Credit Risk Analysis Workshops for Banking Professionals

Introduction to Credit Risk Analysis Training for Bankers

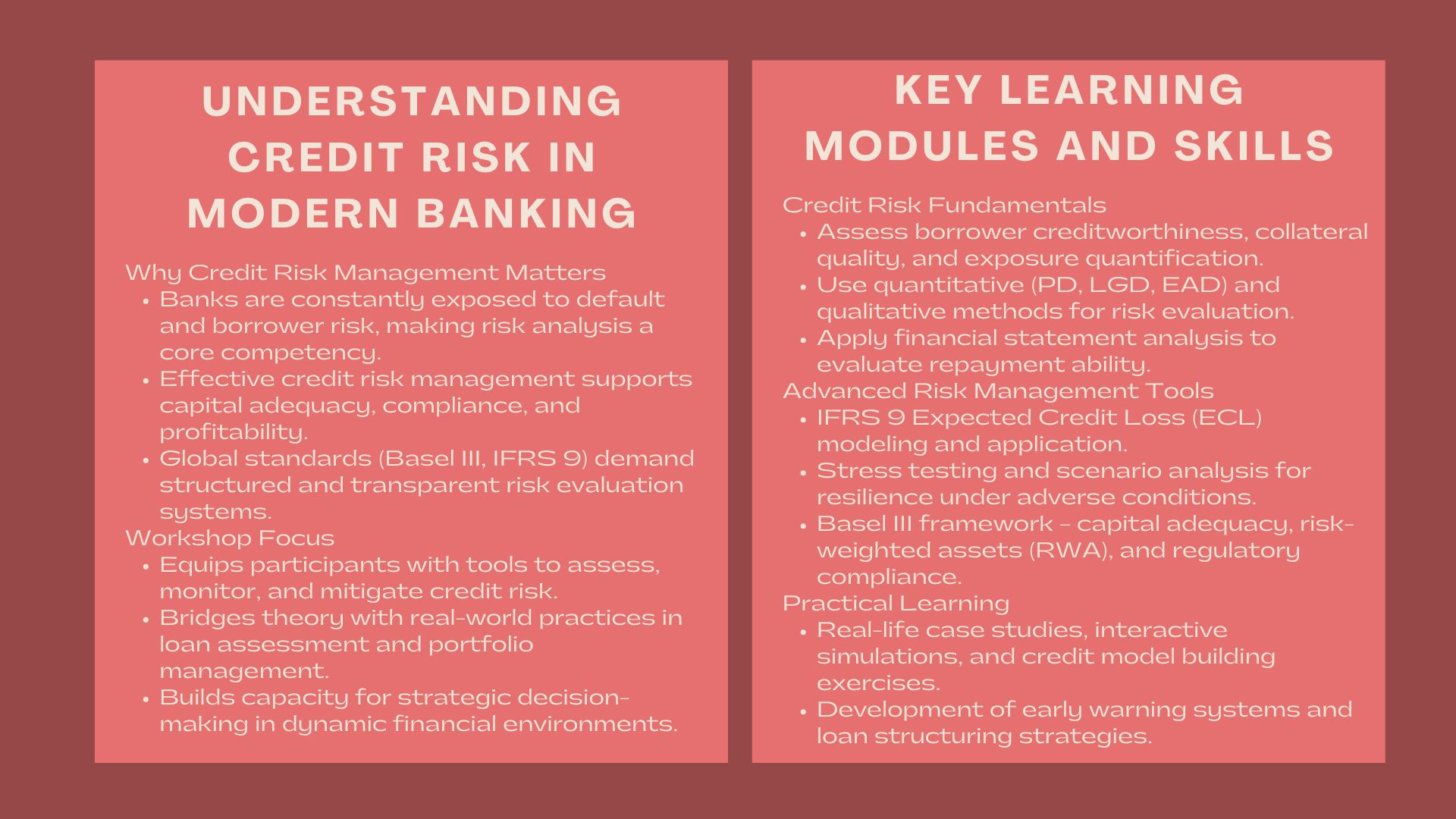

The ability and knowledge to handle credit risk has become one of the most important banking skills in the current environment that is becoming more complex with each passing day. Banks and finance institutions are at all times exposed to the default risk of the borrowers and adequate evaluation of the risk is essential in a stable financial system.

The Credit Risk Analysis Workshops of Riverstone Training on Banking Professionals are based on the idea that the participants will be armed with the analytical tools, structures, and strategies to assess, monitor, and manage credit risks. This course offers real-life and practical experiences to be able to conform to the global standards of banking and to the practice of the banking industry.

Learning the Basics of Credit Risk.

The Motive of Credit Risk in Banking Business.

In the case of bank, effective management of credit risk does not only deal with reduction of losses but also with the maximization of the portfolio. An effective credit risk framework can be used to make sure that capital sufficiency levels are adequate, facilitate compliance with regulatory standards and improve profitability by making better lending decisions.

Major Elements of Assessment of Credit Risk.

The participants will have a detailed idea of such fundamental aspects as borrower creditworthiness, collateral assessment, exposure quantification, and risk grading systems. The training also presents methods of determining the risk of individual borrowers and portfolio-level exposure.

Quantitative and Qualitative Analysis.

