How to Conduct Due Diligence Effectively: Professional Standards, Common Failures, and Training Pathways

Introduction to How to Conduct Due Diligence

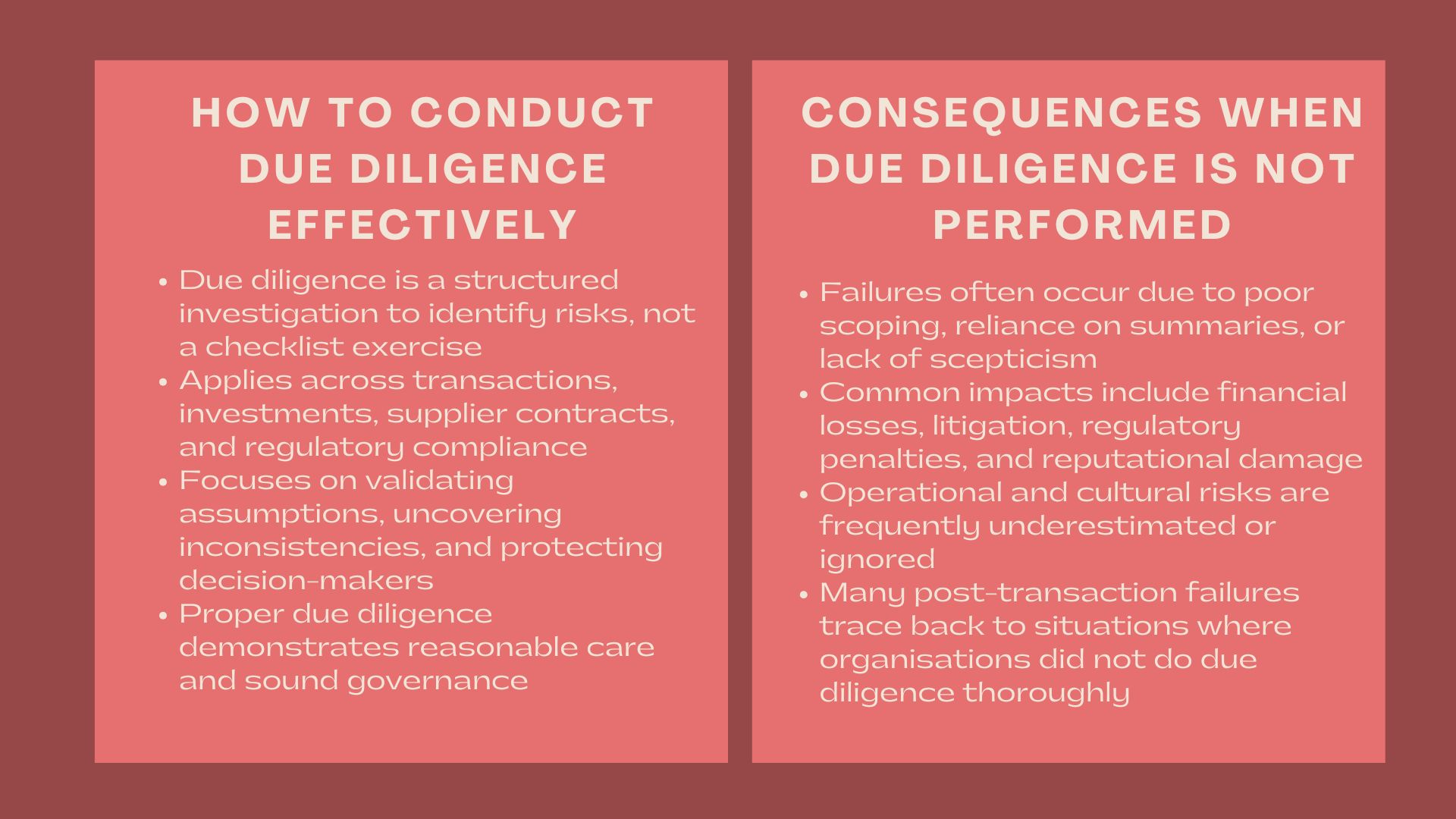

The knowledge of how to perform due diligence is an essential skill in contemporary business, investment, acquisition and purchase, and compliance with regulations. Due diligence is not a procedural checklist and is a form of organized investigation that is aimed at uncovering risks, justifying assumptions, and shielding decision-makers against unnecessary losses. Those organisations which failed to conduct due diligence correctly, in most instances, suffer financial write-downs, litigation, reputational harm and disruptions to business which would otherwise have been avoided through rigorous analysis.

Due diligence WHS training and other specialised training like due diligence programme are becoming more and more of a requirement as regulatory expectations and transactions become more complex. This article defines the meaning of due diligence and its purpose, discusses professional methodologies of due diligence, discusses failure implications, and the value and importance of structured training in developing sustainable due diligence capacity.

Understanding the Purpose of Due Diligence

Due diligence is fundamentally a logical procedure of confirming information prior to committing to something. To know how to conduct due diligence, one must know that the task is not to find out what is correct but to identify risks, inconsistencies, and uncertainties. Due diligence is applicable in corporate takeovers, supplier contracts, property purchases, investments as well as occupational safety requirements.

In terms of governance, due diligence is used to show that the decision-makers have been acting with reasonable care. In situations when organisations failed to conduct due diligence, it is not that they lacked data but did not have such analysis, professional scepticism or accountability in the review process. Proper due diligence converts raw information into insight in the form of a decision.

How to Conduct Due Diligence in a Structured Manner

Professional experts on how to do due diligence take the process in distinct steps. The initial step is scope definition where the reason why the review is being conducted is matched against the transaction or decision under evaluation. This involves the determination of financial, legal, operational, tax, regulatory and safety related risk areas in the context.

