REITs and Real Estate Fund Training: Structuring Investments and Returns

Introduction: Certified REITs and Fund Training Singapore

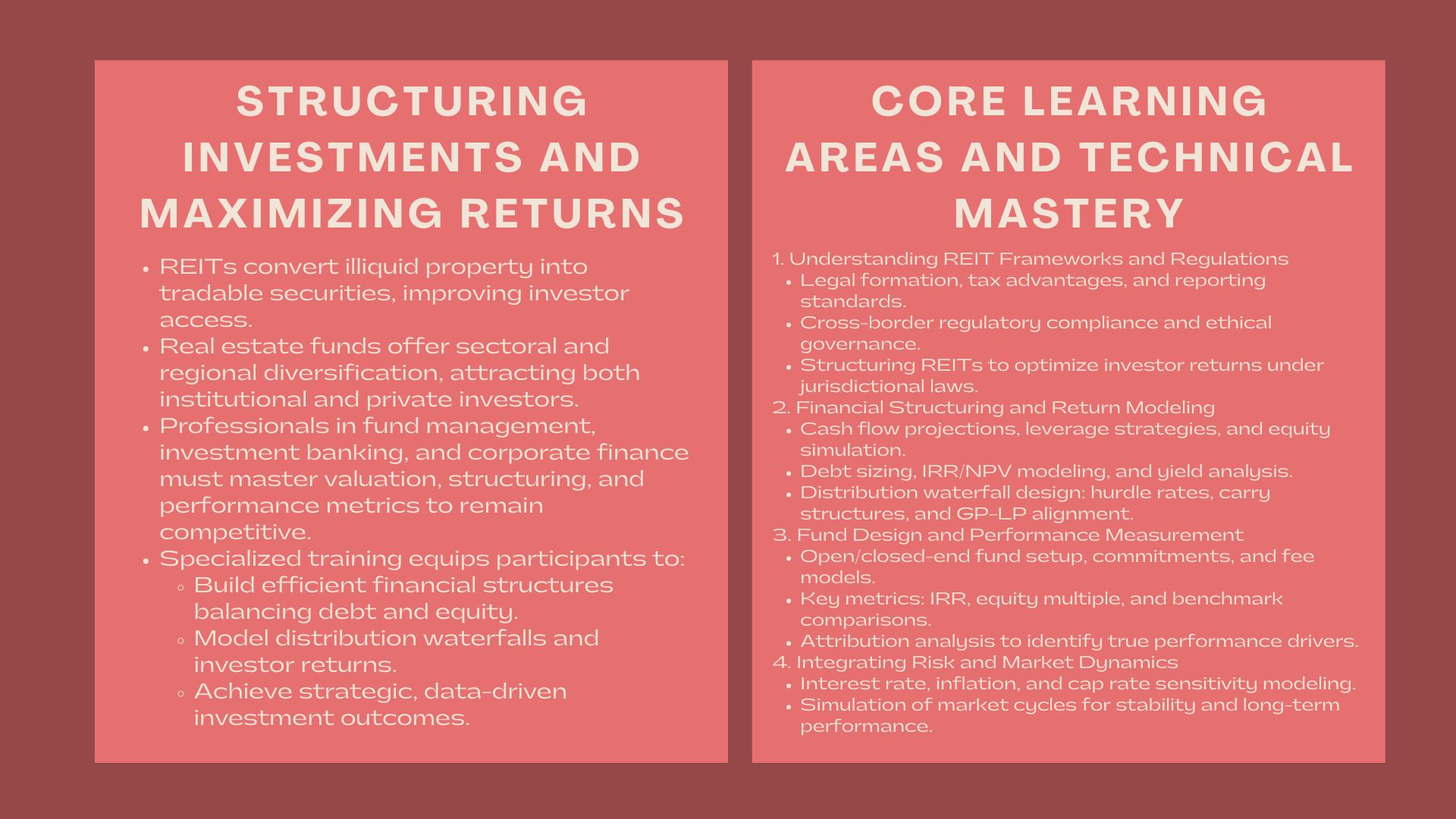

REITs and real estate funds are vital elements of current investment portfolio, which provides the investor with exposure to income-generating property and diversified exposure to real assets. Nevertheless, the design of these vehicles, the setting of investor expectations, and the proper modeling of returns need a thorough knowledge of the real estate finance, as well as fund management principles.