An integrated method of credit risk takes quantitative measures such as probability of default (PD) and loss given default (LGD) and qualitative judgment. The workshop assists the participants in understanding financial statements, risks in the industry, and applications of credit scoring models to make lending decisions.

Enhancing Analytical and Decision-Making Skills

The credit risk analysis training Phnom Penh program emphasizes real-world applications. The participants learn how to evaluate credit exposure in various fields and types of borrowers through interactive sessions, case studies and financial modelling exercises.

Credit Evaluation using Financial Statement Analysis.

Getting to know the financial health of a borrower is a basic requirement of any banking professional. The participants will be trained on how to read income statements, balance sheets, and cash flow statements to determine the ability to repay the debt and financial stability.

Macroeconomic Risk Analysis, Sectoral.

The credit risk is not only determined by the internal factors of a borrower but by the external market condition as well. The program examines the impact of the macroeconomic indicators, industry trends and geopolitical events on the credit performance.

Constructing and Operating Credit Models.

Participants will be exposed to credit rating systems and internal models applied in the banking industry including credit scoring models and expected credit loss (ECL) frameworks under IFRS 9. The practical exercises give an excellent idea of how raw data is to be translated into actionable risk insights.

Bringing Credit Risk Management into Banking Practice.

Risk mitigation and Loan Structuring.

Adequate loan structuring is needed to have a balance between the return and risk. The training addresses methods like collateralization, loan covenants and mechanisms of credit enhancement that aid in reducing the possible defaults.

Portfolio Diversification and Concentration Management.

The participants are taught how to control the risk of portfolio concentration by diversifying their lending in terms of sectors, geographies and type of borrowers. The training presents analytical tools to calculate the portfolio exposure and recreate stress-testing situations.

Early Warning Systems and Credit Monitoring.

One of the key components of credit risk management is to determine warning signs before defaults. Respondents will have the understanding of how to establish efficient monitoring systems and early warning signs that can be used in making proactive decisions.

Innovative Concepts in Credit Risk to the Banking Professionals.

With the change in financial markets, credit risk management methods and tools also change. This workshop presents the new level of analysis and regulation concepts that are applicable in the modern banking industry.

IFRS 9 and Expected Credit Loss Framework.

The course describes how credit risk in banks has been transformed under the IFRS 9. The participants get to know how to model the expected credit losses, classify the financial assets and make sure that they adhere to the international accounting requirements.

Stress Testing and Scenario Analysis.

The stress testing would assist banks to check the impact of the unfavorable economic environment on their loans. The program offers practical activities on how to create stress tests models, interpret findings and have them incorporated in the decision-making process.

Basel III and Risk-Weighted Assets (RWA).

One of the key aspects of the program is devoted to the Basel III framework – capital adequacy, risk-weighted assets and credit risk capital requirements. This will provide the parties with the expertise to match the risk strategy of their institution to international standards.

Why Choose Riverstone Training in Phnom Penh

Riverstone Training is recognized for delivering professional finance training programs tailored to the needs of banking and financial professionals in Asia. Its banking credit risk workshops Phnom Penh are designed by industry experts with decades of practical experience in risk management, lending, and financial analysis.

Industry-Relevant Curriculum

The program incorporates both theoretical concepts with practical applications so that those participating in the program are able to apply their learning practically in their day-to-day work. The curriculum reflects the reality of banking issues, which include real-life learning on borrower behavior, as well as handling institutional exposure.

Global Experienced Expert Trainers.

All sessions are facilitated by the top professionals that have worked with major banks, credit rating agencies and regulatory bodies. Their experience makes the participants know not only how to control the credit risk but also why some strategies may be effective in various financial situations.

Engaging in Learning and Learning by Doing.

The workshop format is biased towards practical experience. The participants will undergo exercises that will include case studies, model-building, and problem-solving exercises – making sure that the concepts are being internalized completely and can be used right away.

Career Development and Work Perks.

Learning how to manage credit risks would enable one to pursue several career opportunities within the banking, corporate finance, and investment management sectors.

Roles and Opportunities

Credit analysts, risk officers, loan portfolio managers, and compliance specialists are some of the careers that graduates of the program tend to have. These jobs will demand thorough knowledge of credit risk concepts – the basis delivered by Riverstone Training workshops.

Improved Performance in the Institution.

In addition to personal development, better credit risk management is enjoyed by organizations. Risk-trained employees help to enhance both the quality of the portfolio and their efficiency in capital and lessen the rates of default.

Recertification and Recognition.

At the end of the workshop, the participants will be given a professional certificate by Riverstone training, which certifies them as being knowledgeable in credit risk assessment and management. The qualification boosts their reputation and employment chances in the financial industry.

Conclusion

The issue of credit risk is still the focal point of any banking professional. It is important to have effective analysis, organized monitoring and good risk management practices that will ensure that the portfolio of loans is healthy and the institution resilient.

The combination of technical, analytical and strategic competencies enabled through the Riverstone Training Credit Risk Analysis Workshops on Banking Professionals enable the professional to be a better fit in modern banking. This program will enable professionals in Phnom Penh to think globally and act locally by combining the best practices across the world with a local understanding to become confident in working in a highly risk-conscious financial landscape.