Mastering Global Finance Through the Investment Banking Operations Course and the Investment Banking Master Course

Introduction to How To Master Investment Banking Operations

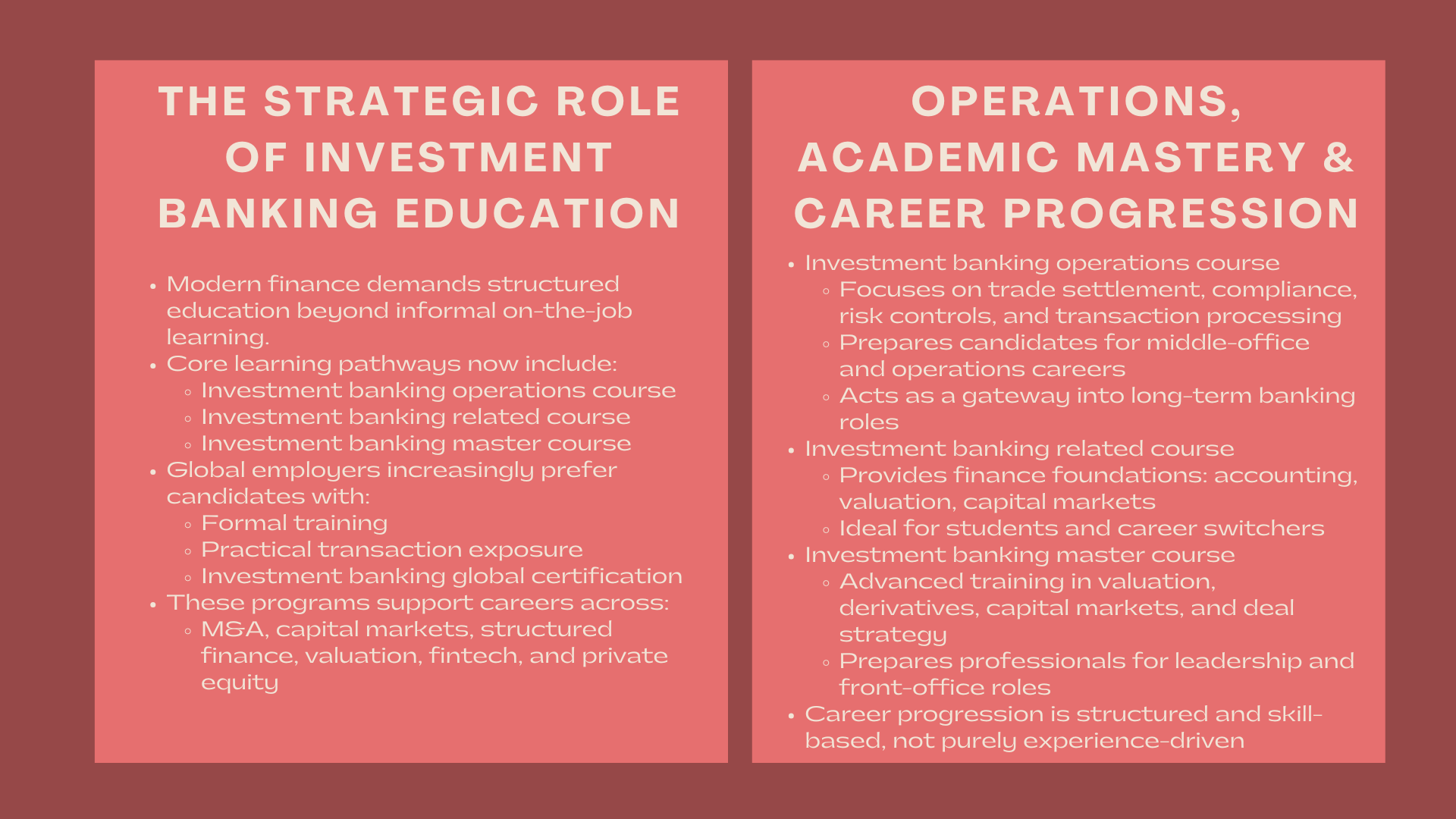

Nowadays, in the world of extremely competitive global finance, formal professional training has become an essential prerequisite to high-impact jobs. Be it upcoming analysts, middle level workers, or business managers, more and more people are pursuing strict finance qualifications in order to keep up with the trends and stay competitive. Some of the programs like the investment banking operations course, the Investment banking related course, and the investment banking master course have become the focus of this change.

