Case Study: Insurance E-Learning Services Enhancing Insurance Knowledge, Risk Awareness, and Professional Capability Through Digital Learning

Background on Case Study Insurance E-Learning Services

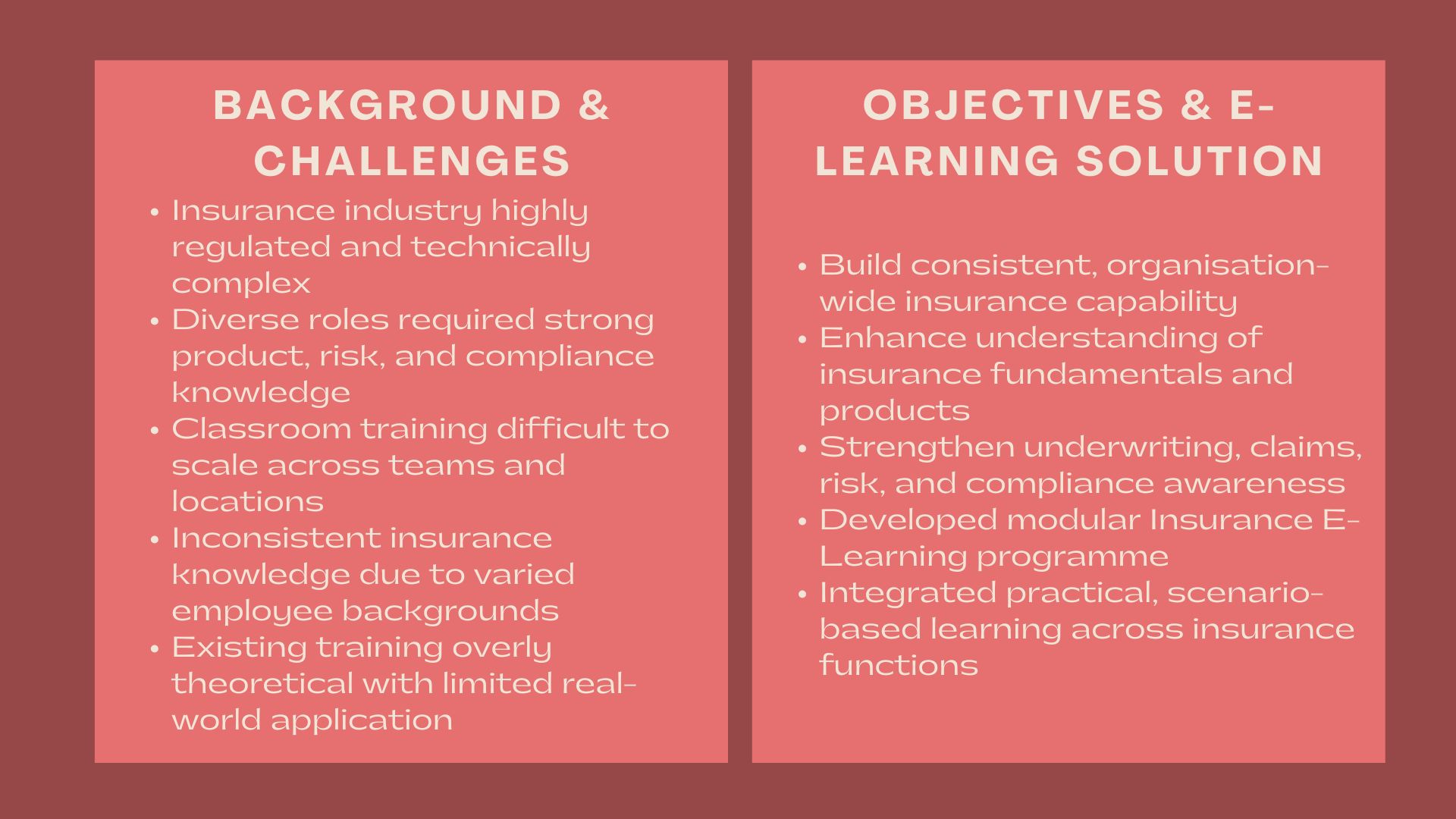

In the insurance sector, there is a very regulated and technically hectic environment. Underwriters, support teams, insurers, brokers, and claims professionals have to learn a lot of different types of insurance products, regulations, and core principles of risks, and the way insurance works. Meanwhile, the industry is constantly being transformed by the swift shifts in customer expectations, digitalisation and regulatory standards.

