Venture Capital Investing

Venture Capital Investing Introduction

Venture capital has become one of the most significant agents in the economy of innovation that is impacting the development of business, technological advancement and world entrepreneurship. Geographic location is becoming a concept which is less important because online platforms and global markets enable startups to grow at a rate that has never been seen before. Nevertheless, even with the increased access to the entrepreneurship, the process of starting and funding a high-growth start-up is complicated and very competitive. This is the reason I have decided to take a venture capital investing course as a strategic move to those who would wish to know how venture capital works, decisions of investors and how a startup funding would translate to value of the enterprise in the long run.

It takes much more than usual financial knowledge to venture invest. It requires an understanding of portfolio management, founder analysis, uncertain valuation, and legal structuring of deals, all of which are hardly taught in conventional business schools. This has led to the emergence of special courses like venture capital executive course and entrepreneurship and venture capital course becoming very relevant. Venture education assists executives in enhancing corporate innovation strategy and founders and startup professionals in enhancing fundraising preparedness and scalability.

This paper will discuss why venture capital education is essential, the benefits that a professional can acquire out of venture programs, and how one can choose the best course by taking into account career goals and investment goals.

Professional Learning on Venture capital and the importance of education

Venture capital is a type of investment which is private and is targeted at businesses at the early stages and those that have the high potential of scaling. This is contrasted to the traditional investments where revenue is predictable and profitability is stable, venture capital is conducted under high uncertainty. A large number of startups do not succeed or generate minimal returns, whereas a very few generate returns of high order that offset the rest of the portfolio. This is a power law nature that is the basis of venture investing and the reason that specialized venture knowledge is a necessity.

There is a misconception by many professionals that venture capital is merely a funding venture of creative ideas. It is actually a systematic process that involves market sizing, business model testing, founder testing, competition positioning, capital efficiency testing and exit planning. Another area that needs legal structuring is venture investing, in which the ownership rights, power to govern, investor protection and control of strategy are established in contracts.

An effective venture capital investing course provides students with systematic frameworks in order to judge start-ups in an objective way. The participants are provided with tools of analysis in order to evaluate opportunities with more discipline and confidence, rather than depending on intuition. This is becoming a knowledge that is more applicable to venture fund professionals, as well as corporate strategists, bankers, consultants, private equity practitioners, and innovation managers.

To senior leaders, a venture capital executive course will provide them with a more insight into the governance oversight and portfolio strategy. In the meantime, entrepreneurs who start their businesses can take a course in entrepreneurship and venture capital, which brings together venture financing and business-building basics.

The Rationale behind a Venture Capital Investing Course Producing Competitive Advantage

One of the key benefits of pursuing a course in venture capital investing is that it creates a different way of thinking, unlike the conventional way of managing a business. Traditional business setups aim at ensuring cost efficiency, consistent growth and reliable profitability. Venture capital, on the other hand, aims at fast growth, market destruction, and building long-term enterprise value. Startups backed by venture funds take risks by incurring short-term losses to experience aggressive expansion and market control.

This forms a special environment of decision making. Venture investors often consider businesses with small revenues, incomplete products, unconfirmed customer demand and changing business models. Thus, the investment decision should be made successfully with the use of strategic thinking, high level of judgment, and skills to read early signs of success.

A venture capital investing course is structured and instructs those who are taking it to understand how investors assess risk and develop investment conviction. Students get familiar with traction metrics, customer retention metrics, unit economics, and scalability metrics. They also get to know how to recognize early warning signs like weak founder fit, unrealistic growth theory, ineffective product-market fit and inefficient business model.

The timing is also a very important aspect in venture investment. Startup funding is vulnerable to liquidity cycles, sector dynamics and macroeconomic changes. Quality programs are used in describing how inflation, interest rates, and capital market environment determine performance of ventures.

Career-wise, a venture capital investing course enhances the credibility and provides more chances in venture related services. It is also beneficial to enhance communication with founders and investors through the construction of fluency in venture vocabulary and deals.