Meanwhile, it is often heard that professionals question the hard or easy nature of the investment banker course, as the investment banking global certification system is becoming widespread across the globe. Collectively these learning tracks define technical competence, professional reputation and career acceleration in contemporary investment banking.

1. The Strategic Role of Investment Banking Education in Global Finance

1.1 Why Investment Banking Education Has Become Essential

Today investment banking goes much further than the normal capital raising and advisory services. Contemporary investment bankers work in the areas of merger and acquisition, capital markets, structured finance, valuation, private equity, and fintech-based transactions. Due to a more complex financial system, formal education has become mandatory in the form of the investment banking operations course and investment banking master course.

The pressure to hire technically trained professionals has been high with the level of regulation, sophistication in transactions and complexity of cross-border deals increasing. The current trend in institutions has given priority to applicants who have formal investment banking global certification since it is recognized that standardized education diminishes operational risk, improves ethical adherence and increases productivity.

1.2 The Evolution from Informal Training to Structured Global Certification

The investment bankers used to be taught basically through the apprenticeship-type of training within the financial institutions. This unofficial model has now been substituted with formal academic and professional credentialing models. The investment banking related course has taken on a base level in early career training, and the investment banking operations course has advanced to execution level competence in carrying out transactions, compliance and documentation.

Investment banking master course: At the postgraduate stage, the technical modeling, valuation, leadership and strategic decision-making are integrated into one professional qualification.

2. Core Structure of the Investment Banking Operations Course

2.1 Operational Mastery as a Career Gateway

The course of investment banking operations concentrates on the backbone of the financial institutions in terms of post-trade and transaction execution. These initiatives will offer comprehensive exposure to trade settlements, custody offerings, risk management, regulatory reporting and transaction lifecycle management. Front-office professionals are used to initiate deals whereas operations professionals are used to guarantee integrity of transactions and compliance with regulations.

The graduates of the investment banking operations course are employed and prepared to work as transaction processing, compliance governance, risk operations, and middle-office analytics. These work positions are very important gateways to long-term investment banking careers.

2.2 Industry Relevance and Practical Application

The investment banking operations course is valuable in the extent to which it proves very practical in the real world. The participants operate with simulations of live transactions, regulatory framework, Basel III, anti-money laundering procedures, and real-time settlement systems. Banks are collaborating more with training institutions so that they can align the curriculum with a practical operating environment.

3. Academic Pathways Through the Investment Banking Master Course

3.1 The Strategic Purpose of the Investment Banking Master Course

The master course in investment banking is the holiest academic qualification in this area. It incorporates an enhanced corporate finance, valuation, portfolio management, derivatives, risk engineering and capital markets strategy in a single degree program. The program is oriented to people working in the direction of the leadership positions in the global investment banks, asset management, and the private equity firms, and sovereign wealth funds.

In contrast to the entry level programs, the investment banking masters course focuses on strategic thought-process, negotiating transactions, regulatory risk management and cross-border structuring of capital. Graduates are produced who are not only technologically masterful, but at the same time decision-makers at the executive level.

3.2 Career Outcomes and Market Positioning

Individuals who possess an investment banking master course are always placed in impactful positions like M&A advisory, structured finance leadership, treasury risk management, and financial strategy consulting. The qualification is seen by the employers as an indication of technical and intellectual discipline.

4. Understanding the Investment Banking Related Course as a Foundation

The investment banking related course is an academic and transitional course to those entering the field of finance. Such programs are usually based on the basics of financial accounting, the basics of corporate finance, the theory of capital markets, financial modeling, and the theory of introductory valuation.

The investment banking related course is also particularly attractive to career switchers who move their job in accounting, economics, engineering, or data analytics to banking. It lays the theoretical foundation needed to proceed into the course of investment banking operations or the master course of investment banking.

5. Investment Banker Course Is Hard or Easy: A Realistic Professional Assessment

It is one of the most common questions that are asked and asked whether the investment banker course is hard or easy. The fact is that the perceived difficulty is dependent on the background, learning discipline and career motivation. Academically, such courses are mathematically intense, conceptually restrictive and time consuming.

The course in investment banking should be assessed based on the market criteria. The nature of investment banking is always challenging because of the complexity of the valuation theory, financial instruments, regulatory requirements, and competitive deal structure. This professional reality is manifested in courses, which have high requirements of learning.

Nevertheless, through proper preparation, rigorous study plans, and practice in the real world, even very technical parts of the investment banking operations course and the investment banking master course can be managed. Challenge, hence, is used to denote the weightiness of the profession and not an unnatural learning obstacle.