The asset management industry, investment bank or corporate finance industry workers in the modern property investment environment need to have mastered the complexities of REIT structuring, valuation, and measurement of fund performance in order to succeed in the competitive industry. Developed training programs like a reits investment structuring and return modelling course provide the tools to analyse, to be technical and strategic in creating effective investment vehicles and creating optimal outcomes to the investor.

The Changing ETF of REITs and Real Estate Funds.

Property ownership- Capital Markets Integration.

REITs have also brought changes to the real estate investment through the conversion of illiquid assets to tradable securities and thereby investors get access to property portfolio of large scale without owning them directly. Real estate funds, in their turn, offer institutional and private investors the flexibility to combine resources and take sector-specific or geographically orientated strategies.

With the increasing integration of the global real estate markets, an individual in either fund management or capital markets will have to ensure he knows how asset valuation, financing structure and the expectation of returns by investors interact.

The importance of Financial Structuring.

Financial structuring determines the manner in which the cash flows, leverage is employed and the manner in which the investors are paid. An efficient framework is what will make sure that returns are in accordance with risk tolerance and investment goals. The participants are taught through structured training on how to balance debt and equity elements, waterfall modelling as well as making predictions on distributions to different classes of investors all of which are critical in the establishment of superior and profitable real estate investment vehicles.

Primary Learning Results of Specialist REIT and Fund Training.

The knowledge of REIT Frameworks and Regulations.

The participants start with the basic description of REITs structures, their formation, tax advantages, and regulatory requirements. Training modules cover:

- Regulations and legal provisions of key markets.

- Income distribution and asset diversification requirements.

- Business ethics and reporting principles.

- Tax efficiency approaches and cross border concerns.

Awareness of this enables them to organize REITs in accordance with the jurisdictional laws in order to optimize the returns of investors.

Mastering Investment Structuring and Financial Modeling

A reits investment structuring and return modeling course emphasizes technical skills in financial modeling—specifically tailored to real estate assets. Participants learn to:

- Develop comprehensive cash flow plans of property portfolios.

- Carry out debt sizing and interest coverage.

- Make up distribution waterfalls and equity return simulations.

- Compare yield on cost, IRR and NPV.

Such exercises will make the participants test the financial viability of investments, arrange capital effectively, and describe the anticipated results to investors with reputability.

Real Estate Fund Structures Design.

Training also explores the design of private real estate funds beyond that of REITs. Participants explore:

- Open and closed end fund structures.

- Capital commitments, drawdowns and distribution phases.

- Performance based pay and fee structures.

- LP-GP compatibility and mechanisms of governance.

Through the understanding of these concepts, professionals are able to develop fund vehicles that harmonize liquidity, control and investor alignment which are essential to achieving the success of long term in the management of the real estate funds.

Performance Analysis of Real Estate Fund.

Assessment of Key Performance Metrics.

Performance analysis is more than returns tracking. Participants are taught to rate the success of funds using:

- Equity multiples and cash-on-cash returns.

- Time-weighted returns Internal rate of return (IRR)

- Competition with property indices and peer funds.

- Identification of performance drivers by attribution analysis.

This analytical tool enables fund managers and analysts to determine both relative and absolute performance of portfolios and transparency and accountability in reporting.

Risk and Market Dynamics

Risk represents the most uncertain aspect in a firm’s financial condition, while Market Dynamics denote the intricate dynamics within the macroeconomic environment.<|human|>The use of Risk and Market Dynamics Incorporating Risk and Market Dynamics, Risk is the most uncertain part of the financial status of a company, whereas Market Dynamics imply the complexities in the macroeconomic environment.