The second step will be devoted to information collection and confirmation. This includes examination of financial statements, contracts, records of compliance, operation records and third party confirmations. Disciplined approach makes sure that the information one receives is not taken literally or without evaluating it to be accurate, comprehensive and consistent. This is the point at which the organisations which failed to conduct due diligence usually fail, as they were relying on summaries, not primary evidence.

The third phase is the analysis and risk evaluation. The findings are assessed based on the potential impact and probability, specifically the deal breakers, valuation implications, and post transaction integration risks. Individuals who have completed a formal course due diligence programme are normally in a better position to make objective interpretations on findings and escalate material issues accordingly.

Financial and Commercial Due Diligence Considerations

Most transactions are still based on financial and commercial due diligence. It does not take only a review of historical financials to know how one can perform due diligence in this area. It entails the evaluation of the quality of earnings, sustainability of cash flow, working capital needs and forecast realism.

There have been numerous high profile failures due to lack of due diligence checking of revenue concentration, customer churn or concealed liabilities by buyers. A healthy due diligence exercise connects the financial information to the realities of operation so that how they are reported would be consistent with the business basics.

Market positioning, competitive dynamics, pricing power and customer dependencies are also investigated as a part of commercial due diligence. These lessons directly impact valuation and strategic decision-making, and the need to implement structured training to an extent of due diligence.

Legal, Regulatory, and Compliance Due Diligence

The legal and regulatory due diligence helps to shield organisations against acquiring hidden liabilities. Due diligence in this field entails checking of contracts, exposure to litigation, intellectual property right, regulatory approval and compliance history.

This area is usually a failure in cases where the change-of-control clause, licensing requirements, or regulatory investigations were poorly vetted by organisations. These omissions may slow down operations, raise the expenses, or make deals unnecessary.

Due diligence is also used as evidence of good faith and reasonable care in regulated situations. Formal training in the form of a course due diligence programme is used to assist professionals in identifying red flags in the regulations and to document findings in the right way.

Operational and Human Capital Due Diligence

The operational due diligence assesses the ability of a business to fulfill its strategic commitments. The experts in knowing how to perform due diligence evaluate supply chains, technology infrastructure, internal controls, and scalability. Human capital factors encompass, management capacity, labour stability, incentive systems and cultural conformity.

Those organisations that failed to undertake due diligence in this respect tend to underestimate the problems of integrating and the risk of execution. The underperformance that is post-transact is often associated with cultural differences or poor operational underpinnings that were seen and disregarded in the diligence.

Formal education improves the capability to relate the findings of operations to strategic performance, a proficiency that is highlighted in the more advanced course due diligence programmes.

Due Diligence WHS Training and Workplace Safety Obligations

In numerous jurisdictions, the health and safety liabilities in the workplace have been expanded to include due diligence liabilities on directors and senior officers. Due diligence WHS training is centered on the need to make leaders aware of their responsibility to ensure safety systems, risk controls as well as compliance structures are good.

Being aware of how to perform due diligence within a WHS setting is to look at safety policy, safety incident records, training programs and contractor management practices. The impacts of failure by organisations in conducting due diligence in WHS issues may encompass statutory fines, individual accountability as well as devastating reputations.

Due diligence WHS training offers ordered instructions on how to find safety risks, record administration, and entrench safety deliberations in administration procedures. This type of training is becoming recognised as a necessary and not a luxury of responsible leadership.

Consequences When Due Diligence Is Not Performed Properly

The term failed to perform due diligence is often mentioned in ex-post facto explanations of unsuccessful deals and non-adherence to compliance. These consequences are usually financial, legal, regulatory, and loss of stakeholder trust.

In addition to short-term effects, the lack of due diligence arises and sabotages organisational learning and culture of management. Investors, regulators and boards are demanding more and more evidence of decision-makers being aware of how to undertake due diligence and that they have exercised that knowledge in the same manner over time.

These are expectations that support the worth of formal education offering, such as a course due diligence curriculum and a safety-critical position due diligence WHS training.

The Role of Formal Due Diligence Education

A systematic due diligence programme of course offers professionals structures, tools, and case-based learning in addition to ad hoc experience. Financial analysis, risk analysis, legal analysis, operational evaluation, and reporting guidelines are some of the common courses.

Individuals who have taken a course in due diligence are in a better position to create diligence scope, assume burden, and convey findings in understandable ways to stakeholders. This ability will minimize chances of ignoring or applying trivial risks.

Equally, due diligence WHS training is necessary to guarantee the fact that safety concerns are embedded in the larger governance and transaction procedures which harmonize business goals with legal and ethical accountabilities.

Building a Sustainable Due Diligence Culture

Companies who are doing well in due diligence make it part of the decision-making process, and not a transactional aspect. Due diligence is an area of shared competence as finance, legal, operations, and leadership teams understand how to perform it.

This cultural style minimizes the possibility of individuals or organisations failing to conduct due diligence because of the time constraint or overconfidence. Consistency and quality in the long term are supported by the training programmes, standardised methods and accountability mechanisms.

Governance investment in a course due diligence framework and continued due diligence WHS training enhance value creation in the long run.

Conclusion

To make well-informed decisions, manage risks and ensure sustainable business success, it is important to know how to do due diligence. Due diligence is not a ritual and is rather a disciplined procedure that safeguards organisations against unnecessary damage. Failures by businesses to conduct due diligence are usually devastating and protracted.

Training on due diligence programme Formal training in the due diligence programme provides professionals with skills in analysis and judgment necessary in complex transactions and regulated environments. Simultaneously, due diligence WHS training would make sure that the highest level of governance is observed in the area of workplace safety responsibilities.

In a growing multi-faceted and responsible business landscape, organisations that invest in due diligence ability would be in a better position to generate value, ensure compliance and develop long-term trust of the stakeholders.