The conventional methods of classroom-based training have been found to be more and more challenging to roll out in big insurers. Participation and consistency are usually constrained by scheduling factors, geographical distance, and demands of operation. Moreover, one aspect that continues to emerge among the various insurance practitioners is the need to engage in life-long education to keep pace with product development, regulatory changes, and the changing risk environment.

In order to overcome such challenges, an insurance based organisation contracted our firm to develop and implement an all out Insurance E-Learning programme. The aim was to develop a structured, flexible and practical digital learning tool that would enhance the understanding of fundamentals of insurance, risk and compliance awareness and improved real world application throughout the organisation.

Issues and Challenges

The organisation had a number of learning and capability issues that were faced before the engagement and were typical in the insurance industry.

Another major problem was the lack of consistency in the level of knowledge in departments. The employees joined the organisation with different insurance experiences and thus did not have a balanced understanding of the key concepts including the underwriting principles, policy structure and claims process.

The other difficulty was inaccessibility to training. The session held in the classrooms meant that the employees had to be out of the day-to-day running of the businesses and it was not easy to ensure complete participation without compromising productivity.

There was added complexity in the form of regulatory and compliance requirements. The constant changes in insurance policies and code of conduct necessitated regular and prompt training which could not be easily achieved using the conventional approach.

More practical and applied learning was also required. Available training resources were geared towards theory without properly relating the ideas to actual insurance situation, e.g., policy underwriting, claims evaluation, or customer interaction.

Objectives

The main aim of the engagement was to create Insurance E-Learning solution that can be implemented throughout the organisation to create consistent and practice based and scalable insurance capacity.

Key objectives included:

- Enhancing the basic insurance awareness.

- Improving knowledge in insurance products and policy structure.

- Enhanced awareness on the operations of underwriting, claims and risk management.

- Enhancing regulatory and compliance knowledge.

- Providing customizable, distance learning in a wide variety of positions.

The programme was required to assist the entry level workers and the experienced employees and at the same time to have the same standard of learning throughout the organisation.

How We Helped

We developed a modular Insurance E-Learning programme, which was inclusive of the core insurance concepts, the workings and applied learning.

The programme started with the basics of insurance, which presented the learners with the concept of insurance as a means of transferring risk, the nature of the insurance market and major players such as the insurance companies, reinsurers, brokers and regulators. This provided a common level of understanding amongst the learners.

Later modules were on insurance products and policy structures and it included life insurance, general insurance and specialty insurance products. Students were introduced to policy terms, limits of coverage, exclusions, and assumptions about the price of policies, which now give them understanding of the structure and pricing of policies.

The programme included underwriting principles. Risk assessment, underwriting requirements, considerations of prices and portfolio management were presented to learners based on examples representing real underwriting decisions.

Another major area of focus was claims management. The modules took the learners through the claims lifecycle, including notification and assessment and finally settlement and dispute resolution, with particular emphasis on accuracy, fairness, and compliance.

The programme incorporated regulatory and compliance issues. Students acquired insight into regulatory requirements, code of conduct and principles of governance applicable in the insurance operations.

In order to make the programme practically relevant, real-life situations and examples which are based on cases were included. Students used the concepts to real life scenarios like assessment of underwriting hazards, claims decisions, and customer questions.

Learning Design and Delivery

The Insurance E-Learning programme was aimed at ensuring the highest levels of engagement, flexibility, and retention of knowledge.

The content was provided in brief, specific modules that included instructional videos, visual instructions, and real-life applications. The complicated concepts of insurance have been simplified through organized structures and well-explained concepts.

Active learning in the form of quizzes, scenario-based questions, and applied exercises were used to stimulate the participation and support the main ideas.

The online learning experience was also dynamic and self-managed to ensure that learners could still perform their daily tasks without disrupting the operational process and as well as ensuring uniformity in the learning process.

The modular design also facilitated easy updates thus ensuring the programme could be updated to capture any changes in regulations, products or even changing business demands.

Outcomes and Value Delivered

The case study indicates that Insurance E-Learning Services is worthwhile in creating scalable, consistent and practical insurance capability.

Students gained more knowledge about the principles of insurance, the insurance products and the working mechanism, which allowed them to fulfill their duties more efficiently and confidently. Better understanding of underwriting, claims and regulatory requirements helped in enhancing the culture of risk management and compliance.

Organisationally, the e-learning solution was a cost effective and scaled training method. This enabled the organisation to provide uniform learning/training present in teams and geography, minimising knowledge loss and improving the overall capacity.

The programme also adhered to continuous professional development by creating a hierarchical learning framework, which could be extended or tailored according to business demands.