What is a Carbon Credit?

Carbon Credit is a permit or certificate that allows the bearer to emit about 1 ton of Carbon Dioxide or CO2 or any other similar Greenhouse Gasses. This Credit is given to companies as an emission allowance to regulate the total carbon emission in the air in the industry. The primary goal of this is to reduce the amount of greenhouse gasses in the atmosphere like Carbon dioxide or CO2 which is the most common yet the most harmful of the greenhouse gasses.

Features of Carbon Credit:

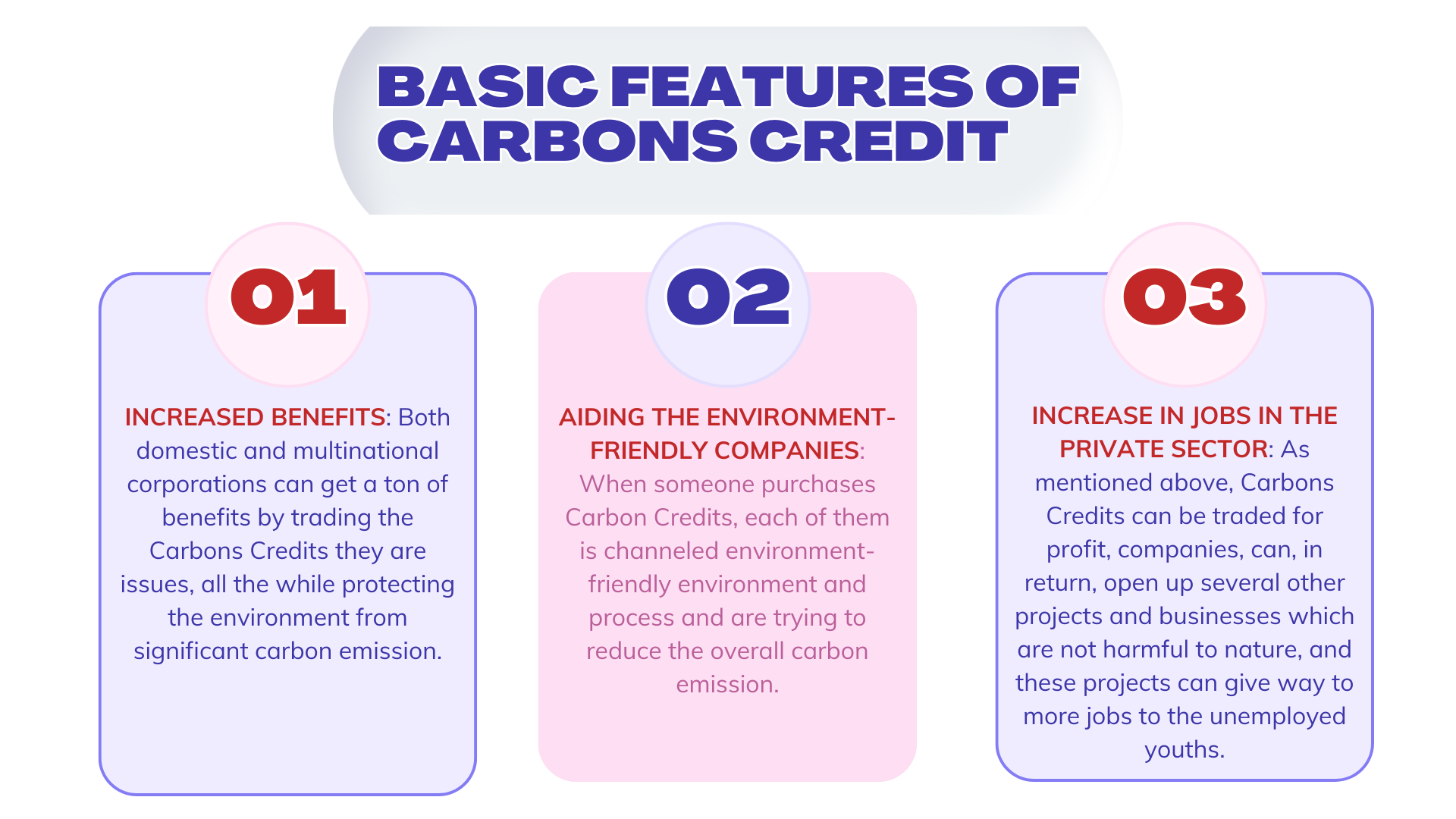

One of the essential functions of Carbon credit is that it can be traded. Companies that don’t pollute the environment or reduces the pollutant discharge in the environment sell the certificate to the company which exceeds the discharge of pollutants in the environment so that overall release controlled. When we think of Carbons Credit, we generally think about protecting the environment. Yet, there are significant financial gains involved in the trading of Carbon Credits if appropriately practiced. For professionals interested in understanding the mechanisms and profitability behind this system, a finance course on carbon credit trading Singapore provides valuable insights into compliance frameworks, pricing, and market trends. Similarly, those involved in sustainability-driven investments can benefit from a business valuation course for carbon credit projects, which focuses on evaluating the financial worth of carbon assets and offset projects. Here are some of the basic features of Carbons Credit:

- INCREASED BENEFITS: Both domestic and multinational corporations can get a ton of benefits by trading the Carbons Credits they are issues, all the while protecting the environment from significant carbon emission.

- AIDING THE ENVIRONMENT-FRIENDLY COMPANIES: When someone purchases Carbon Credits, each of them is channeled environment-friendly environment and process and are trying to reduce the overall carbon emission.

- INCREASE IN JOBS IN THE PRIVATE SECTOR: As mentioned above, Carbons Credits can be traded for profit, companies, can, in return, open up several other projects and businesses which are not harmful to nature, and these projects can give way to more jobs to the unemployed youths.

