Professional Business Valuation Courses in Singapore

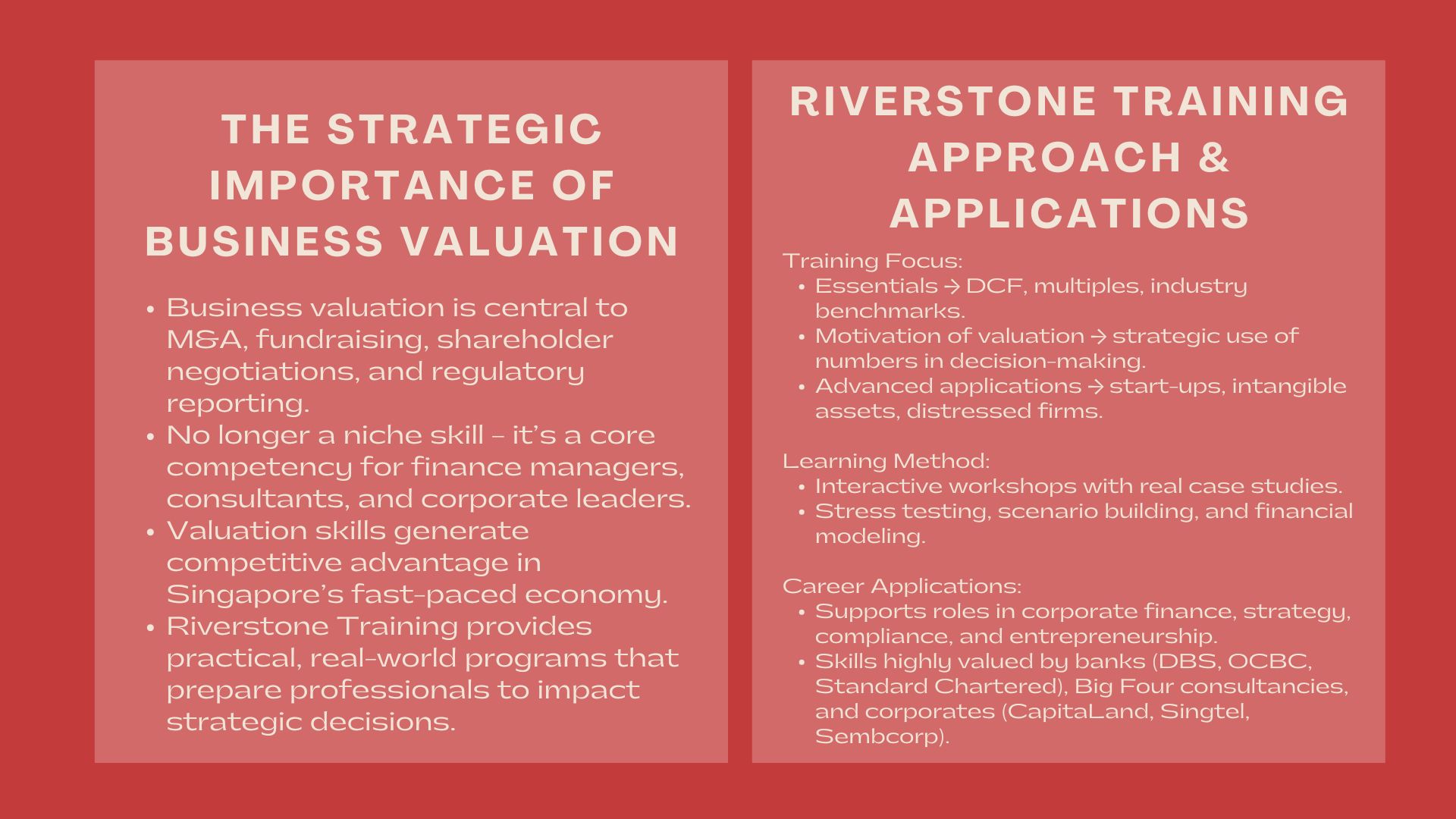

Business valuation is in the middle of strategic decision making in industries in the vibrant economy of Singapore. Regardless of the nature of the mergers and acquisitions, fundraising, shareholder negotiations, and regulatory reporting, companies need professionals who are able to appropriately figure out the enterprise value. Valuation is no longer a niche skill to the finance managers, consultants, and the corporate leaders but a core skill that generates competitive advantage.

Riverstone Training has established itself as a reliable institution in the education of finance, has developed organized programs in business valuation providing technical insights and practical skills. These courses help professionals to participate in vital corporate discussions and impact the strategic results by providing them with practical tools and real-life situations. Professional valuation training is a decision that can change the career speed of those who want to pursue financial and strategic careers.

Mastering the Essentials of Valuation

Training Built for Decision-Makers

Riverstone’s business valuation training for managers Singapore is designed with senior professionals in mind. It does not teach one to use academic models alone hence the program educates the participants on how to put valuation techniques into practice in business. Managers are taught to compute discounted cash flows, examine earnings multiples and use the benchmarks that are unique to industries to determine corporate value.

Notably, the course focuses on the motivation of valuation of why. Participants would understand how numbers can be used to make strategic decisions of either selling a subsidiary, acquiring a competitor or raising capital. This renders the training particularly applicable to managers that periodically report recommendations to the boards and senior executives.

