Finance Professional Certifications

Introduction

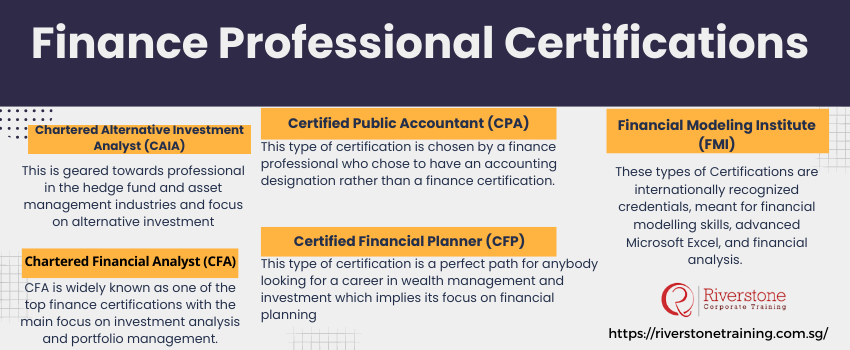

Although certification is not everything you need but your potential client and educated investors to give extra credits to those who have been and recognize the fact that candidates study for long hours to meet the highest professional and ethical standards. In this guide, we will walk you through the top finance designation and certificates for professionals who want to advance in their careers as certified financial analysts.

Here is the top list of finance professional certifications that you need to advance in your career as a financial analyst:

- Chartered Alternative Investment Analyst (CAIA) designation

- Certified Public Accountant (CPA) certification

- Certified Financial Planner (CFP) designation

- Financial Modeling Institute (FMI)

- Chartered Financial Analyst (CFA) certification

Chartered Alternative Investment Analyst (CAIA) designation:

This is geared towards professional in the hedge fund and asset management industries and focus on alternative investment. The advantage of this certification is that it is a great furniture area of finance that includes hedge funds real estate private equity and takes an average of 12 to 18 months to complete. The negative side of this certificate is that it is not versatile or a brother designation as it is so focused.

CAIA is one of the highest finance certificates and costs about $3000 in total with a two-level program. The pass rate for this certificate is about 70%

Certified Public Accountant (CPA) certification:

This type of certification is chosen by a finance professional who chose to have an accounting designation rather than a finance certification. The major advantage of this certification is that it is a must-have for those who want a career in accounting and excellent for anyone who wants to ultimately have the CFO’s job. The downside of this certification if that is a minor focus as it specializes in corporate finance which makes it most suitable for accounting jobs and also it can require a long time journey to complete the accreditation.

CPA curriculum consists of business environment and concepts, financial accounting and reporting, regulation, and auditing and attestation. It is a well-paid aspect of the finance career paths and a gold standard in the accounting world. This certification cost about $3000 from start to finish and is typically covered by the student’s employer and a varied pass rate per exam which is mostly about 50%

Certified Financial Planner (CFP) designation:

This type of certification is a perfect path for anybody looking for a career in wealth management and investment which implies its focus on financial planning. The advantage of this certification is that it is a good value and great differentiator for private banking wealth Management careers and retail banking.

But the downside is that it has a fairly narrow focus and is not very portable to other finance careers which are outside of wealth management such as corporate development or investment banking. This certificate is a great one for those who want to manage high net worth clients and costs about $2000 which can be lower and higher depending on how much course material is purchased. It also has a pass rate of about 67%

Financial Modeling Institute (FMI)

These types of Certifications are internationally recognized credentials, meant for financial modelling skills, advanced Microsoft Excel, and financial analysis. The FMI offers three levels of certification which gradually increase in difficulty as candidates obtain each subsequent level.

This certification level matrix includes;

- Advanced Financial Modeler (AFM)

- Chartered Financial Modeler (CFM)

- Master Financial Modeler (MFM)

Chartered Financial Analyst (CFA) certification:

This is highly sought for by finance professional all over the world and consist of three levels we take advantage of four years to complete. CFA is widely known as one of the top finance certifications with the main focus on investment analysis and portfolio management. This certification cost about $4000 and $5000 depending on whether or not you will have to rewrite any exam or how late or early you register for an exam with a pass rate to obtain the full certification program below 20%.

The advantage of this certification is that it is highly regarded and internationally recognized as one of the most challenging financial certifications and a requirement for many jobs in equity research and asset management. The disadvantage of this certification is that he has a low pass and the amount of material covered is so vast. It can be a very expensive goal that you may never actually achieve and the curriculum is highly focused on Portfolio management which may not be relevant for many career paths in corporate finance.

Finally, you can advance your career as a finance analyst using any of the top listed professional finance certifications in this article.