The Reason Why Leaders should undertake a Venture Capital Executive Course

A venture capital executive course is a course aimed at high profile professionals who require strategic and governance based knowledge about venture investing. Whereas entry-level venture programs put great importance on valuation and deal structure, executive programs emphasize personal responsibility in leadership, accountability in investment governance, and alignment of long-term, long-term innovation.

Corporate venture capital (CVC) has emerged as an ever-increasingly significant instrument of large organizations acquiring an early access to new technologies and disruptive business designs. Nevertheless, most corporate venture programs become unsuccessful because of the lack of good governance, investment discipline, investment thesis clarity, and internal commitment. Consequently, little strategic value may be created by venture investments.

An excellent venture capital executive course equips leaders on how to articulate an investment thesis, an institutional framework, and align venture investments with corporate priorities. It also describes methodologies of measuring venture performance that is not just based on short term financial performance, conflict of interest management, and establishment of effective processes of managing the investment committee.

Another giant area of focus is risk oversight. Venture investments have the ability to cause compliance and reputational risks in the regulated sectors of banking, healthcare, and energy. A venture capital executive course provides the executives frameworks to deal with such exposures and at the same time be innovative and competitive in the long run.

Executives who have venture capital knowhow rest in a better position to make risk-free strategic decisions and spearhead organizational change in a fast paced business world.

The Emerging Prominence of an Entrepreneurship and Venture Capital Course

It has led to a huge demand to the entrepreneurship and venture capital course due to the flourishing global startup ecosystem. Entrepreneurship is no longer seen as a niched career, it is now a mainstream approach to innovation and wealth creation and economic growth. Incubators, accelerators, and venture funding networks are the methods that governments, universities, and private institutions keep on enhancing the startup ecosystems.

The existence of these support systems notwithstanding, it is a challenge to create a scalable startup. Weak strategy, financial lack of discipline, and lack of investor readiness are the main reasons that many founders fail. Formal entrepreneurship and venture capital course offers a powerful foundation through an integrated business-building skills and venture financing strategy.

This form of course educates the founders about the process of idea validation, product-market fit, scalable business models, and sustainable growth plan. Meanwhile, it also describes how venture capital investors analyze startups and what performance indicators are the most important in the process of fundraising.

This twofold point of view is critical due to the fact that a venture-backed entrepreneurship is not like the old form of small business ownership. Venture investors are looking to see rapid growth and scalability, and have a clear exit potential. Entrepreneurs who are aware of this framework are in a position to streamline their strategy in line with the expectations of their investors.

Pitching and ability to negotiate is also enhanced by a quality entrepreneurship and venture capital course. Founders get to know how to communicate traction, how to define a market opportunity, negotiate dilution, governance rights, and terms of investment.

Fundamental Issues in a Venture Capital Investing Class.

