew the data; if lots of customers do not purchase a subscription, it might seem like each user is on a cheap plan. This happens when the top-priced plans are at a very premium price.

Usage of of the Average Revenue per Account

Average Revenue Per Account is a valuable tool that can help a business understand the profitability of accounts. However, it should not be used alone without additional information, as outliers can easily skew the results.

Guide to Average Revenue Per Account

This article would be a guide of ARPA in detail. It would describe the various methods of calculating it and mention the formula at the bottom of the page, and the significance of breakdown of ARPA new and existing accounts. It would also provide practical solutions through which companies could maximize their ARPA in form of up selling, cross selling and even the optimization of prices levels. Additionally, it will cover understanding revenue vs income for Average Revenue Per Account, helping businesses grasp the differences and use these insights to improve profitability.

Why a High Average Can Be Misleading and How to Avoid It

The shortfalls of ARPA as discussed in the source would be dealt with in this piece. It would cover the potential impact of outliers i.e. a small number of high-value clients who can distort the average and then leave a false perception of safety. The article would provide some tips on how to incorporate ARPA with other metrics, such as customer lifetime value (CLV) and the churn rate to obtain a better understanding of the health of a business. For example, professionals who attend practical finance workshops for professionals often learn how to integrate ARPA with broader valuation and performance measures for more accurate business insights.

Using ARPA to Understand Customer Behavior

The subject matter involved would be about how ARPA can serve to be an effective instrument in comprehending what customers take as value. It would also explain how product, service and customer segment analysis on ARPA can become an indication about customer spending pattern and preferences. The article would give examples on how this information can be utilized by businesses in order to enhance their offerings, marketing as well as business approach in general. In addition, understanding ARPA alongside valuation skills—such as how to value a private limited company—can help businesses make informed strategic decisions when assessing customer profitability and long-term growth potential.

Understanding of Average Revenue Per Account Formula

Understanding of Average Revenue Per Account Formula