M&A Valuation Workshops for Investment Banking and PE Professionals

Introduction to Expert Certification in MA Valuation

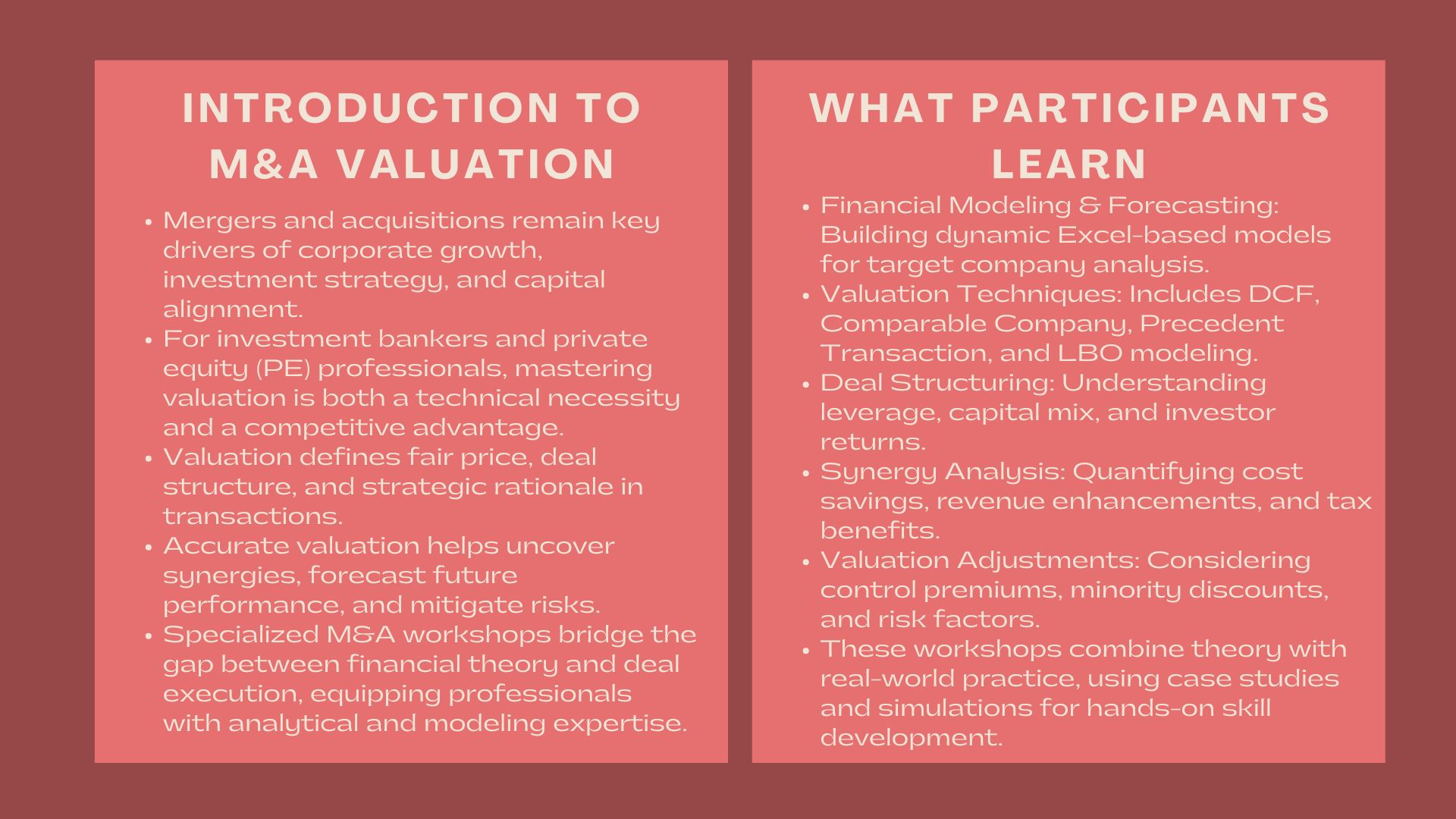

Mergers and acquisitions (M&A) are still at the centre of corporate expansion, capital realignment, and investment strategy. In the case of investment banking and the private equity (PE) professionals, the valuation technique is not only the technical demand but the competitive edge. The international M&A arena is ever changing with more complex deals, regulatory focus and adoption of new valuation models. Thus, attending specialized M&A valuation workshops provides professionals with analytical capabilities, financial acumen and experience required to succeed in this rapidly changing environment.

Knowing the Significance of M&A Valuation.

Role of Valuation in Deal-Making.

The essence of any M&A transaction is valuation. It defines the value of a company, what price may be fair and how to organize the deal. Valuation is also applied by investment bankers in advising clients on bids, financing and negotiations and PE professionals in assessing acquisition targets, likely returns and exit strategies.

Proper valuation gives the decision-makers the opportunity to discover synergies, to predict future performance and to avert the occurrence of risks. Wrong or too rosy valuations may result in overpayment, shareholder discontent or even collapse of the deal. Therefore, one has to learn deeply about the methodology of valuation, which is an important aspect in terms of M&A activities.

The Need for Specialized Training

While financial modeling is a core competency in finance, M&A valuation requires a distinct set of advanced techniques. A m&a valuation modeling course for investment bankers and private equity professionals focuses on the nuances of different deal types, including leveraged buyouts, minority investments, and distressed acquisitions. These programs extend beyond the simple discounted cash flow (DCF) analysis, to include deal structuring, sensitivity analysis and value creation by means of synergies.