Successful real estate investment involves the need to balance between risk and reward. Training examines the relationship between macroeconomic variables such as interest rates, cap rate patterns, inflation and supply-demand dynamics and their effect on valuations and returns.

Through simulation of various situations, the participants gain a better perspective of how market cycles influence the stability of income, values of assets, and the overall performance of funds.

Real Estate Investment Strategy and Deployment of Capital.

Sector Diversification and Geographic Diversification.

One of the major areas of training is portfolio construction – how to spread investments across the various asset types available, which include office, retail, logistics, residential and hospitality properties. The participants also analyse the impact of regional and demographic trends on demand and risk-adjusted returns.

Using practical examples, the professionals acquire the knowledge of how to strategically allocate capital, eliminating the concentration risk and increasing the strength of the portfolio.

Asset Management: Value Creation.

Acquisition does not always determine the performance of funds; management of the assets at hand is equally significant. The training programs show how to increase property income by enhancing its operation, redeveloping, and repositioning strategies.

The participants also get an understanding of the sustainability efforts and ESG integration, which are central distinguishing factors of long-term value creation among contemporary real estate investors.

The Organization of Returns to the Disparate Investor Profiles.

Knowing Capital Stacks and Waterfalls.

One of the most important parts of real estate fund training is to structure distribution waterfall in such a way that returns are distributed in an equal manner to investors. The participants are taught to model complex structures with involvement of:

- Hurdle rates and preferred returns.

- Caught up and carried interest mechanisms.

- Encourages and share levels of profits.

These arrangements are done to ensure the alignment of incentives between the general partners (GPs) and limited partners (LPs) in order to balance between performance incentives and investor protection.

The Communication of Return Expectations.

Investor relations need to be based on clear, transparent communication. The areas of training focus on the presentation of performance projections, risk-adjusted metrics of returns, and exit scenarios in a manner that increases investor confidence and supports the process of capital raising.

Real Estate Investment and Technology, Data Analytics.

Using Data to make decisions.

The contemporary REITs and funds are based on the use of analytics to improve decision making. Training will expose the participants to tools in:

- Agreement aggregation and property benchmarking.

- Occupancy and rental growth predictive analytics.

- Dashboards on visualization and monitoring of portfolio risk.

The use of a data-driven approach will enable professionals to make superior investment and management decisions to enhance the performance of the portfolio in the long run.

Fund Management Digital Transformation.

Investor reporting, communication, and performance tracking digital tools are becoming the norm as investor desires change. The participants are taught how to incorporate technology in the fund operations, which would guarantee efficiency and transparency.

Who Are the Attendees of These Programs.

The training suits well those in the real estate investment, asset management, and finance field, such as:

- Fund managers and investment analysts.

- Money and treasury people in corporations.

- Property transaction advisors in the investment bank.

- REIT executives and institutional investors.

- Real estate and capital market consultants.

The participants also acquire theoretical information as well as practical modeling and structuring skills that they can use in their day to day duties.

Among the advantages of REIT and Fund Training are these.

Improving Technical and Strategic Competence.

The participants gain comprehensive idea of the process of investing in real estate- acquisition of assets and creation of funds to measurement of performance and reporting to the investors.

Enhancing Investor Communication.

Through learning the art of performance analysis and modeling returns, professionals are able to convey and explain fund plans and outcomes to the investors, regulators, and partners.

Expanding Career Opportunities

Completing a real estate fund management and performance analysis training program demonstrates expertise in one of the most dynamic sectors of finance. With the growing institutional interest in the real assets, people who are inclined to work in such fields as structuring funds and their evaluation will become more and more demanded.

Conclusion

With the global capital movements still being inclined towards real assets, real estate funds and REITs are still among the important means of investment diversification and predictable returns. Individuals with the high-level of modeling, structuring, and performance analysis will be in good position to exploit this increasing demand.

Training programs which addresses both financial and strategic aspects of real estate investment enables participants to develop the sustainable structure of the funds, achieve the highest performance, and provide the stable value to the investors. These skills are important to the success of real estate finance and fund management in the long-term, in a changing market environment.