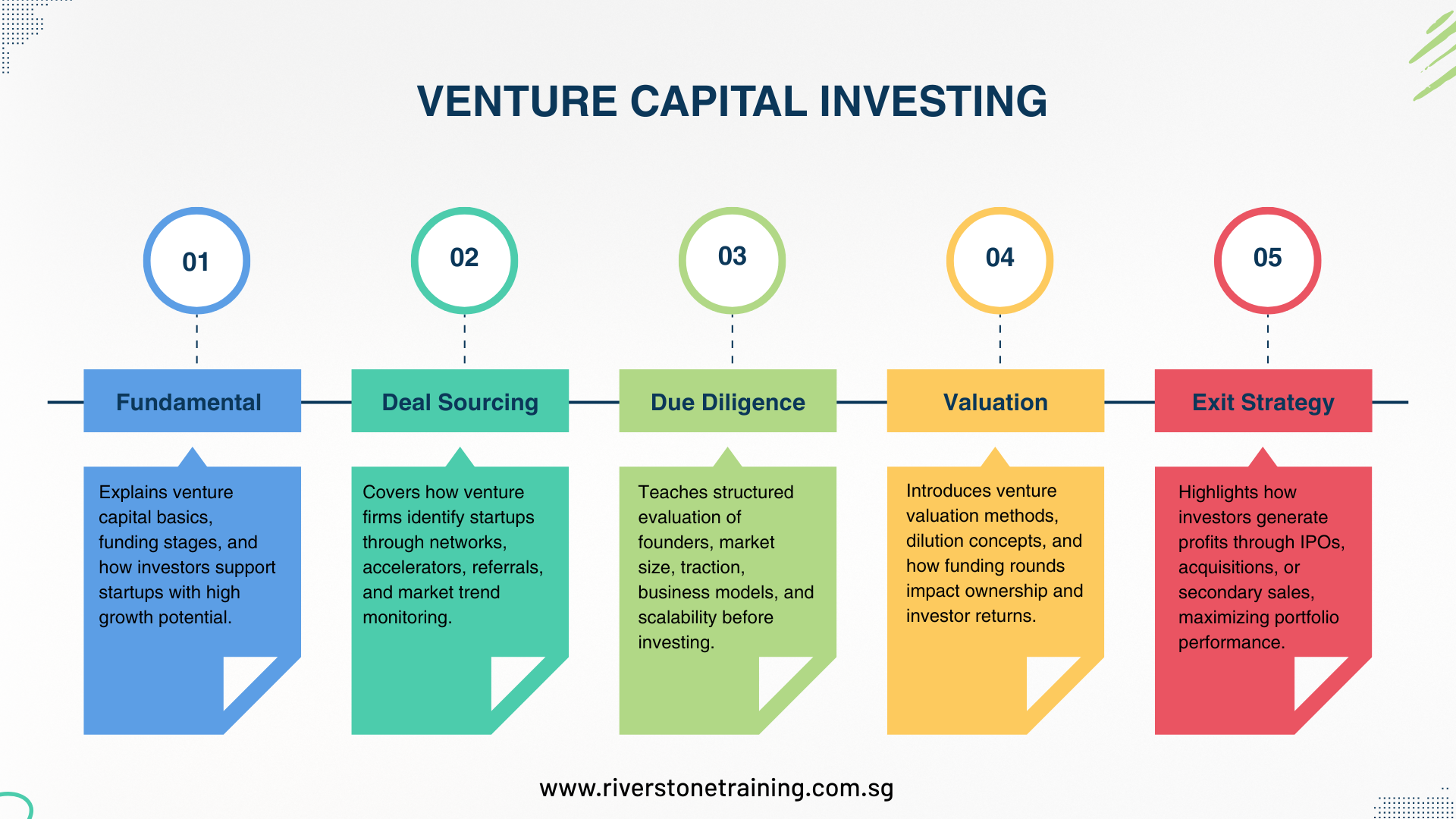

A good venture capital investing course will encompass both technical as well as strategic subjects. Another major topic is deal sourcing, which is the process by which venture firms discover investment opportunities in founder networks, accelerators, ecosystem relationships, and industry relationship.

Due diligence and startup evaluation is another major area of focus. As startups do not usually have a good track record of financial performance, venture capitalists base their thinking on future analysis, market research, and founder competency test. The participants are taught to assess the level of scalability, competitive advantage and strength of execution.

Valuation is also essential. A professional venture capital investing course describes the nature of pre-money and post-money valuation, a model of dilution, and the motivation of startup valuation at different funding stages. It also presents venture specific valuation methods like comparable funding rounds and return based modeling.

The structuring of deals is also important. Venture investment is based on legal agreements such as term sheets, convertible notes and SAFEs. These reports determine liquidation preference, control of governance, rights of investor and exit terms. It is the responsibility of the two groups of investors and entrepreneurs to comprehend these mechanisms in order to prevent undesirable results.

