How to Manage Foreign Exchange Gain/Loss?

What is Foreign Exchange Gain/Loss?

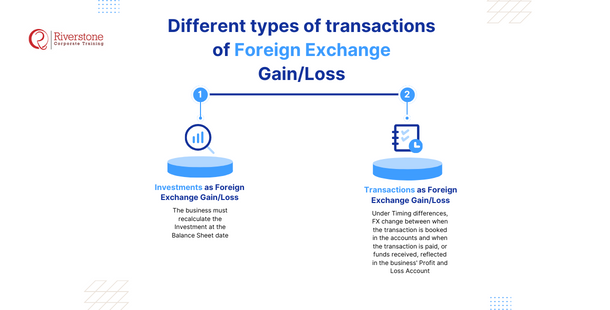

- There are two main types of transactions that bring about Foreign Exchange Gain/Loss in a company. These are investments (in subsidiaries particularly) and regular operations selling goods and services with overseas partners in the company’s supply chain.

- Investments have simple dynamics – they are revalued based on the FX rate at the Balance Sheet date. Regarding transactional activities, a company can take one of several approaches to translate to the company’s reporting currency.

- The most significant considerations are how to hedge transactions and how much of the exposure to hedge their Foreign Exchange Gain/Loss

Different types of transactions of Foreign Exchange Gain/Loss

Different types of transactions of Foreign Exchange Gain/Loss

Investments as Foreign Exchange Gain/Loss

The business must recalculate the Investment at the Balance Sheet date. The FX gain or loss between the previous Balance Sheet date or the date the Investment must be recognized in the financial accounts as a separate line item. A similar calculation must take place if the company had disposed of any investments since the previous Balance Sheet date.

This allows a reader of the accounts to separate the Investment amount from the FX gain/loss related to the Investment.

If the Investment is short-term, investing surplus funds in the business in Financial Assets, then the FX gain or loss will be reflected in the company’s Profit and Loss Account. If the Investment is long term, in a subsidiary, for example, the FX gain or loss will get recognized in the company’s reserves.

Transactions as Foreign Exchange Gain/Loss

Under Timing differences, FX change between when the transaction is booked in the accounts and when the transaction is paid, or funds received, reflected in the business’ Profit and Loss Account.

Investments in an overseas entity that produces a set of accounts in a Foreign Currency must be translated at the Financial Statements reporting date using spot FX rates or using an average monthly rate if the currency does not move significantly.

Hedging for Foreign Exchange Gain/Loss

It is worth considering Hedging transactions with longer duration or of significant value to the company. These might include contracts with stage payments over many months, Investment in the plant, and an ongoing supply contract.

Part of the consideration here is the volatility of the second currency that you are trading in. Another factor is how much FX volatility the business is willing to accept. It’s potentially galling for management to establish overseas contacts and relationships, negotiate contract terms, and work with new suppliers to find that an FX movement of 20% resulted in all of the business margin earned on the overseas business being wiped out.

Different types of transactions of Foreign Exchange Gain/Loss

Different types of transactions of Foreign Exchange Gain/Loss