How Carbon Credit Works?

Carbon Credit is generally a permit or a certificate that can be presented to both companies and nations by a regulatory or governmental body. Every Carbon Credit is valued against the emission of 1 ton of hydrocarbon fuels, for a specified period. The United Nations’ Intergovernmental Panel on Climate Change developed the Carbons Credit as a market-oriented protocol to reduce the total amount of carbon emitted into the atmosphere. The companies or nations that allotted a certain number of Carbons credits can even trade them to gain upon vast amounts of profit as well.

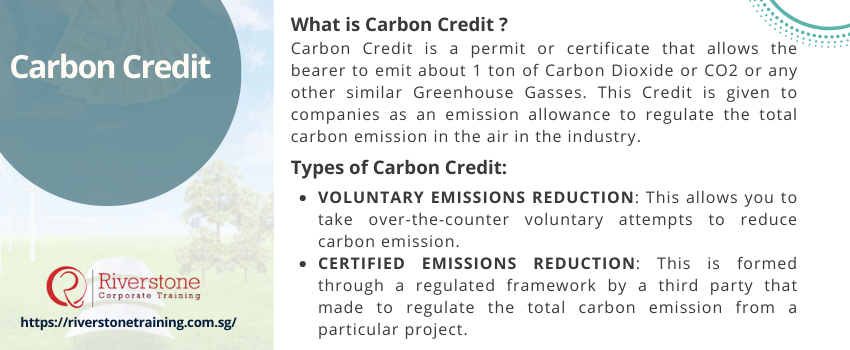

Types of Carbon Credit:

VOLUNTARY EMISSIONS REDUCTION: This allows you to take over-the-counter voluntary attempts to reduce carbon emission.

CERTIFIED EMISSIONS REDUCTION: This is formed through a regulated framework by a third party that made to regulate the total carbon emission from a particular project.

Compliance vs. Voluntary Carbon Trading Explained

To know about climate action, it is important to navigate through the world of carbon markets. These two markets are categorized as compliance market and voluntary market. Compliance carbon markets are government-regulated carbon schemes, which play a role in achieving government set emissions reduction levels, as with the Paris Agreement Article 6 carbon market. The voluntary carbon market, on the contrary, gives companies and individuals a chance to buy carbon offset credits voluntarily to compensate their carbon footprint. Professionals looking to understand these systems in depth can benefit from the best compliance course for carbon credit, which explores regulatory frameworks and global carbon strategies. Through both markets, climate finance flows to decarbonization initiatives around the world and contributes to achieving net-zero emissions. Understanding the importance of business market analysis in finance is also crucial, as it helps assess the financial viability and strategic impact of participating in carbon markets.

CONCLUSION:

Carbon Credit is a grand scheme to reduce the overall carbon emission to protect the atmosphere and the Ozone layer. With this effective yet environment-friendly approach, one can end up protecting the environment before time runs out.