Practical Workshops and Advanced Applications

For professionals seeking deeper expertise, Riverstone offers corporate valuation workshops Singapore that focus on applied case studies. The participants create financial models and assumptions of stress tests and argue about valuation scenarios, based on real market transactions. Such interactive sessions reflect on the challenges that professionals encounter in their daily lives and thus the learning is practical and immediately applicable.

In addition, advanced business appraisal courses Singapore cover specialized areas such as valuing start-ups, intangible assets, and companies in distressed situations. As Singapore becomes a technology and innovation center, these high-tech skills can assist business people to review businesses with unusual revenue streams or less history.

The Most Effective Valuation Skills.

Dept and Career Roles in Demand.

Training on valuation is useful to various individuals in different corporate functions. Valuation models are applied in corporate finance by analysts and managers in order to facilitate mergers, acquisitions, and divestitures. In evaluating partnerships or expansion projects, strategy departments will use valuation. Valuations are also included in the financial reporting and other regulatory submissions by audit and compliance teams.

Such directly beneficial job roles are Corporate Finance Manager, Investment Analyst, Transaction Services Associate, Business Development Executive, and Chief Financial Officer. Even the entrepreneurs and the founders of start-ups in Singapore are taking valuation training more and more in order to be able to bargain with venture capital firms or even structure the equity offerings with confidence.

Companies in Search of Valuation Expertise.

The concept of increasing number of valuation professionals is evidenced by Singapore employment scenario. The M&A and corporate finance teams of investment banks have analysts recruited by DBS, OCBC, and Standard Chartered. Deloitte, EY, KPMG, and PwC are all consulting firms that keep on advertising open roles of advisor of transaction with a high valuation.

Other companies such as corporations in the real estate (CapitaLand, Mapletree, Keppel Land), telecommunication (Singtel, StarHub) and energy (Sembcorp, SP Group) also have valuation specialists who are tasked with the aim of assessing investment opportunities and managing the performance of portfolios. As Singapore is one of the business centers of the world, valuation professionals are commonly on the list of interest by both local and global employers.

Career Benefits and Real-World Outcomes

The beneficial effects of the participants.

Alumni of Riverstone valuation programs often report their programs provided them with an immediate career edge. Most of them point towards better skill in developing and understanding valuation models, and the others point towards the newly acquired skills in justifying their assumptions during meetings with top management.

Some of the participants have also been given promotions shortly after their completion of the program, and they are not working as analysts but as managers. Some have moved into high-paying careers like venture capital or investment banking, with some citing the training provided by Riverstone as the stepping stone that made them overcome technical deficiencies and attain credibility.

Long-Term Career Growth

In the future, it can be expected that valuation expertise will continue to be needed in Singapore. This will lead to the city-state being one of the most attractive locations to have regional headquarters and international capital flows, and this will guarantee that professionals capable of appreciating businesses will remain very demanded. The usual career path starts with jobs at Valuation Analyst or Corporate Finance Executive, moving up to Chief Financial Officer, Finance Manager, Strategy Director and then on to positions of Valuation Analyst or Corporate Finance Executive.

The skills are also transferable all over the world. Valuation trained professionals in Singapore are also frequently transferred to work in Hong Kong, London or New York where their skills are used in cross-border transactions and multinational portfolios. This portability makes the training of valuation a long term investment in the local and global career opportunities.

Insights from Singapore’s Job Market

The analysis of active employment advertisements is a good indication of relevance of valuation skills. An example is the recent advertisement of Finance Managers who were in charge of valuing and reporting of portfolios at CapitaLand. PwC Singapore posted adverts of Transaction Services Associates who have to have advanced modelling and valuation skills. Temasek Holding has announced positions about Investment Associates who will be expected to review acquisition opportunities and perform due diligence.

Other firms such as the GIC and Keppel Capital actively recruit professionals possessing valuation experience in the position of investment analysis and fund management. These roles do not just focus on technical expertise but also communication skills to present valuation findings in a way that will make sense to the boards, investors and clients.

These types of postings emphasize the variety of the use of valuation – in banking, consultative, corporate, and investment firms. People who attend business valuation training manager Singapore or take courses of corporate valuation workshops Singapore are unique in the sense that they exhibit technical and strategic skills. To individuals who want to work in senior positions, the senior business appraisal courses Singapore offer the advantage to handle complicated valuation of intangible assets or fast-growing companies.

Valuation Skills that Should be of Top Priority to Singapore Professionals.

Valuation is a new language of corporate strategy in Singapore. Valuation insights influence the boardroom decisions whether companies are thinking about acquisition in Southeast Asia, raising funds with the help of IPOs, or restructuring a business line. Lack of this skill by finance professionals can make them incapable of engaging in such talks whereas their skilled counterparts are taken as strategic players.

Moreover, the transparency and fair value reporting are becoming the central focus of regulatory practices in Singapore. This puts professionals with valuation training in demand in compliance, auditing and financial reporting jobs. In both the young professional and the mid-career manager, formal training on valuation might ensure a career long life in the fast paced landscape of the field of finance.

Conclusion

Valuation skills are a must in the Singapore fast paced business environment. Business relies on the skills of people, who are able to calculate enterprise value correctly, present their report convincingly, and lead the process of strategic decision making. The programs offered by Riverstone Training are highly specialized and give the participants both mastery of technical side and practical usage that is very competitive in employment market.

To managers, analysts and potential executives, professional business valuation training is not only an investment in education, but also an investment in their career advancement, promotion and ultimate success in a dynamic Singapore financial environment.