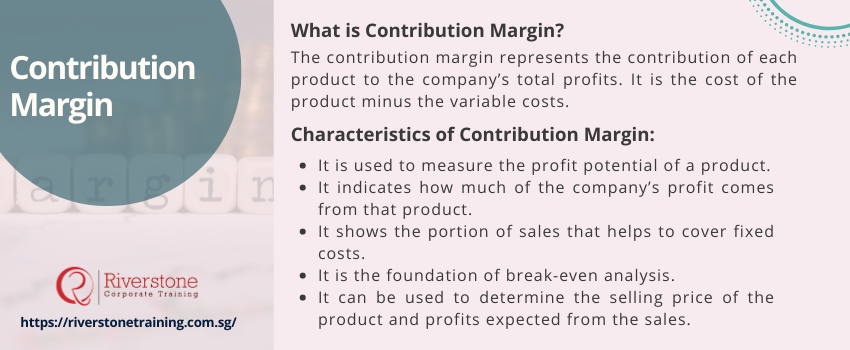

Definition of Contribution Margin:

The contribution margin represents the contribution of each product to the company’s total profits. It is the cost of the product minus the variable costs. It shows you the total amount of revenue available after subtracting variable costs to cover fixed expenses and provide profit to the company.

Understanding the importance of cost behavior in financial planning helps businesses analyze how their fixed and variable costs interact with contribution margin. Additionally, knowing how to interpret revenue and income on financial statements can enhance decision-making based on contribution margin insights. These concepts are often covered in the best financial modeling course in Singapore, equipping professionals with practical tools to evaluate profitability and cost structures effectively.

Characteristics of Contribution Margin:

The features of this are listed below-

- It is used to measure the profit potential of a product.

- It indicates how much of the company’s profit comes from that product.

- It shows the portion of sales that helps to cover fixed costs.

- It is the foundation of break-even analysis.

- It can be used to determine the selling price of the product and profits expected from the sales.

Applications of Contribution Margin:

The contribution margin represents a company’s product profitability. The company needs to do this analysis as it helps them forecast their product’s future sales and profit percentage. The contribution margin is decisive because it represents how much money is available with the company to pay the fixed costs, such as rent and other utilities, that paid even when production or output is zero.

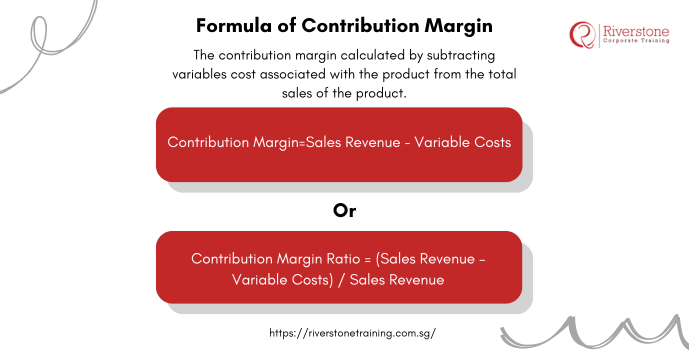

Formula of Contribution Margin:

The contribution margin calculated by subtracting variables cost associated with the product from the total sales of the product.

Contribution Margin=Sales Revenue − Variable Costs

Or

Contribution Margin Ratio = (Sales Revenue – Variable Costs) / Sales Revenue

Pros:

- It helps company management to select a product from the various possible product that uses similar manufacturing resources.

- One of the most significant advantages is that it is straightforward to use.

- Another advantage is that contribution margin analysis is done by using the information that the company’s management already has, and hence there is no need to calculate these prices exclusively.

- Low margins indicate that economically nonviable products should be discontinued.

- Investors also keep a close eye on the contribution margin to assess a company’s high performing product value. Company shifting its focus from its star product or any new competitor product emergence may indicate a reduction in the company’s profits and, eventually, a reduction in its share price.

Cons:

- We assume that the selling price of the product is constant, which is not in many cases, such as when some discount is given to a particular buyer.

- We assume that cost is linear and can easily divide into fixed and variable expenses; however, some of the costs are quasi-variable, which do not fall entirely in any of these two categories.

- We assume that manufacturers produce and sell the same number of units.

- Multiple-product businesses are assumed to maintain the combination among their services and goods constant even as the purchase pricing changes.

Using Contribution Margin to Drive Profitability in Singapore:

Prepare a detailed article with emphasis on how the businesses in Singapore can make use of the contribution margin analysis to make the best of the product or service mix. This material is expected to include practical examples, which apply to the industries locally (e.g., F&B, retail, professional services, Singapore manufacturing). Comment on the identification of high-contribution products/services, the marketing of such products/services and when low-contribution products/services should be scrapped.

Have a paragraph there on how the knowledge of the contribution margin, often taught in the best finance certification courses in Singapore for professionals and refined through an advanced financial modeling course in Singapore, can assist Singapore companies make wiser choices with regard to sales promotions, discounts and inventory keeping in order that its general profitability is maximised.

Advanced Contribution Margin Applications for Strategic Growth in Singapore:

Provide the content that is beyond a simple calculation of break-even point to discuss the higher levels of strategic use of contribution margin to businesses targeting a growth in Singapore. This may involve application of contribution margin in making make-or-buy decisions, determining profitability of new markets or growth opportunities (e.g. to Southeast Asia out of Singapore), determining the financial effects of investment in new technology, or contracts with suppliers. Give some case studies (anonymous may be detailed or hypothetical) on how the companies in Singapore have had the use of the sophisticated contribution margin analysis to attain the competitive advantages and sustainable growth.

You may also emphasize the role of business segment information in strategic growth Singapore when evaluating performance across units, and how professionals who completed an investment course Singapore for working professionals are better equipped to interpret and apply such financial insights.

Conclusion:

We could conclude that the contribution margin is essential for each company to know its product profits. This also helps the company’s management to make an informed decision regarding which products bring the most profit to the company. The contribution margin says a lot about a company’s revenues, expenses and gains or losses hence it is significant.