Finance Certificate Programs

Introduction

Financial certifications require a big investment, both in time and money as these certifications do not only provide value for individuals in the accounting and Finance Certificate industry but also help their companies, too. That is why lots of employers help with the expenses of obtaining professional certifications, including the best financial modeling certification course Singapore.

Certificate Programs are specifically meant for professionals who want to gain a speciality skill set and are seeking to advance greatly in their careers. In addition, finance certificate programs take less time to complete than a degree program which sometimes takes a year or less. The Finance Certificate is designed to prepare students for employment in the financial services industry or those who are responsible for how making financial decisions. This makes it a great finance course for working professionals Singapore.

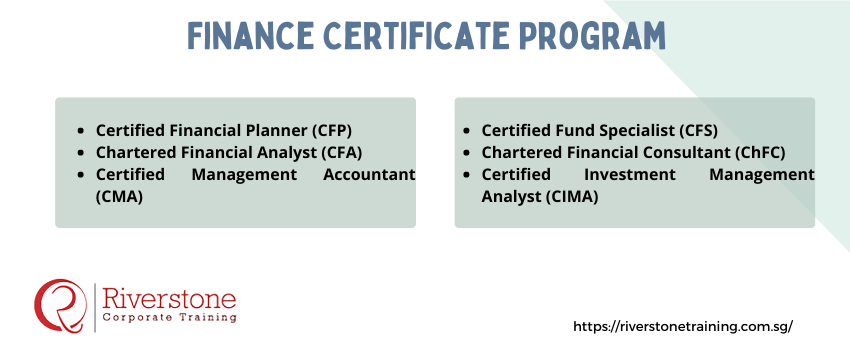

Here is a list of finance certificate programs you can choose from if you are looking to advance in your finance career.

- Certified Financial Planner (CFP): Those with this designation have demonstrated competency in all areas of financial planning. Candidates in this program will complete studies on over 100 topics, including stocks, bonds, taxes, insurance, retirement planning and estate planning. The program is administered by the Certified Financial Planner Board of Standards Inc. and In addition to passing the CFP certification exam, candidates must also complete qualifying work experience and agree to adhere to the CFP Board’s code of ethics and professional responsibility financial planning standards. A financial planner works with individuals to help them understand their options and make financial decisions suited to their personal financial situation and goals. Since, because of the nature of their work, a lot of trusts is placed in these individuals, the CFP Board posts information on the financial planning process and current licensees, allowing clients of CFPs to verify if their financial planners’ designations are in good standing.

- Chartered Financial Analyst (CFA): This designation is offered by the CFA Institute (formerly the Association for Investment Management and Research [AIMR]). To obtain the CFA charter, candidates must successfully complete three difficult exams and gain at least three years of qualifying work experience, among other requirements. In passing these exams, candidates demonstrate their competence, integrity and extensive knowledge in accounting, ethical and professional standards, economics, portfolio management and security analysis. CFA charter holders tend to be analysts who work in the field of institutional money management and stock analysis, not financial planning.

- Certified Management Accountant (CMA): This is a globally recognized Certified Management Accountant program that is offered by IMA (Institute of Management Accountants). It allows you to demonstrate the expertise of advanced accounting and financial management knowledge in critical areas such as financial planning, analysis, control, and decision support. The CMA exam consists of 12 content domains organized into two exam parts, including multiple-choice and essay questions. This certification is ideal for professionals seeking a managerial accounting training course or a financial management course for professionals aiming to deepen their strategic and analytical skills.

- Certified Fund Specialist (CFS): The Institute of Business and Finance (IBF) is formerly known as the Institute of Certified Fund Specialists. Any individual with this certification must have demonstrated his or her expertise in the mutual fund industry and mutual funds. These individuals often advise clients on which funds to invest in and, depending on whether or not they have their license, they will buy and sell funds for clients. This Finance Certificate provides training for the CFS, and the course focuses on a variety of mutual fund topics, including portfolio theory, dollar-cost averaging and annuities. The knowledge these CFS designees hold is kept current through their continuing education requirements.

- Chartered Financial Consultant (ChFC): this type of certification is meant for Individuals who have demonstrated their vast and thorough knowledge of financial planning. The ChFC program is administered by the American College. In addition to successful completion of an exam on areas of financial planning, including income tax, insurance, investment and estate planning, candidates are required to have a minimum of three years of experience in a financial industry position. Like those with the CFP designation, professionals who hold the ChFC charter help individuals analyze their financial situations and goals.

- Certified Investment Management Analyst (CIMA): This type of designation helps to focus on asset allocation, ethics, due diligence, risk measurement, investment policy and performance measurement. Only individuals who are investment consultants with at least three years of professional experience are eligible to try to obtain this certification, which signifies a high level of consulting expertise. The Investment Management Consultants Association offers the CIMA courses to Individuals who hold CIMA designations and are required to prove their expertise through continual recertification, which requires CIMA designees to complete at least 40 hours of continuing education every two years. CIMA designation holders tend to have careers with financial consulting firms, which involve extensive interaction with clients and the management of large amounts of money.