Another area of core is portfolio strategy. Due to the reliance on the few successful companies in venture returns, investors need to diversify appropriately and closely organize follow-on capitals. Students are exposed to the portfolio construction, reserve strategy and exit planning.

Lastly, there is exit strategy. Venture investors usually get returns via acquisitions, secondary sells or IPO. The knowledge of when to exit and exit value prospective is critical to venture success.

The difference between Venture Capital and Traditional Investing

Most practitioners use assumptions of the public market investing when approaching venture capital. Conventional investing is based on prior track record, predictable cash flow and prior valuation models. Venture capital though is motivated due to future potential and scalability over the long run as opposed to short term stability.

Startups are characterized by the low revenue and negative cash flow. The growth indicators that venture investors are focusing on are user acquisition, customer retention, engagement rates, and the potential to lead the market. This needs analytical solutions that could not be assessed using financial statements.

It is through a course in structured venture capital investing that we are able to understand why venture capitalists are comfortable with large failure rates, why a portfolio must be diversified, and why growth is likely to be an important factor when compared to profitability. Patience is also needed in venture investing where returns are normally made after five to ten years. Investors have to endure the uncertainty by undergoing the various funding rounds and changing market environments.

In the case of senior leaders, a venture capital executive course enhances the capacity to deal with long-term venture exposure and position venture activity in accordance with the strategic business priorities.

The effect of Venture Capital Education on the decision-making process

Enhanced decision-making discipline is one of the greatest opportunities of a venture capital investing course. The venture investing is characterized by incomplete information, great uncertainty, and emotional bias. Founders can tell strong stories, however, investors should assess opportunities by use of structured analysis.

Venture education imparts market analysis frameworks, traction analysis, competitive mapping and business model testing. The participants would be taught to watch out to red flags that included unrealistic growth projections, poor unit economics, poor founder misalignment and weakness in regulatory vulnerabilities.

Venture capital executive course enhances the leaders to make governance decisions. The executives get to learn on how to appraise portfolios, run investment committees, define approval procedures and track venture performance in a systematic manner.

To founders, a course on entrepreneurship and venture capital enhances the execution decisions in business such as pricing, product development, strategy of market entry, hiring and scaling priorities.

In general, venture education minimizes uncertainty as it avatars more complicated decisions into systematic analytical tasks.

Professional Advantages and Future Perspectives

Doing a venture capital investing course greatly enhances career opportunities in venture related positions, including venture analyst, investment associate, corporate venture manager, innovation strategist, and startup advisor. Venture education is used by many professionals who are moving out of consulting, banking or private equity to venture capital.

In the case of the founders, venture education enhances fundraising preparedness and bargaining skill. A venture capital executive course can be of special use to senior executives who can run corporate innovation portfolios. In the same way, a course on entrepreneurship and venture capital is associated with career growth in accelerators, incubators, venture studios, and start-up ecosystem organizations.

The new emergent sectors of artificial intelligence, climate technology, and fintech are transforming venture capital. Emerging venture initiatives (like ESG investing and impact measurement) and data-driven venture tools (such as AI-based startup screening and sophisticated portfolio analytics) have become part of the modern venture programs. The knowledge of the venture combined with the current analytical ability will provide a long-term competitive edge to professionals.

Conclusion

Venture capital is one of the most powerful assets to innovation and entrepreneurship across the world. Structured venture education is an effective and well-defined strategic value in an uncertain and competitive investment environment. A good venture capital course is one that equips a person with the necessary knowhow in startup evaluation, valuation, deal structure, portfolio planning, and the exit planning. In the case of top leaders, a venture capital executive course enhances the power of governance and innovation leadership. To startups and entrepreneurs, a course on entrepreneurship and venture capital is an exceptionally effective blend of business-making and investor-making knowledge.

With the ever-growing venture markets, venture capital skills have turned out to be a valuable professional resource. Regardless of the investment or fundraising or leading corporate innovation aim, venture education provides better decision-making, increased credibility, and business success in the long run.