6. Global Recognition Through Investment Banking Global Certification

6.1 The Role of Global Certification in Career Mobility

The international investment banking global certification system normalizes technical competence internationally. Since financial institutions are transnational, skill checking consistency is the only requirement to meet compliance, trust, and interoperability of operations. International certification guarantees the employers that professionals are at the internationally accepted standards.

The professionals are able to acquire greater mobility in the financial hubs including New York, London, Singapore, Frankfurt, and Hong Kong through investment banking global certification. Such appreciation opens the doors to career growth and earnings in an enormous way.

6.2 Regulatory and Institutional Endorsement

Usually, banks, asset managers and regulatory bodies are directly involved in influencing the investment banking global certification curricula. This will see it in line with the changing regulatory requirements, technological upheavals and global risk governance structures.

7. Technology Integration in Modern Investment Banking Education

The digital transformation has transformed the operation of the courses of investment banking operations, the investment banking related course, and the investment banking master course. Settlement on blockchain, algorithmic trading, AI-based valuation, and real-time risk analytics have become a part of numerous programs.

Simulation environments can be created online and allow students to simulate live trading desks, simulated IPOs and multi-jurisdictional M&As. These are also the platforms where remote learning is supported according to the requirements of investment banking global certification.

Alt copy of where the SEO images are needed: investment banking operations course and investment banking master course learning ecosystem explaining the flow of certification under investment banking global certification system.

8. Employer Demand and Workforce Development Trends

Banks and other financial institutions are incorporating the investment banking operations course into organized graduate recruiting plans. The investment banking related course is a filtering system to the entry-level applicants, whereas the investment banking master course is consistent with the pipeline development to the leadership.

Certified professionals are now at the heart of succession planning, compliance governance and digital finance transformation programs, all of which are now a part of human capital strategies. With volatile deal volumes regarding macroeconomic cycles, employee flexibility that is supported by formal education is a strategic priority.

9. Compensation, Career Stability, and Long-Term Value Creation

The investment banking operations course graduates are joining good career paths with good salary advancement prospects as there is scarcity of operations and are regulated. At the same time, an investment banking master course qualifies the professionals to work in investment advisory, trading and structured finance with higher risks but greater rewards.

The investment banking global certification plus the operational competence adds the earning strength even in the time of economic downturns when both regulatory and risk functionalities are more essential.

10. Risk Management, Ethics, and Governance in Investment Banking Education

In modern finance studies, ethics, corporate governance and management of systemic risks are now integrated in the investment banking operations course and the investment banking master course. Still the world financial crisis brought out the shortcomings of technical training in ignoring the ethical and structural aspect.

With the new investment banking global certification system, professionals are currently assessed as per behavioral integrity and technical competence. This change strengthens popular belief and institutional sustainability.

11. Transitioning from Education to Front-Office Leadership

Those who started their career with an investment banking operations course tend to move to front-office operations under ongoing learning and promotion schemes. The course in investment banking is the one that assists in the exposure at the starting level and the course in investment banking master opens the door to strategic leadership.

The debate on whether the investment banker course is a hard or easy question becomes a far-off dream once the professionals have encountered the challenges of dealing structuring, regulatory compliance, and global capital flows across borders. Education is just a reflection of the professionalism required of the industry itself.

12. Global Market Outlook and the Future of Investment Banking Education

The demand of professionals who have been trained with recognized international investment banking qualification will be on the increase as the capital markets are increasingly linked. Climate finance, ESG-linked securities, digital assets, and tokenized capital markets will continue to change the course curricula of the spectrum of investment banking operations course and the investment banking master course.

Banks and other financial bodies are now after flexible professionals who are capable of not only learning the classical valuation, but can also read the algorithmic trading data, cyber-risk exposure and cross-border regulatory interfaces.

Conclusion

The contemporary investment banking ecosystem requires a lot more than theoretical finance knowledge. The course in investment banking operations, the course in investment banking related and the course in investment banking master are combined to create a stratified system of professional education that prepares an individual with the capability to operate with excellence, strategic leadership, and global mobility.

The same question of whether the investment banker course is difficult or easy, all boils down to the fact that the profession is disciplined. Most importantly, these learning paths are supported by the credibility and portability that is provided by the investment banking global certification which is currently becoming the hallmark of international employability and career resilience. Structured investment banking education is one of the strongest transforming forces on a professional level in a fast changing global financial system.