Such workshops combine theory with practice in a way that enables participants to construct, interpret and audit valuation models in real time. It is the capability of converting complicated financial information into practical information that the difference between a mediocre analyst and a deal professional performing at the highest level.

Fundamental M&A Valuation Workshop Elements.

Financial Modeling and Forecasting.

Financial modeling is the core of M&A valuation – the art of creating dynamic excel based models, which model the performance of target companies. Participants are taught how to make precise forecasts, evaluate revenue drivers, and modify the capital expenditures, working capital and financing structures.

The strong model is the basis of using valuation models like DCF, comparable company analysis and precedent transaction. More complex workshops also bring the concept of scenario modeling, which enables the analyst to experiment with the influence of the change in the main variables in the valuation results.

Deal Structuring and Valuation Methodologies.

M&A valuation training generally encompasses a variety of approaches to bake value in various perspectives. These include:

- Discounted Cash Flow (DCF) Analysis: This analysis is used to assess the intrinsic value using projected cash flows.

- Comparable Company Analysis (Comps): The comparison of peer valuation multiples based on peer analysis.

- Precedent Transaction Analysis: Evaluation of prior deal information in order to learn about the market trends and the acquisition premiums.

- Leveraged Buyout (LBO) Modeling: The measurement of the possible returns to the equity investors in different capital structures.

These approaches are often used together in workshops in an effort to create a triangulated valuation perspective amongst the participants. Knowing how the two complement each other enables the professionals to customize their analysis depending on the deal situation and the nature of the industry.

Synergy Identification and Valuation Adjustments.

One of the key sources of value creation in M&A is synergies, including operational and financial ones. Participants are trained in workshops to quantify a range of possible synergies, including cost and revenue improvements as well as tax breaks.

The participants are also taught to alter the valuations of control premiums, minority discounts and the country risks factors. This holistic strategy will have the valuation based on real world considerations and not spreadsheet assumptions.

Skills and Competencies Gained from Training

Strengthening Analytical and Technical Skills

An advanced mergers and acquisitions valuation training program develops technical proficiency in financial modeling, valuation analysis, and deal structuring. The participants learn Excel functions, model automation and quality control methods.

The training also improves analytical thinking besides technical skills. Participants get to understand how to analyse financial statements, determine value drivers and evaluate implications of various assumptions. This level of analytical rigour enables the professionals to be able to present and defend valuation findings in high stakes deal negotiations.

Improving Strategic Decision-Making.

M&A valuation cannot be simply a number crunching exercise – it is a matter of strategy in analysis. The most effective workshops help participants to connect valuation results with the corporate strategy. As an example, the enterprise can know how the market position of a target or intellectual property can affect the value in the long term.

Case studies and simulation have taught the professionals to assess strategic fit of targets of interest, design the best financing package, and predict integration difficulties that may arise after the merger. These are competencies priceless to constructive, value accretive decision-making in actual transactions.

The Pros of Attending M&A Valuation Workshops.

For Investment Bankers

Investment bankers in advisory and deal execution identities compete at an advantage by having mastered the valuation complexities. The training will help them to provide more plausible valuations, create superior pitch books, and create trust in their clients. Improved negotiation results and efficiency in transactions are also the benefits associated with the enhanced valuation capabilities.

In the case of Private Equity Professionals.

The advantages are that PE professionals develop their capacity to analyze the opportunities of investment and predict returns. Through workshops, they are assisted to perfect due diligence, uncover hidden sources of values, and pay less than what is perceived as an asset. They also get an insight into exit strategy planning i.e. when and how to optimize portfolio investments.

For Corporate Finance Teams

M&A valuation workshops are used by corporate finance and strategy departments to enhance internal decision-making. It could be the analysis of potential acquisitions, divestitures, or joint ventures, whatever the case, participants will have the confidence to justify the decisions made at the board level using sound financial analysis.

Applications in the Real World and Case Studies.

Most of the workshops incorporate real-life M&A case studies so that the participants can be able to apply the concept of valuations to practical transactions. Such practical activities may involve a review of high-profile mergers, reverse takeovers, or cross-border acquisitions.

Through dissection of real deals, the participants are exposed to different issues, including cultural integration and regulatory barriers among others that can influence the valuation results. They also acquire an understanding of red flags and how to make changes to assumptions, which makes their professional judgment more focused.

Choosing the Right Workshop

In choosing a valuation workshop in M&A, the following are some of the factors that must be taken into consideration:

- Expertise of Instructor: Instructors who have experience in a real world M&A will be able to provide real life experience that extends beyond theory.

- Curriculum Richness: Find those courses that address the principles of basic valuation and those that deal with advanced modeling.

- Interactive Learning: Group projects with simulations and workshops are likely to increase retention and skills application.

- Certification and Recognition: Accredited programs are likely to have certificates that enhance the professional credibility.

The appropriate choice of the program guarantees the participation of the relevant, practical, and industry-oriented knowledge that can be implemented in the roles of participants.

Conclusion

With the continuing boom in the global deals, M&A valuation competencies are emerging as a must have requirement among individuals in the financial sector wishing to grow their careers. At the same time, specialized training does not only hone technical skills but also develop strategic sensitivity and ability to work with convoluted transactions.

It is an investment that will continue to reward its holders with professional dividends in the long run whether in investment banking, in private equity, or in corporate strategy.